The earnings season for the June quarter has been quite volatile for large-cap tech firms. With challenging comparisons due to rapid growth driven by AI in recent years, investors have been focusing on how companies manage to expand margins while increasing capital expenditures. As a long-term Meta Platforms (META) bull, I remain optimistic, as the company’s Q2 results not only exceeded expectations but also surpassed those of other AI tech giants, helping it be an outperformer this earnings season.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Meta’s Q3 guidance further boosts confidence, indicating that AI spending is positively impacting short-term results despite tough comparisons, which strengthens the long-term bull case. In this article, I’ll review Meta’s key Q2 highlights and explain why its approach to AI appears to be effective, addressing both short-term concerns and long-term expectations for shareholders.

Meta’s Q2 Results Were Better than Expected

When I wrote about Meta’s earnings expectations in a previous article, I took a cautious stance due to the typical volatility after earnings. As expected, volatility hit, but this time, it was positive for META’s bulls.

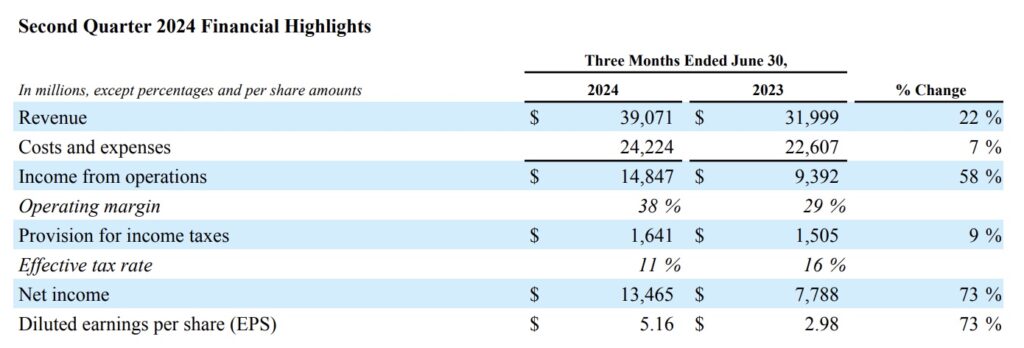

Meta’s performance was less surprising, given its recent track record of beating estimates. Still, it’s impressive, considering the tough comparisons. For Q2, analysts expected a 20% revenue increase, down from 27% in Q1. Meanwhile, Meta delivered $39.1 billion in revenue, a 22% annual increase, surpassing Wall Street’s $38.3 billion forecast.

This growth indicates that Meta is capturing more market share in advertising as advertisers shift from traditional methods to digital platforms like Instagram and Facebook. The success of Meta’s short-form video platform, Reels, in countering TikTok’s popularity also plays a role.

Revenue growth led to a 58% jump in operating income, which reached $14.8 billion from $9.4 billion last year. With an operating profit margin of 38%, Meta’s model is impressive, especially considering that most of its services are free.

Despite its massive market share, Meta increased its family daily active users by 7%, hitting 3.27 billion. This broad user base and increased engagement provide a strong competitive edge. Ad impressions across its apps grew by 10% year-over-year, reflecting higher user engagement and more ads being shown.

Notably, Meta achieved these strong operational metrics with fewer employees. The company reduced its headcount by 7,800 in Q2, highlighting Mark Zuckerberg’s effective cost management and contributing to the significant rise in operating income.

Here’s What Sets Meta Apart in the Current Earnings Season

A key concern for Q2 across Big Tech, especially amid the AI boom, were capital expenditures (CapEx) and guidance for both the top and bottom lines. For instance, major players like Alphabet (GOOGL) and Microsoft (MSFT) disappointed investors with high spending on AI that did not lead to a corresponding increase in cloud segment margins.

Consequently, the big question becomes, what return will Meta see from this spending, and when will those benefits materialize?

To answer that question, it’s important to note that Meta’s focus on AI is to improve its ad business and consumer behavior on its platforms. Then, secondarily, the company expects to drive revenue growth by scaling up new AI-based products like Meta AI and AI Studio.

Given this clear focus, Meta’s Q3 outlook helped alleviate concerns about inconsistent returns. The company projected revenues between $38.5 billion and $41 billion for Q3, signaling a 20% increase despite tough comparisons. This has sent a message that the AI investments are already paying off, particularly in how Meta manages CapEx and operating expenses.

