As the electric vehicle space becomes more competitive with a new entrant seemingly every day, XPeng (XPEV) has a huge advantage over market participants still building prototypes and manufacturing plants. The Chinese smart EV company already manufactures thousands of vehicles each month and even has a solid delivery plan for Europe unlike most Chinese companies.

The stock has held flat in the last few months as the EV market heats up again. Investors should focus back on the stocks with substantial deliveries already, such as XPeng, compared to speculative plays with only the promise of sales years down the road.

Huge January Delivery Boost

For January 2021, XPeng achieved a record monthly delivery of 6,015 smart EVs. The amount was up 470% from last January, but more importantly the company delivered 315 more vehicles than in December.

As recent as October, XPeng only delivered 3,040 vehicles in the month. In January alone, P7 deliveries reached 3,710 while the company had 2,305 G3 deliveries. On the Q3 earnings report, XPeng had a Q4 delivery target of 10,000 units and the company has already started the new year with a quarterly rate topping 18,000 units.

Where the story gets really interesting is the delivery of another 200 vehicles to Europe. XPeng has now shipped 400 G3 smart EV SUVs to Norway. The market knows a Chinese manufacturer will face restricted competition in China, but the big opportunity could be sales outside of China while using manufacturing assets in the home country to produce a cheaper EV.

The European EV market offers a large opportunity with countries such as Germany, France, UK and Norway all topping 100K EV vehicles sold in 2020. XPeng is just scratching the surface of demand with shipments of 200 vehicles.

Most Chinese tech companies and smartphone manufacturers have generally failed to garner major sales outside of China due to trust issues and brand loyalty to Western firms. XPeng has the opportunity to break these barriers.

Flat Stock

The stock has been flat for months now following the peak back above $70 in late November. Investors can now buy the stock at the same price as the secondary offering completed at $45 back in October. The investment story is somewhat de-risked by XPeng nearly doubling manufacturing output from the reported October deliveries in just a few months.

XPeng has a market cap of $36 billion and sales are on pace to top estimates of $2 billion in 2021 and $4 billion in 2022. The stock is by no means cheap trading at nearly 10x 2022 revenues targets, but the company has one of the best opportunities to achieve a global EV sales network having a head start on the competition.

Takeaway

The key investor takeaway is that XPeng is a far more interesting stock now after a cooling off period and a big secondary raise. Investors should hope for some more Apple Car induced weakness to snap up the stock on dips knowing the fears are likely over played. Other companies have years before ramping up meaningful production while XPeng is quickly heading towards annual production topping 100,000 EVs making the stock more appealing here.

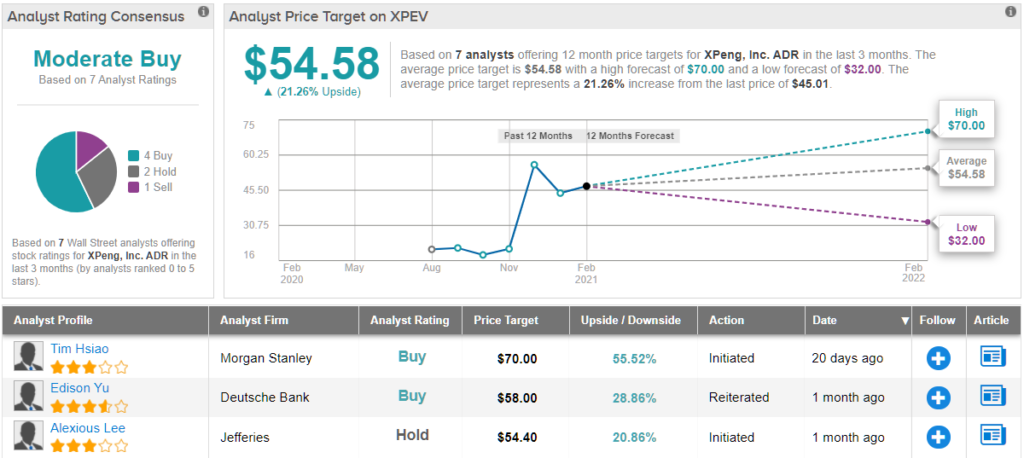

In terms of Street consensus, XPEV gets a Moderate Buy rating based on 4 Buys, 2 Holds, and a single Sell. On top of this, the $54.58 average price target puts the upside potential at ~21%. (See XPEV stock analysis on TipRanks)

Disclosure: No position.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.