Several of the market tech giants are reporting earnings this week, but avid market watchers will have to wait until the end of next week for the biggest of them to dial in its latest quarterly statement.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Apple (NASDAQ:AAPL) will report fiscal third quarter results (June quarter) next Thursday (August 3). Ahead of the print, Deutsche Bank analyst Sidney Ho thinks the latest data suggests there could be a positive surprise in store.

“Recent checks and third-party data suggest upside to iPhone, Mac and Services,” the 5-star analyst noted. “While the recovery in global smartphone demand is below expectations, it appears that the premium market (and hence Apple) is less impacted.”

Moreover, ahead of the new iPhone launch, the build out appears to be moving along smoothly and Ho reckons there’s the possibility iPhone units will actually post year-over-year growth in CY23 rather than show a decline of 5% as the Street currently expects.

That said, for the current quarter, while Ho and the Street’s iPhone shipment expectations match – both are at ~$43 million – Ho sees iPhone revenue falling 8% year-over-year and 27% sequentially to $37.3 billion, lower than the Street’s $39.8 billion estimate. As noted above, however, on account of third-party preliminary unit shipment data, Ho does think there’s the possibility revenue for iPhones (and Macs) will come in above his estimates.

As for the headline metrics, Ho is also slightly below Street expectations, calling for revenue/EPS of $80.5 billion (a 3% y/y drop and down 15% QoQ) and $1.16, respectively, vs. the Street at $81.5 billion/$1.20.

Looking ahead, Ho anticipates Apple will suggest that F4Q (September quarter) y/y revenue will improve on the negative 3% display expected in F3Q. For the quarter, Ho is modeling a 1% y/y increase and 13% sequential improvement for revenue to reach $90.6 billion, a touch below consensus at $90.8 billion. The analyst sees EPS at $1.33, also slightly below Wall Street’s $1.37 forecast.

Over the past 3 months, Big Tech names, Apple included, have experienced some serious multiple expansion but Ho thinks there are reasons why the good times are set to continue for Apple.

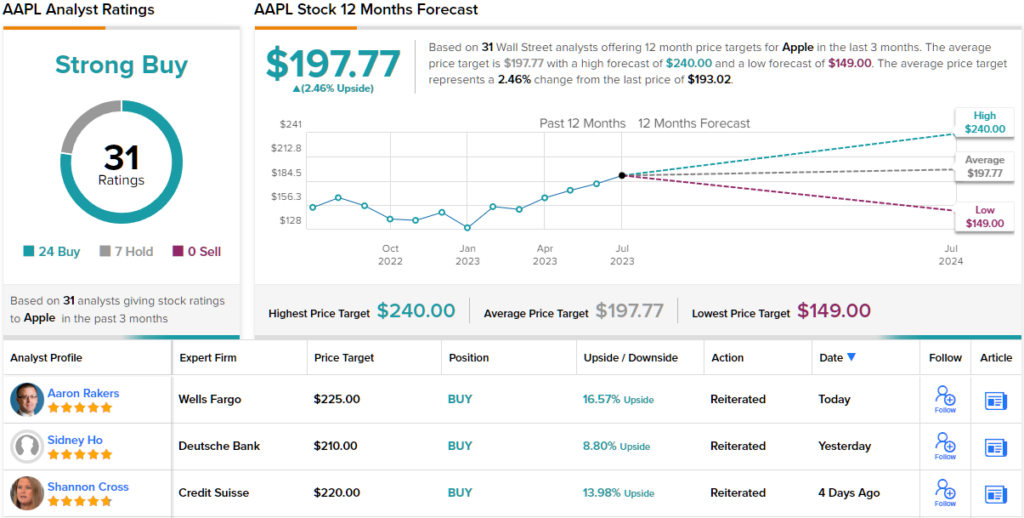

“Despite higher valuation,” Ho summed up, “we continue to view AAPL favorably given its high quality of earnings and strong balance sheet, and we raise our price target from $180 to $210.” (To watch Ho’s track record, click here)

Overall, 23 analysts join Ho in the bull camp and with an additional 7 Holds, the stock claims a Strong Buy consensus rating. That said, going by the $197.77 average target, the shares will stay rangebound for the foreseeable future. (See Apple stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.