Movie theater chains were amongst the hardest hit businesses during the pandemic, a period when AMC Entertainment (NYSE:AMC) almost went bankrupt.

However, as a sign that times have moved on since, the company recorded its highest quarterly attendance rate since 4Q19 – 66.4 million, amounting to 12% year-over-year growth – the last quarter before the Covid-19 pandemic began.

Elsewhere in Q2, there were other pleasing metrics. Revenue reached a four-year high, coming in at $1.35 billion, representing a 15.6% year-over-year uptick and beating the consensus estimate by $60 million. Also amounting to its best showing since the fourth quarter of 2019, adjusted EBITDA reached $182.5 million, a 71% improvement on the same period a year ago. At the bottom-line, adj. EPS of $0.00 beat the analysts’ forecast by $0.04.

Looking ahead to Q3, buoyed by blockbusters such as Barbie, Oppenheimer, and Mission Impossible – Dead Reckoning, the company said July represented the highest monthly revenue in the company’s 103-year history, so the outlook seems promising too.

Scanning the print, long time AMC bear, Wedbush analyst Alicia Reece hails an “excellent” quarter, but reminds investors of the potential for very serious headwinds. One pressing concern is AMC’s involvement in a legal dispute regarding the conversion of its preferred APE units.

“It is worth pointing out that if AMC faces the perfect storm of a court ruling that does not allow the company to fold APE shares back into AMC shares, while the SAG-AFTRA and WGA strikes go on for months longer, then AMC could face bankruptcy next year if it is unable to raise enough cash with its APE shares,” she explained.

On the other hand, that constitutes a worst-case scenario, and while possible, it is not a “foregone conclusion.” If the situation is reversed, AMC’s impressive performance in Q2 and the ongoing positive trends in Q3 box office results suggest that the company is in a favorable position to maintain its upward recovery path.

“Specifically,” adds Reece, “if the court ruling allows AMC to fold APE shares into AMC shares, and the Hollywood labor strikes resolve in the coming weeks, AMC would be positioned to fully exploit the industry box office rebound that we are seeing unfold now.”

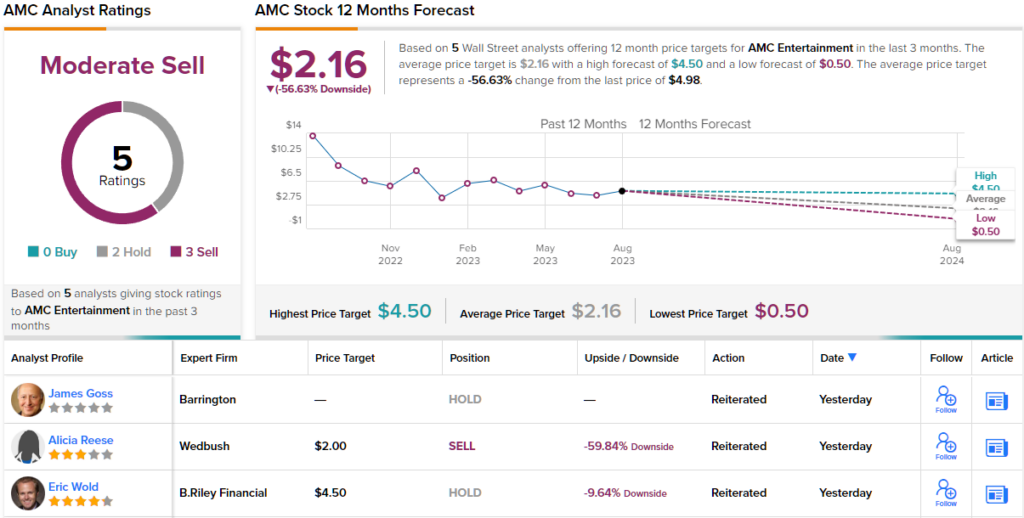

Maybe so, but for now Reese remains in the bear camp, reiterating an Underperform (i.e., Sell) rating and $2 price target. The figure suggests shares will post downside of a big 60% over the coming year. (To watch Reese’s track record, click here)

Other analysts are hardly any more optimistic right now. The stock receives a Moderate Sell consensus rating, based on 3 Sells and 2 Holds. The $2.16 average target is slightly higher than Reese’s objective but still factors in a one-year decline of ~57%. (See AMC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.