Following its earnings call on Thursday June 4, Broadcom Inc. (AVGO) reported yet another quality quarter, beating both revenue and EPS. Guidance was also lifted, as the company has been benefitting from the high demand for semiconductors, particularly its Trident and Tomahawk 3 chips. (See AVGO stock analysis on TipRanks)

Christopher Rolland of Susquehanna Financial Group published a report detailing these recent successes. After reviewing Broadcom, Rolland reiterated a Buy rating on the stock, and determined a price target of $540. This price target reflects a 13.68% upside from the Friday June 4th closing price.

Regarding the Broadcom earnings call, Rolland described the tone as “upbeat,” and was quick to note that Networking and Broadband trends have contributed significantly to the strong quarter. He also highlighted that the CEO was optimistic on the booking trends, “despite a flattening in the company’s lead-times,” and does not foresee capacity related issues ahead due to over-booking.

Rolland quoted the earnings call transcript, which said that the work-from-home trends have been forcing “somewhat of a renaissance” in broadband revenues. Also from the call, the Broadcom management indicated increased investments in Silicon Photonics and other sensitive hardware material.

Christopher Rolland was positive in general about the stock, boldly stating, “Broadcom remains one of the best large-cap franchises in the industry.”

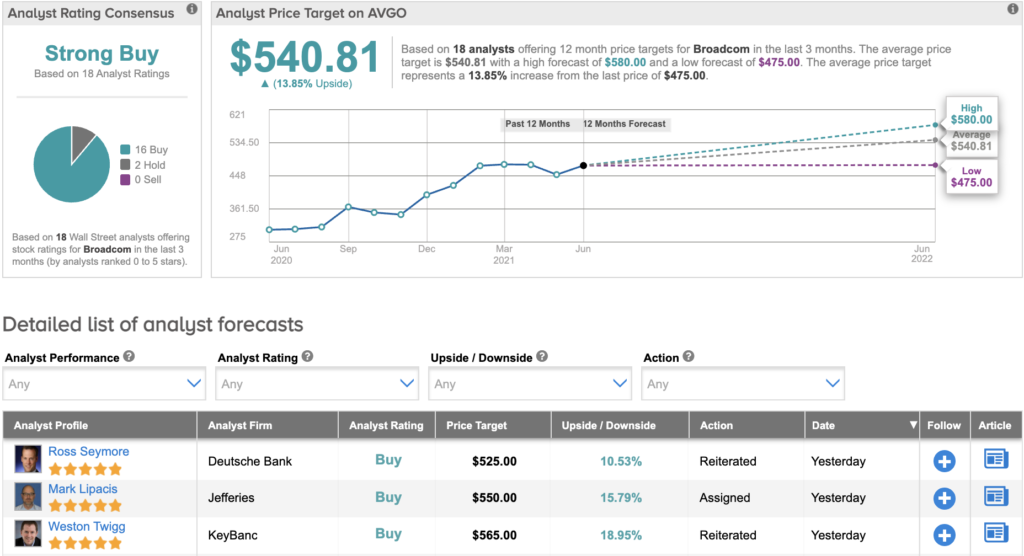

On TipRanks, AVGO has an Analyst Consensus Rating of Strong Buy, based on 16 Buy and 2 Hold ratings. Additionally, the AVGO average analyst price target is $540.81.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.