Investors are bracing for more trouble as the aggressive rate hikes by the Federal Reserve to tame inflation are expected to push the U.S. economy into recession. The S&P 500 (SPX) and NASDAQ 100 (NDX) have declined 23.3% and over 31% year-to-date, respectively. While many tech stocks have been clobbered this year, Apple’s (NASDAQ:AAPL) stock has shown some amount of resilience and is down 15% year-to-date. Most Wall Street analysts remain bullish about the tech giant based on its strong track record, continued innovation, and progress into new growth areas like fintech.

Apple is Well-Positioned for Long-Term Growth

Apple’s Q3 Fiscal 2022 (ended June 30, 2022) revenue increased 1.9% to nearly $83 billion, but earnings per share fell 8% to $1.20. That said, the company managed to top analysts’ expectations for both key metrics.

While Apple cautioned investors about near-term pressures, including currency headwinds and supply chain woes, it expects revenue growth to accelerate in the September quarter compared to the June quarter.

Meanwhile, Apple is diversifying its manufacturing footprint amid production disruptions in China. Apple recently announced that it would be manufacturing the iPhone 14 in India. The company has been manufacturing old models of iPhones in India but this time it is going ahead with the production of a newly launched device. The move is expected to boost Apple’s prospects in a lucrative market like India.

Additionally, Apple continues to deepen customer engagement with its services business, which includes sales from Applecare, advertising, cloud, payment, and other services. Note that the company’s services business is more profitable than its products segment. The company has been advancing in the attractive financial services market through solutions like Apple Pay and Apple Wallet.

Back in June, Apple announced that it will launch a buy now, pay later service called Apple Pay Later. The facility will allow customers to split their purchase into four equal payments that can be spread over six weeks. Earlier this year, Apple rolled out its Tap to Pay on iPhone feature that enables contactless payments.

Is Apple a Buy or Sell Now?

In a recent research note to investors, Wedbush Securities analyst Daniel Ives noted that the iPhone 14 is likely witnessing “brisk sales” as wait times are getting longer. The analyst stated, “Wait times on many iPhone Pro 14 models are now 4-6 weeks for Apple customers and lengthening into November.” Ives stated that the overall demand for Pro is 8% to 10% ahead of his expectations.

The analyst also sees strong sales in China, mainly via e-commerce channels. He expects China’s business to be a vital factor in Apple’s growth story and estimates that nearly 30% of iPhone customers in China “are in the window of an upgrade opportunity.”

Despite macro pressures, Ives believes that Apple’s growth story “remains a bright spot in the tech landscape with darker clouds abound in many pockets of consumer tech.” Ives reiterated a Buy rating on AAPL stock with a price target of $220.

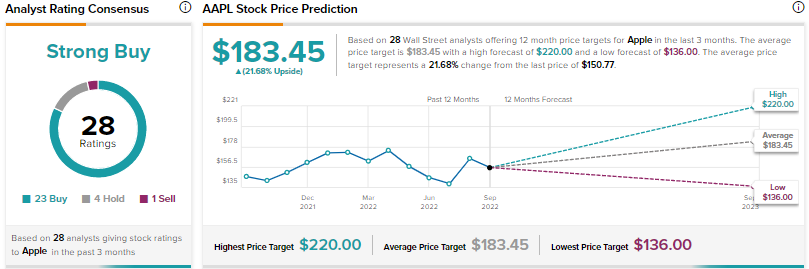

All in all, Apple scores the Street’s Strong Buy consensus rating based on 23 Buys, four Holds, and one Sell rating. The average Apple price target of $183.45 suggests nearly 22% upside potential from current levels.

Conclusion

Despite macro pressures, Apple seems to be an attractive pick for the long haul based on strengths like continued innovation, solid growth potential for the services business, and strong execution.

Apple scores a “Perfect 10” on TipRanks’ Smart Score System, indicating that the stock is likely to outperform the broader market.