Palo Alto Networks’ (PANW) position as a leading cybersecurity firm presents a compelling long-term opportunity for patient investors. Polaris Market Research estimates that the global cybersecurity market will maintain a 9.7% CAGR from now until 2030. Palo Alto Networks stock has boomed as a result of the industry’s growth, up by almost 400% over the past five years. Although 2024 started on a low note, the firm has parried most of its losses and looks poised to generate long-term gains.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Cyberattacks Are Increasing

The steady increase in cyberattacks will boost demand for Palo Alto Networks’ technology, prompting me to be bullish on the stock. There is a strong incentive for hackers to infiltrate databases and obtain valuable information. Hackers have a lot of ways to make money from their efforts. They can steal credit card information and sensitive data that they can sell on the dark web. Hackers can also block off access to sensitive information and demand a ransom in crypto to gain access to the important folders, data, and other resources that were taken.

Palo Alto Networks’ Q4 FY24 presentation mentions that ransomware public extortion activity is up by more than 50% from 2022. While many cybersecurity breaches have cost millions of dollars, the firm mentions that some hacks have had multi-billion-dollar impacts. It’s hard for companies to regain trust after enduring significant breaches, and some hacks make companies temporarily unable to do business.

For instance, some of MGM’s (MGM) casinos got shut down during a cyberattack, and lengthy queues emerged at Las Vegas hotels. Shortly after the cyberattack, MGM suggested that the attack cost the company $100 million in business.

Good cybersecurity isn’t optional anymore, especially for corporations. While all cybersecurity stocks should benefit from these tailwinds, none of them should benefit as much as Palo Alto Networks. The firm has the largest market share in the cybersecurity industry, having a comfortable lead over second place Fortinet (FTNT).

Artificial Intelligence Creates Challenges and Opportunities

Artificial intelligence has boosted productivity across many industries, and it’s aiding cybersecurity firms like Palo Alto Networks. There are two reasons why PANW investors should feel bullish about artificial intelligence.

The first benefit is that AI tools can help Palo Alto Networks deliver better products and services for its consumers. The firm has been using artificial intelligence for several years, long before it became mainstream with ChatGPT. Palo Alto Networks uses AI for several purposes that save people time. For instance, its technology identifies important security events without generating low-value alerts. Only showing important alerts saves analysts time and allows them to prioritize significant events. Artificial intelligence can also fill gaps and minimize the likelihood of small threats becoming big ones.

The second reason artificial intelligence will help Palo Alto Networks stock is because bad actors also have access to the technology. Just as workers are using AI to enhance productivity, hackers are also using it to attack and penetrate more companies. Artificial intelligence’s ability to enhance PANW’s offerings while enabling more cyberattacks can help the stock march higher in the long run.

Platformization Has Boosted the Firm’s Financial Performance

Palo Alto Network’s platformization efforts have paid off, translating into better financial performance. Platformization refers to the process of transforming a company’s offerings into a unified platform, which integrates multiple products or services under one system. This development is another reason why I am bullish on the stock. Although the strategy wasn’t greeted with open arms when the firm first announced it, Platformization has been gaining momentum as it consolidates features and reduces complexity.

The firm closed out Q4 FY24 with more than 1,000 total Platformized customers and more than $2.0 million in annual recurring revenue per Platformized customer. That figure is up by more than 10% since Q1 FY24.

Platformization heavily contributed to upbeat Fiscal 2025 guidance, which suggests revenue will range from $9.10 to $9.15 billion. Those figures project a year-over-year growth rate of between 13% and 14%. Platformization should continue to boost the company’s long-term financial results due to its adoption and recurring revenue model.

Is Palo Alto Networks a Buy?

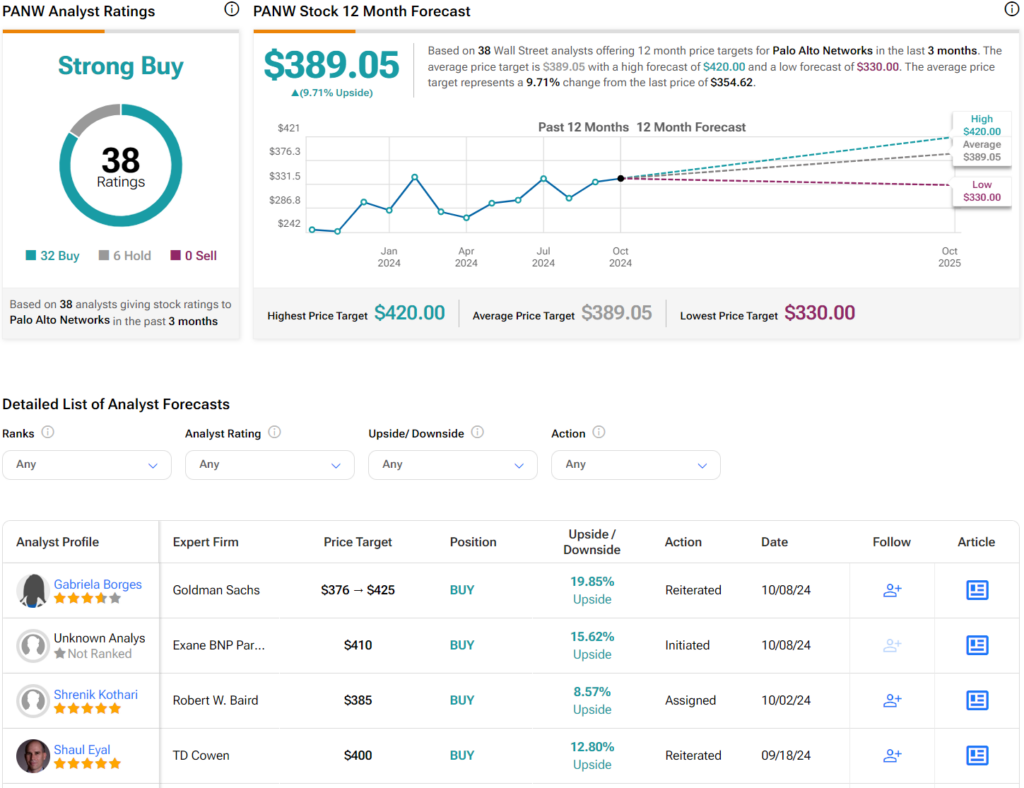

Palo Alto Networks is currently rated as a Strong Buy among 38 analysts based on 32 Buys and six Holds. In addition, the average PANW price target of $389.05 per share suggests 9.7% upside potential. However, some analysts are more optimistic, with the highest price target of $420 implying an 18% gain.

The Bottom Line on Palo Alto Networks Stock

Palo Alto Networks has the largest market share in the cybersecurity industry, and after a cold reception from investors, Platformization has helped the company grow its annual recurring revenue. Furthermore, cybersecurity attacks are on the rise and can cost millions of dollars to navigate once a breach occurs. As a result, many companies will continue to pour some of their capital into cybersecurity software, and Palo Alto Networks stands to be a top beneficiary of this trend.