Adobe, a leading creative software giant (NASDAQ:ADBE), faced significant market rejection earlier this year, causing its stock to plunge. However, investor sentiment has turned positive as Adobe’s shares surged more than 15% following strong Fiscal Q2 results, which included robust growth in key metrics, increased guidance, and enhanced clarity regarding the company’s AI strategy. Looking ahead, Adobe continues to trade at discounted multiples from its peak, still presenting an attractive buying opportunity.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

This positive outlook supports my bullish stance on Adobe’s prospects for the remainder of the year.

Why Is ADBE Underperforming This Year?

Adobe has encountered a few challenges this year that have contributed to its downward spiral. First, Adobe faces stiff competition from Canva, an intuitive editing platform that consistently launches new tools. This competition has made it increasingly difficult for Adobe to maintain its dominance, especially at the lower end of the market.

Additionally, Adobe faced customer backlash over privacy concerns when it announced it would give all users free access to their projects.

However, the primary issue that overshadows Adobe is the uncertainty regarding its AI strategy. Concerns about how Adobe plans to integrate AI into its software have caused apprehension among investors. As a result, Adobe has struggled to meet Wall Street’s expectations in recent quarters. The market focus has shifted mainly to AI infrastructure companies like Nvidia (NASDAQ:NVDA), leaving Adobe perceived as lagging in the AI race.

This perception has sidelined Adobe, as market participants may view the company as falling behind its competitors in the AI arena.

Is Optimism Justified Following Fiscal Q2 Results?

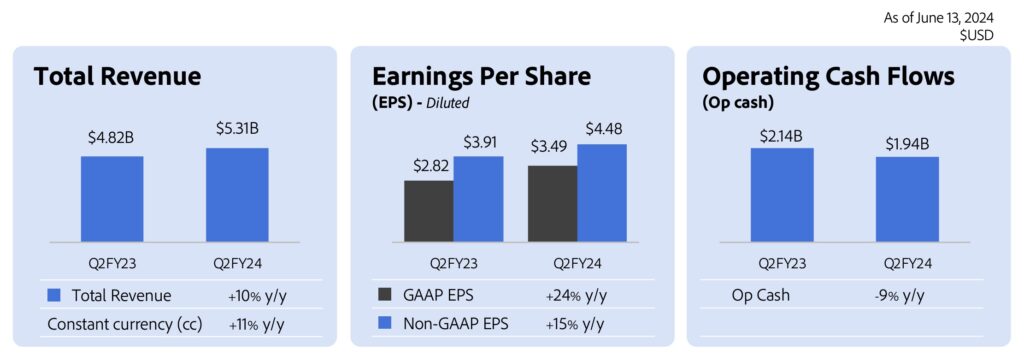

Adobe’s recent Fiscal Q2 results have provided investors with reasons to feel optimistic, with shares jumping around 15% following the release of the figures.

Adobe reported revenue growth of 10% year-over-year, totaling $5.31 billion and also delivered solid results on the bottom line, with GAAP EPS reaching $3.49, a 24% increase year-over-year. The fiscal second quarter showcased double-digit bottom-line growth in its Digital Media segment (responsible for 74% of the company’s total revenues), which grew 11% year-over-year, while the Digital Experience segment (25% of total revenues) grew 8.7% year-over-year.

In both cases, Digital Media’s ARR (annualized recurring revenue) jumped by 13%, and Digital Experience’s subscription revenue increased by 9%, highlighting the robustness and predictability of Adobe’s recurring business model.

Regarding margins, Adobe’s GAAP operating margin stood at 35.5%, a year-over-year increase of 1.8 percentage points. Despite this improvement, Adobe reported an operating cash flow decrease of 9% year-over-year at $1.94 billion. Over the past year, this decline in cash generation has been impacted by the $1 billion acquisition termination fee payout to Figma.

However, Adobe continues to generate robust free cash flow ($6.49 billion over the last 12 months) and has repurchased shares totaling $2.5 billion in Q2.

Furthermore, another significant development of the quarter was the upgrade in the company’s full-year 2024 guidance, which includes an increase of $50 million in digital media net new ARR and a raise in the lower end of revenue expectations from $21.3 billion to $21.4 billion.

Management attributes this success to growing customer value through an innovative product roadmap. Adobe has made substantial strides in enhancing its product offerings, making them more valuable to customers and increasing market interest in Adobe’s services. The infusion of artificial intelligence (AI) into Adobe’s products has further enhanced their utility for creators, positioning the company at the forefront of technological advancement in the creative software industry.

For example, Adobe has introduced new features on Acrobat aimed at boosting productivity in handling multiple documents, powered by Adobe Firefly. This allows users to generate images using text prompts. Additionally, the Firefly AI image tool is closely integrated with Photoshop and Lightroom offerings, enhancing upsell potential. I believe this is exactly the type of news Wall Street wanted to hear.

What Is Not Priced Into Adobe’s Investment Thesis?

Even though Q2 has given Wall Street a new lease on life, I think what’s not yet priced into Adobe stock is the complexity of projecting the next two years based on what generative AI can achieve.

If Adobe can effectively implement its AI strategy and demonstrate that its customers are not switching to other AI tools, it will be challenging to bet against a leading company in its segment. This is particularly true for a company with a large user base strengthened by AI capabilities, similar to the situation faced by Apple (NASDAQ:AAPL) this year.

Despite a forward price-to-earnings (P/E) ratio of 28x, Adobe is still not up for the year, remaining below its price at the beginning of 2024. It is also 20% below its five-year average, and I believe this scenario presents an interesting opportunity for investors. While ADBE stock has rebounded slightly from earlier lows of around $430 per share, it is still trailing the major indexes significantly for the year.

This slight rebound, driven by excellent earnings announcements, has not pushed the stock into overvalued territory. In fact, I consider Adobe’s current trading price reasonable, given the company’s solid fundamentals and growth prospects.

Additionally, management’s confidence in the company’s future is further underscored by its decision to repurchase shares. Stock buybacks are typically a strong signal that the company believes its shares are undervalued.

Is ADBE Stock a Buy, According to Analysts?

The consensus among Wall Street analysts regarding ADBE is a Moderate Buy. This is based on 21 Buys, five Holds, and one Sell rating assigned in the past three months. The average ADBE stock price target is $618.28 among 27 analysts, implying an upside potential of 18.4%.

The Bottom Line

Adobe’s Fiscal Q2 results not only demonstrated the company’s solidity but also alleviated some concerns regarding its AI capabilities, helping the stock partially regain momentum. ADBE is currently trading below its historical valuation average, making it a compelling opportunity to invest in a robust business on a dip.

Given these factors, I believe that as Adobe continues to execute its AI strategy, its position as a market leader in creative software should strengthen and significantly enhance its value, thereby garnering better appreciation from Wall Street. Therefore, I am bullish on ADBE stock.