Given that U.S.-China relations haven’t exactly been affectionate, the mentioning of Baidu (NASDAQ:BIDU) – even as a compelling argument for the ultra-hot artificial intelligence (AI) space – will undoubtedly arouse controversy for some investors. However, the underlying tensions themselves, along with attractive financial metrics, practically sell the case for Baidu. Therefore, I am bullish on BIDU stock.

BIDU Stock Rides the Biggest Tailwind Ever — China

Specializing in internet-related services, Baidu often draws comparisons to Alphabet (NASDAQ:GOOG) NASDAQ:GOOGL) with the label “Google of China.” Presenting various services that are similar to Google’s offerings, such as Baidu Maps, the Chinese tech juggernaut has aggressively moved into the AI domain. Further, BIDU stock should benefit from support from China’s private and public sectors.

First, a Reuters report that came out in late May of this year stated that Baidu is likely to establish a venture capital fund of 1 billion yuan or approximately $145 million, per TipRanks reporter Shrilekha Pethe. “This fund aims to invest in start-ups that can contribute to the growth and development of AI applications across sectors,” Pethe wrote.

In addition, Baidu will launch a competition for developers to build applications off its ERNIE bot, which is Baidu’s AI chatbot service product. Under development since 2019, the company launched ERNIE back in March.

Regarding the public sphere, the Carnegie Endowment for International Peace mentioned in January last year that “the Chinese government has rolled out a series of policy documents and public pronouncements that are finally putting meat on the bone of the country’s governance regime” for AI.

Further, the organization emphasized that “anyone who wants to compete against, cooperate with, or simply understand China’s AI ecosystem must examine these moves closely.”

Bluntly, the Chinese government is putting serious muscle into its AI directive, fueled in part by competition with the West. Cynically, then, this framework should represent a sustained catalyst for BIDU stock.

Baidu Sells Itself

While AI has stormed into the spotlight, thanks to OpenAI and its chatbot creation, ChatGPT, the market reality right now is that several AI-related enterprises command significant premiums. For example, shares of semiconductor specialist Nvidia (NASDAQ:NVDA) now trade at nearly 56 times forward (projected) earnings. That’s not to say NVDA is a Sell. Rather, it’s just overpriced. However, in this case, Baidu sells itself.

Right now, the market prices BIDU stock at a forward multiple of 15.08. That’s incredibly cheap compared to the software (Internet) sector’s average forward price-earnings ratio of 466.55 times. Even compared to the industry’s trailing P/E ratio of 28.7 times, Baidu remains undervalued, as the stock’s trailing P/E ratio sits at 26.8.

Even better, BIDU stock trades at a price-to-book value of 1.57. In contrast, the average price-to-book value for the underlying sector clocks in at 5.21 times. Against a host of other key financial metrics, Baidu offers prospective investors a discount.

Even on a price-chart basis, BIDU stock seems to make much sense. For example, since the January opener, BIDU stock gained 20.3%. In sharp contrast, NVDA printed a gain (during the same period) of nearly 200%.

I believe you’re more likely to be left holding the bag with NVDA than with BIDU stock if you’re buying now.

Consistent Profitability Helps Seal the Deal

Another reason to take a long look at BIDU stock centers on its financials; specifically, the underlying enterprise benefits from consistent profitability.

In the Fiscal Year ended December 2019, Baidu posted net income of 2.06 billion yuan. Despite the sharp ravages of COVID-19, the company rang up net income of 22.47 billion yuan the following year. In Fiscal 2021, Baidu posted 10.23 billion yuan before the metric slipped again to 7.56 billion yuan in 2022.

Still, the point remains that Baidu pings great performances despite outside pressures, instilling confidence in BIDU stock.

Is BIDU Stock a Buy, According to Analysts?

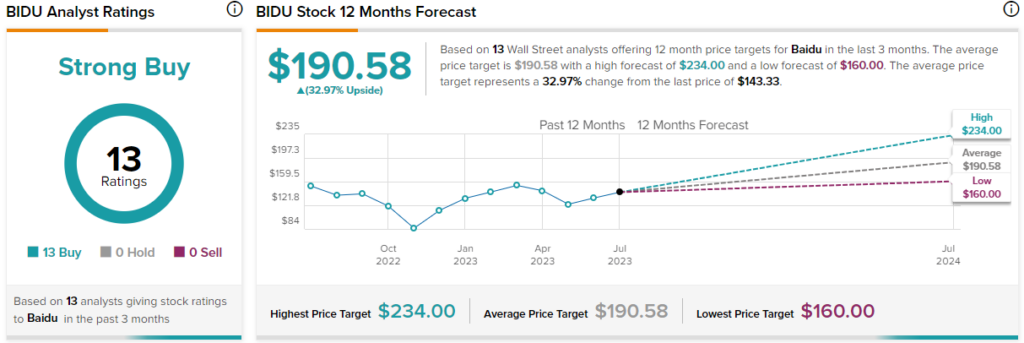

Turning to Wall Street, BIDU stock has a Strong Buy consensus rating based on 13 Buys, zero Holds, and zero Sell ratings. The average BIDU stock price target is $190.58, implying 33% upside potential.

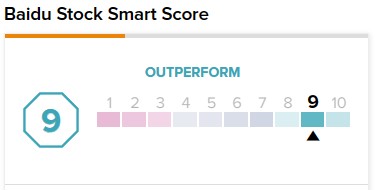

Also, on TipRanks, BIDU stock has a 9 out of 10 Smart Score rating. This indicates strong potential for the stock to outperform the broader market.

The Takeaway: BIDU Stock Offers the Smart Way to Play AI

With AI generating tremendous buzz among retail investors, speculating in the arena might make sense. However, Baidu presents a compelling argument because of its relevance, strong private and public sector support, and bargain price. In other words, if you want to play AI the smart way, you might want to look into BIDU stock.