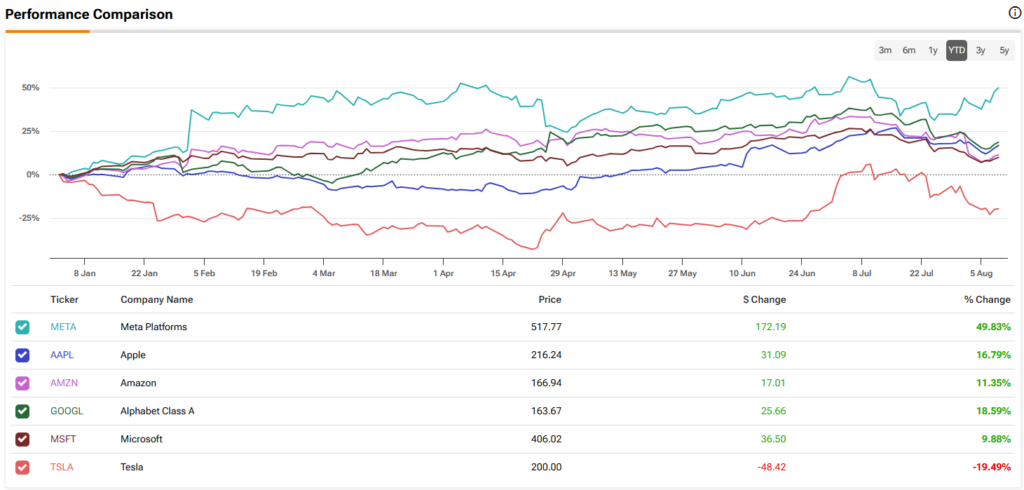

Additionally, Meta raised its annual CapEx forecast from $35–$40 billion to $37–$40 billion, but this didn’t negatively impact the stock price. The stock performed well, jumping around 7% after the Q2 results, while other Big Tech peers, except for Apple (AAPL), saw share prices fall following earnings reports.

Meta also warned that CapEx will increase even more by 2025. While this sounds significant, the current data doesn’t indicate long-term concern. On the contrary, Meta is seeing revenue growth, more daily active users, and increased ad impressions, all pointing to higher user engagement and effective AI recommendations.

The bottom line is that, in my opinion, Meta is currently the top-performing Big Tech company when it comes to managing AI growth expectations. It has adeptly balanced shareholders’ short-term expectations with its long-term growth ambitions.

In fact, Jensen Huang, CEO of Nvidia—referred to as the “Godfather of AI” by tech analyst Dan Ives of Wedbush—has credited Meta Platforms and its CEO, Mark Zuckerberg, with leading the field of AI. This recognition is due to Meta AI’s integration across the company’s social media platforms and the successful launch of Llama 3.1, an open-source AI project.

What Could Go Wrong for Meta?

At the same time, investors in Meta should be prepared for price swings and an aggressive investment strategy. While Meta posted strong Q2 results despite tough comps, challenges are expected to grow each quarter. With CapEx rising until at least 2025, the future returns of this high spending remain uncertain.

Currently, META stock trades at a forward price-to-earnings ratio of 24x, near its five-year average of 23x. I believe this valuation is reasonable for long-term investors, but short-term volatility may still occur.

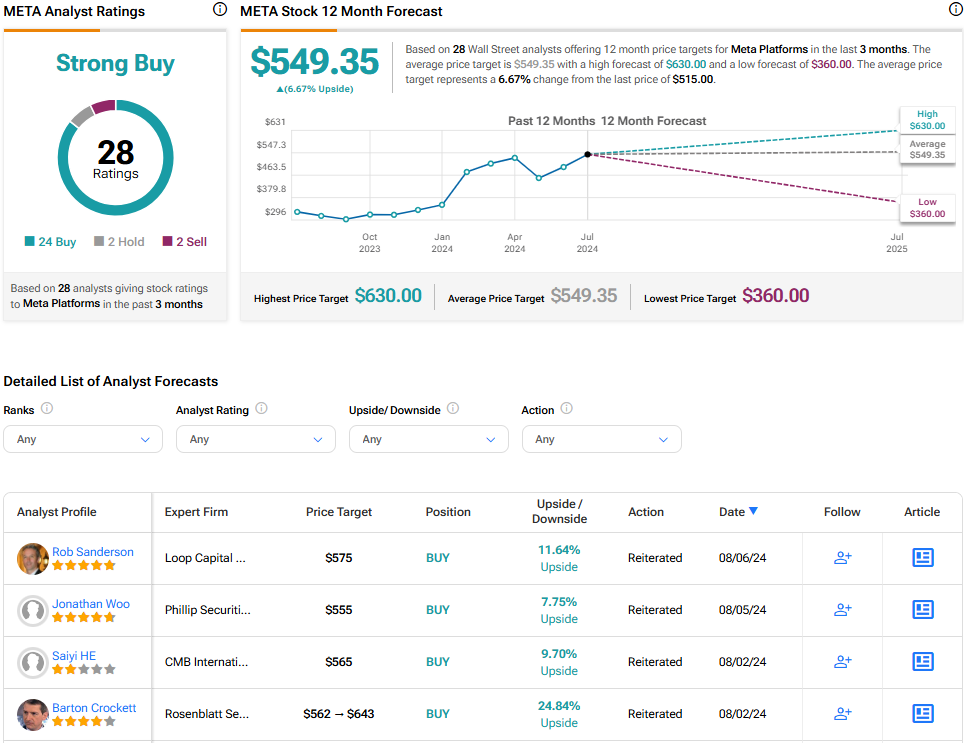

Is META Stock a Buy, According to Analysts?

Meta Platforms stock is rated a Strong Buy by Wall Street analysts. Out of 28 analysts covering the stock, only two are bearish, two are neutral, and the remaining 24 are bullish. 12 analysts have raised their price targets for META, with the average META stock price target now at $549.35. This suggests upside potential of 6.7% based on the latest share price.

Key Takeaway

Meta delivered a solid quarter recently, surpassing market estimates and offering promising Q3 guidance despite tough comparisons ahead. This performance indicates that its AI investments have already paid off and will likely continue to benefit the company in the latter half of the year. Currently, Meta stands out among Big Tech firms for its effective balance of short-term growth and long-term potential amid the AI boom.