Cenovus Energy Inc. (CVE) shares have performed extremely well so far this year, up about 30%, taking advantage of a tailwind from higher energy prices. I am bullish on this stock, as I believe this Canadian integrated oil and gas operator is poised to deliver strongly throughout the year due to relatively high energy prices while the company’s Upstream and Downstream operations continue to improve.

About Cenovus Energy

Cenovus Energy is a Canadian producer of bitumen, heavy/light crude oil, and natural gas products from oil sands, conventional and offshore operations in North America. In addition to its own, Cenovus Energy also markets refined third-party products.

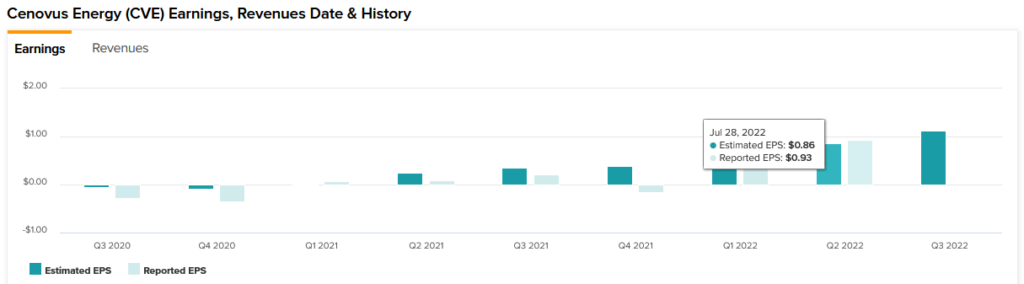

Q2-2022 Results Exceeded Analysts’ Expectations

The company’s Q2 earnings and revenue topped analysts’ estimates, and operating cash flow increased to the extent that it was able to return a significant portion of it to shareholders. All of this was possible despite the impact of certain refineries being shut down for maintenance reasons.

So, Cenovus Energy’s Q2 diluted earnings per share of C$1.19, or about US$0.93, rose almost 11x year-over-year and outperformed the consensus estimate of $0.86.

Driven by higher prices, the company earned from selling its products in both the upstream and downstream markets. Total revenues were C$19.2 billion (or nearly $15 billion), a 115% increase over the same period year-ago quarter, exceeding analysts’ median forecast by $1.74 billion.

In addition to higher realized prices, its operations enabled the company to significantly improve operating cash flow and deleverage its balance sheet.

Cash flow from operating activities increased 118% year-over-year to nearly C$3 billion, and excess free funds flow increased 62% year-over-year to C$2.02 billion, 50% of which was returned to shareholders.

Long-term debt decreased 4% from the previous quarter ended March 30, 2022, and net debt improved to $7.51 billion from $8.41 billion at the end of the first quarter of 2022.

These improvements had a positive effect on the stock price in the recent past, and improvements can continue, going forward. This is because crude oil, bitumen, and natural gas prices are expected to pick up from where they are currently, and the company forecasts to increase production throughout 2022.

CVE’s Capital Budget and Guidance for 2022

The company has updated its capital budget and issued a new forecast for 2022. For the full year of 2022, Cenovus Energy expects to invest C$3.3 billion to C$3.7 billion in upstream, downstream, and retail operations.

It forecasts an upstream production range of 780,000 to 810,000 barrels of oil equivalent per day (BOE/d), reflecting a 2% mid-point increase compared to the previous forecast range.

Commodity Prices: Upside Catalysts and Near Future Prices Forecasts

Crude oil, bitumen, and natural gas are all expected to trade higher over the next few weeks, according to analysts who base their forecasts on strong bullish catalysts.

OPEC’s top oil producers believe an aggressive stance from the Federal Reserve and other central banks will cause a recession and lower oil demand prospects.

Therefore, on Wednesday, August 3, OPEC+ decided to pump additional oil in September, but not more than 100,000 barrels per day, a significantly smaller amount than the increase of 600,000 barrels per day delivered in July and August. The additional production will hardly be enough for a market desperate for more barrels of oil.

Limited supply against rising demand for crude fueled by the energy crisis will almost certainly continue to put upward pressure on commodity prices.

From current levels, crude oil is expected to rise about 27% to $114.75 a barrel (/bbl) 12 months from now, according to analysts’ expectations.

Roughly the same factors that can cause the next crude oil price will also affect bitumen prices.

Analysts expect the price of bitumen to reach CNY4919.20 (Chinese Yuan) per ton within a year. This implies an over 15% increase.

As for natural gas, higher prices are expected to be supported by strong demand from the U.S. and abroad. Rising cooling needs amid unusually high temperatures in the United States, coupled with strong demand from Europe as flows in the Nord Stream pipeline decrease significantly, should continue to support gas prices.

Natural gas is expected to trade at $10.58 per metric million British thermal units 12 months from now (up 29.3% from current price levels).

Increased Production and Commodities Prices Can Support a Dividend Hike

There’s no doubt that higher commodities prices increase Cenovus Energy’s chances of earning better profits from sales of greater volumes of its products, and higher operating profitability should lead to a rise in its stock price. However, the positive effect on the stock price could also be conveyed through a higher dividend if the company hikes it again this year.

The quarterly dividend per share doubled from CA$0.035 paid on December 31, 2021, to CA$0.105 (or US$0.08) paid on June 30, leading to a dividend yield of about 1.7%. Cenovus Energy’s stock has a payout ratio of 9.36%, so there’s more than enough margin to increase the dividend further.

The Technicals: CVE Stock Isn’t Overbought Anymore

The current share price of $16.40 doesn’t seem expensive compared to where it was a few months ago when energy stocks were rallying non-stop. Furthermore, after a sharp ~34% decline from its all-time high of $24.91, it is now significantly lower than its 50-day moving average of $19.70.

Also, CVE currently trades near the midpoint of its 52-week range of $7.20-$24.91 and trades only slightly above its 200-day moving average of $16.15.

Wall Street’s Take on CVE Stock

In the past three months, 11 Wall Street analysts have issued a 12-month price target for CVE. The stock has a Strong Buy consensus rating based on 10 Buys and one Hold. The average CVE price target is $25.77, implying 57.4% upside potential.

Conclusion: Amazing Outlook Provides Strong Upside Potential

Cenovus Energy has astonishing prospects in terms of the expected favorable environment for commodity prices and the higher expected output of its Upstream and Downstream segments. The Canadian oil and gas company is on track to perform strongly this year, and the stock price should benefit.