Shares of the semiconductor company Micron (NASDAQ:MU) have gained about 52% year-to-date. Meanwhile, improved supply/demand dynamics and increased pricing could boost its stock. As the uptrend in Micron stock could continue, it prompts the question: who owns MU?

Now, according to TipRanks’ ownership page, Micron is mostly owned by Other Institutional Investors at 48.23%, followed by mutual funds, public companies, and insiders at 28.47%, 22.85%, and 0.45%, respectively.

Digging Deeper into Micron’s Ownership Structure

Upon detailed examination of institutional ownership, Vanguard stands out as the top shareholder of Micron stock, holding a stake of approximately 7.4%. Following closely is Vanguard Index Funds, with a notable ownership stake of 6.47% in the company.

Among the other institutions, the Hedge Fund Confidence Signal is Very Negative on MU stock based on the activity of 33 hedge funds. Meanwhile, Theofanis Kolokotrones of PRIMECAP Management has a significant stake in MU, owing about 3.43%.

Along with the Hedge Funds, individual investors also have a negative outlook. Of the 704,996 portfolios monitored by TipRanks, only 0.8% have invested in Micron stock. This suggests that investors aren’t confident about Micron’s prospects, at least in the near term.

Is Micron Stock a Buy or Sell?

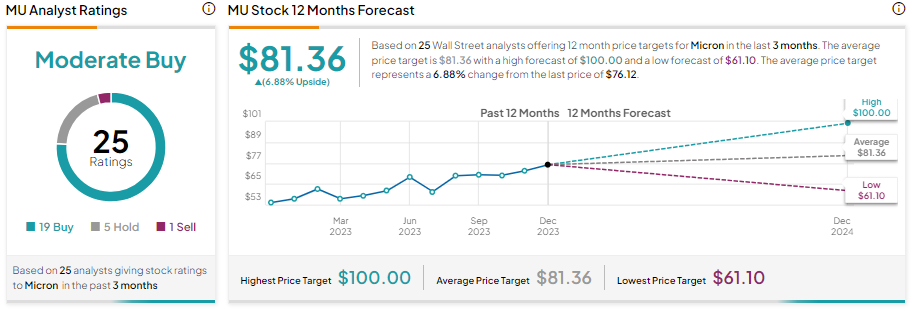

Micron stock gained significantly on a year-to-date basis. Thus, analysts’ average price target suggests limited upside potential over the next 12 months.

With 19 Buy, five Hold, and one Sell recommendations, Micron stock has a Moderate Buy consensus rating on TipRanks. Further, the average MU stock price target of $81.36 implies a 6.88% upside potential from current levels.

Bottom Line

The ownership structure of Micron stock demonstrates a healthy mix of institutional, insider, and individual investors. Micron recently increased its top-line estimates, citing improved demand and pricing environment. Additionally, the company remains confident in reducing its losses, which is positive. However, the ongoing macro challenges could pose challenges, as reflected via analysts’ Moderate Buy consensus rating.