Sentiment has remained negative for the cannabis sector, and it has been reflected in the sharp decline in cannabis stocks. A key reason for the underperformance is regulatory headwinds. Additionally, growth has been lower than expected, and cash burn has concerned investors.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

However, the best time to consider exposure to a sector or stock is when there is blood on the streets. In times of euphoria, stocks are already overvalued. Tilray Brands (TLRY) stock has slipped by 47% in the last six months.

I believe that at $3.50 per share, TLRY stock is an attractive long-term bet. It seems that the correction is largely over, and the stock is poised for a reversal rally.

At the onset, it’s worth mentioning that according to an article from Business Wire, the global cannabis market is expected to grow at a CAGR of 23.9% between 2021 and 2030.

The industry is still at an early-growth stage. Even if the company’s growth is in sync with the industry growth rate, there is ample scope for value creation.

Tilray Has Ambitious Growth Plans

For the first nine months of its Fiscal 2022, Tilray reported revenue of $475 million. On a year-over-year basis, Fiscal Q3-2022 revenue increased 23%. It’s also worth noting that Tilray has continued to consistently report positive adjusted EBITDA.

A key point to note is that the company is on track to deliver annualized revenue of around $630 million for 2022. The company’s CEO has chalked out a plan to boost revenue to $4.0 billion by 2024. If this target is achieved, there will be a meaningful acceleration in top-line growth in the coming years. The target seems to be steep but not unrealistic.

Growth Catalysts

Federal legalization of cannabis is impending in the United States. Tilray’s CEO believes that there is a revenue potential of $1.5 billion from the U.S. on legalization. The CEO is also targeting an acquisition or merger to expand in the U.S. once the legalization bills are passed.

Tilray already has a history of growth through acquisitions. On the flip side, any delay in reforms would negatively impact the stock.

Another growth catalyst is the company’s presence in the medicinal cannabis segment. The medicinal cannabis segment was forecast to grow at a CAGR of 26.6% between 2019 and 2027, according to Transparency Market Research. Further, the market is expected to be worth $52.8 billion by 2027.

This provides Tilray with ample scope for growth, with the company increasingly making investments in health and wellness products. It’s worth noting that Tilray already has an EU-GMP-certified cultivation and production facility in Europe. This will help the company make inroads in Europe’s medicinal market, in which Tilray already claims to have a leading market share.

Risk Factors – Regulation & Dilution

Even with big estimates on the recreational and medicinal cannabis industry size, stocks have been depressed. A major risk factor is a delay in regulatory approvals.

From a financial perspective, there are two points to note. First and foremost, Tilray is still in an aggressive expansion mode. It’s very likely that cash burn will sustain in the coming quarters.

Furthermore, as of February 28, 2022, Tilray reported cash and equivalents of $279.2 million. With cash burn and plans for acquisition-driven growth, dilution of equity seems like a possibility.

However, if Tilray’s top-line growth accelerates significantly, TLRY stock can possibly trend higher even with the cash-burn factor. Also, after a deep correction, most of these concerns seem to have been discounted in the stock.

Wall Street’s Take on Tilray Stock

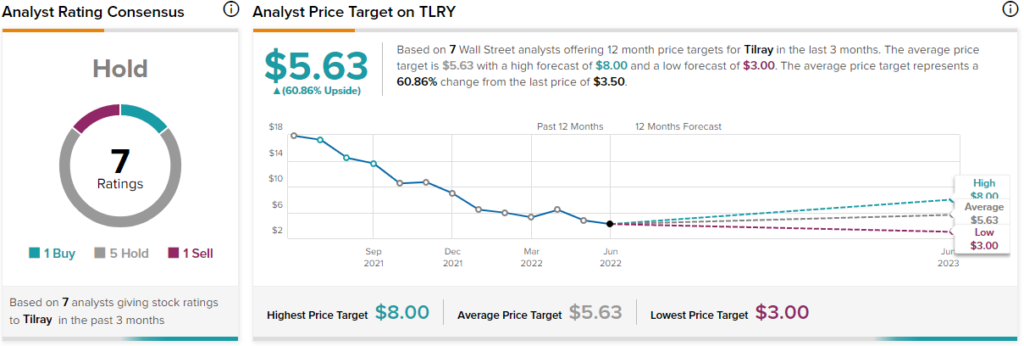

Turning to Wall Street, Tilray has a Hold consensus rating based on one Buy, five Holds, and one Sell rating assigned in the past three months. The average Tilray stock price forecast of $5.63 implies 60.9% upside potential.

Concluding Views – A Deep-Value Growth Stock

Tilray has been pursuing global expansion, even as growth remains relatively sluggish. The company has an early-mover advantage in new markets. For example, TLRY has already expanded in the medicinal cannabis segment in markets like Malta, Australia, New Zealand, and the UK.

One reason to focus on medicinal cannabis is that the segment has higher margins. The company’s gross margin and adjusted EBITDA are likely to improve with an acceleration in growth.

Overall, TLRY stock looks attractive after a deep correction. Regulatory headwinds are an ongoing risk, but the stock seems to have overreacted on the downside. As top-line growth sustains along with positive adjusted EBITDA, Tilray stock is likely to trend higher from current levels.