Citigroup (NYSE:C) recently reported its Q2-2023 earnings results, which I’ll discuss in detail in this article. In a nutshell, Citigroup saw significantly weaker operating momentum in Q2 compared to the very strong start of the year in Q1, mainly due to weakness in capital-market-sensitive businesses and elevated credit losses in the Cards business. Q2 expenses also included one-off charges such as severance to the tune of $200 million.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

However, despite the weak results, management kept its full-year guidance intact, and I expect revenue headwinds to fade into the second half of the year while expense growth slows down in tandem. Thus, I am bullish on the stock at current prices.

Operational Overview

Citigroup reports results in four main operating segments: Institutional Clients Group at 53.7% of Q2-2023 revenues, Personal Banking and Wealth Management at 32.9% of revenues, Legacy Franchises at 9.9%, and Corporate/Other at 3.5% of revenues. Let’s analyze how major segments performed.

Institutional Clients Group saw revenues drop 9% year-over-year, a poor performance considering that expenses rose 13% from Q2 2022. Revenue was hit by weakness in capital-markets-exposed businesses, while expense drivers were investments in Treasury and Trade Solutions, risk and controls, as well as severance payments. Impacted by significant negative operating leverage, net income dropped 45% year-over-year. Further, return on tangible common equity (RoTCE) was 9.2% in Q2 2023 (11.1% in 2022).

Personal Banking & Wealth Management revenue rose 6% year-over-year, better than the 5% increase in expenses. Revenues were higher on strength in U.S. Personal Banking, while expenses grew on elevated risk and control investments. Net credit losses were up 78% relative to Q2 2022, with net income dropping 11% year-over-year. As a result, RoTCE for the segment was 5.5% in the quarter (10.2% in 2022).

Legacy Franchises saw its overall revenue contribution dip below 10% in the quarter, with the largest remaining asset, the Mexico retail bank Banamex, set to be listed in an initial public offering in 2025. The Legacy Franchises segment was a marginal drag on performance in Q2 2023, with RoTCE coming in at -3.9% as a result of a high cost of risk. The two remaining businesses in Asia are set to be sold by the end of 2023, and the bank restarted its Poland exit process.

For the bank as a whole, Q2 revenues dropped 1% year-over-year (2022 saw 5% growth), while expenses were up 9% relative to Q2 2022. RoTCE came in at 6.4% (8.9% in 2022). Furthermore, tangible book value was up 1.3% quarter-over-quarter to $85.34/share, and earnings per share were $1.33/share in Q2, down 39% year-over-year.

Capital and Shareholder Remuneration

Citigroup’s CET1 ratio (which looks at a bank’s capital relative to its assets) finished Q1 at 13.3%, down 0.14% or 14 basis points quarter-over-quarter, impacted by higher risk-weighted assets. The bank’s CET1 regulatory requirement is set to increase by 0.3% to 12.3% in October 2023, implying a current 1% buffer. The 0.3% increase follows the 2023 stress tests which the bank passed, underlined by the 3.9% hike in the quarterly dividend to $0.53/share.

The payout ratio in Q2 was 76%, with Citigroup spending $1 billion on dividends and $1 billion on share buybacks. Given the substantial tangible book discount and robust capital position, I expect the bank to continue allocating a sizable amount for share repurchases. Management’s current thinking is that buyback decisions will be made on a quarter-by-quarter basis.

2023 Outlook

Citigroup boosted its net interest income outlook by $1 billion to $46 billion. That said, weakness in fees kept the overall revenue and expense outlook unchanged. Here’s the outlook:

Revenues of $78 billion-$79 billion, or growth of 3.6%-4.9% over 2022.

Expenses of $54 billion, or growth of 5.3% over 2022.

Despite a weak Q2, on a year-to-date basis, both expenses and revenues are running at 5% above 2022 levels, putting the bank on track to meet its full-year expectations. However, given the fading momentum observed in Q2, my hopes of a guidance boost following the strong start of the year are no longer warranted.

Is Citigroup Stock a Buy, According to Analysts?

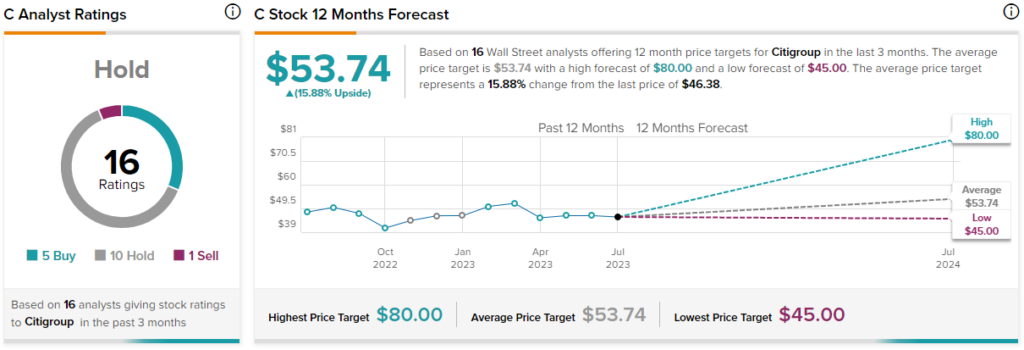

Turning to Wall Street, Citigroup earns a Hold consensus rating based on five Buys, 10 Holds, and one Sell rating assigned in the past three months. Additionally, Citigroup stock’s average price target is $53.74, implying 15.9% upside potential.

The Takeaway

Despite a significant slowdown in operating momentum, management did not cut its full-year 2023 outlook, implying that a turnaround is to be expected in the second half of 2023. Also, the resumed share buybacks voice confidence in the bank’s capital position and earnings capacity.

The Legacy Franchises unit is now below 10% of the whole bank in terms of revenue, with its negative impact on earnings set to fade in the next few years.

Given the market’s negative reaction to the Q2-2023 results, I view the pullback as an excellent opportunity to expand one’s position in the bank. In all likelihood, Q2 will mark a trough in earnings performance for the year, barring a severe recession. I expect market-sensitive businesses to improve starting in the second half of the year, which, coupled with a normalized cost of risk on credit cards, should push Citigroup’s RoTCE back into the high-single digits.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue