Shares of Advanced Micro Devices (NASDAQ:AMD) are up over 48% year-to-date. The significant growth in AMD stock reflects investors’ optimism over AI (Artificial Intelligence). AMD sees multibillion-dollar growth opportunities led by AI, which is expected to have a positive impact on its financial performance and stock price. Since the company is a solid AI player, it made us ask who owns AMD.

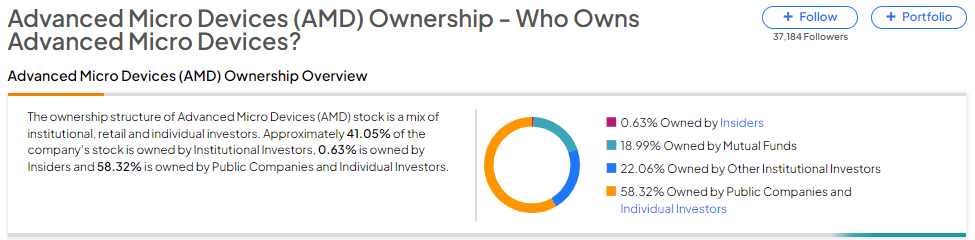

Now, according to TipRanks’ ownership page, it’s mostly owned by public companies and individual investors at 58.32%, followed by other institutional investors, mutual funds, and insiders at 22.06%, 18.99%, and 0.63%, respectively.

Looking closely at institutions (Mutual Funds and Other Institutional Investors), Vanguard owns the most significant stake in AMD stock. This is followed by Vanguard Index Funds, which holds a 6.44% stake in the company.

Among the institutions, the Hedge Fund Confidence Signal is Very Positive on AMD based on the activity of 35 hedge funds. Of all the hedge fund managers tracked by TipRanks, Ken Fisher of Fisher Asset Management LLC has the largest position in AMD stock at roughly $3.07 billion. Next is Philippe Laffont of Coatue Management, whose investment is valued at $1.59 billion.

Although the Hedge Fund Confidence Signal strongly favors AMD stock, it’s noteworthy that individual investors have a negative view of the company. Among the 697,147 portfolios monitored by TipRanks, 3.7% have invested in AMD stock. Despite the prevailing negative sentiment among short-term investors, what stands out is that investors allocate 7.24% of their portfolios to AMD. This suggests that investors are confident about its long-term prospects.

What is the Future of AMD Stock?

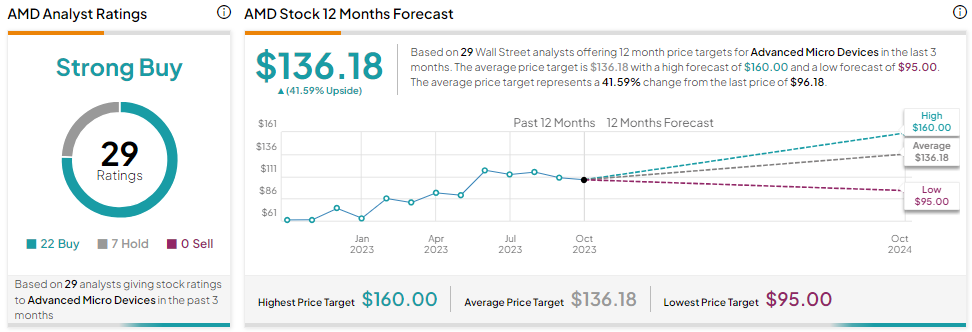

Wall Street analysts are bullish about AMD’s prospects and see significant upside potential in its stock from current levels. The company will likely get a boost from the rapid adoption of AI, which will drive its data center revenues and provide a multi-year growth opportunity. Moreover, new product launches and recovery in the PC market will support its earnings growth.

These positives are reflected in analysts’ optimistic outlook on AMD stock. With 22 Buy and seven Hold recommendations, AMD has a Strong Buy consensus rating. Further, the average AMD stock price target of $136.18 implies 41.59% upside potential from current levels.