Australia and New Zealand Banking Group (ANZ) is among Australia’s top four banks. Although ANZ shares have fallen since the start of the year, TipRanks insights reveal it’s a stock worth watching.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Melbourne-headquartered ANZ provides a broad range of financial services aimed at consumers and businesses. The stock is a component of the blue-chip ASX 20 index. ANZ has been in the banking business since 1835.

ANZ turns to growth acquisitions and greater EV exposure

ANZ is in the process of acquiring Suncorp’s (SUN) banking business in a deal valued at AU$4.9 billion. The acquisition is expected to help ANZ increase its share of the lucrative local mortgage market. ANZ has turned to both institutional and retail investors in a bid to raise the capital needed to fund the acquisition.

The bank is also lending up to US$711 million to an electric vehicle battery joint venture between Hyundai Motor and LG Energy Solution, which will result in a battery facility in Indonesia. The credit deal gives ANZ a position in the rapidly expanding EV market, which is set to benefit from surging future demand for electric vehicles.

Is ANZ stock a good buy?

Although ANZ shares have dropped around 15% year-to-date, analysts remain bullish on the stock. According to TipRanks’ analyst rating consensus, ANZ stock is a Moderate Buy based on six Buys, three Holds, and one Sell. The average ANZ price prediction of AU$25.59 implies over 13% upside potential.

ANZ scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

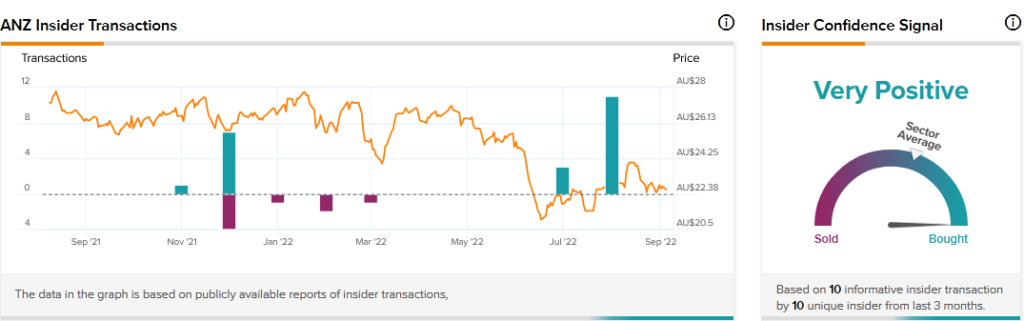

Moreover, ANZ stock is a favorite of insiders. TipRanks’ Insider Trading Activity shows that Insider Confidence Signal is currently Very Positive on ANZ, with corporate insiders purchasing $AU134,100 shares in the last three months.

Final thoughts

As interest rates rise, banks have the capacity to increase the returns on loans. ANZ stock is worth considering for investors seeking exposure to this market dynamic. The bank’s efforts to expand its mortgage business and entry into electric vehicle-related deals bode well for its future. The pullback in ANZ stock may be offering a good value entry opportunity for investors.