The recently passed Inflation Reduction Act (IRA) is expected to be a game changer for the solar and other renewable energy sectors. The IRA includes investments of $369 billion toward climate and clean energy initiatives. The Act is highly beneficial for U.S. solar companies as it includes tax credits and other incentives that will boost the adoption of solar energy solutions and encourage domestic manufacturing of components. Here, we will discuss the prospects of three solar companies – First Solar (NASDAQ:FSLR), SolarEdge (NASDAQ:SEDG), and Sunrun (NASDAQ:RUN). Using the TipRanks Stock Comparison tool, we’ll pick the solar stock that Wall Street is most optimistic about.

First Solar (FSLR) Stock

Shares of First Solar, a U.S.-based manufacturer of solar modules, have risen 23% over the past one month, thanks to the company’s better-than-anticipated second-quarter results and the passing of the IRA.

On August 30, First Solar announced its plans to invest $1 billion in building a new, 3.5 GWDC (gigawatts direct current) manufacturing facility in the U.S. Southeast, marking the company’s fourth fully integrated domestic factory. Furthermore, it intends to invest $185 million in upgrading and expanding its facilities in Ohio. Overall, with these investments, First Solar is enhancing its domestic production capacity, thus aligning with IRA’s goals.

Is First Solar a Good Investment?

Last week, Bank of America Securities analyst Julien Dumoulin Smith upgraded First Solar stock for the second time in a month. Smith upgraded FSLR stock to a Buy from Hold and increased the price target to $141 from $104.50. The analyst feels that when he upgraded the stock earlier this month, he had not fully taken into account the magnitude of IRA credits that First Solar would benefit from.

However, following recent talks with First Solar’s management, Smith sees “significant valuation uplift from IRA credits.” The analyst estimates that the IRA credits would bring in cash of over $3 billion to the company’s balance sheet and feels that the Street is under-appreciating such significant levels of cash.

The analyst opines that First Solar might not use this cash for stock repurchases and dividends but might invest in growth in the U.S. or international markets, or in accretive mergers and acquisitions.

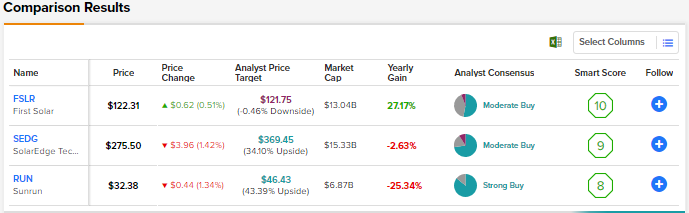

Meanwhile, the Street is cautiously optimistic about FSLR stock with a Moderate Buy consensus rating based on nine Buys, seven Holds, and one Sell recommendation. Given the impressive year-to-date rise of 40%, the average FSLR stock price prediction of $121.75 suggests that the stock could be range bound from current levels.

SolarEdge Technologies (SEDG) Stock

Israel-based SolarEdge provides solar inverters for photovoltaic arrays and also offers other solar energy solutions. The company has been in the news due to patent infringement allegations filed by smaller rival Ampt LLC.

As per Reuters, on August 29, the U.S. International Trade Commission (ITC) stated that it would investigate certain SolarEdge products in reaction to a patent infringement complaint filed by Ampt in late July. In its complaint, Ampt sought a ban on the imports of SolarEdge’s power systems and components, which it believes infringe two of its patents.

In a statement cited by the Reuters report, SolarEdge stated that Ampt had previously lost a patent dispute before the U.S. Patent and Trademark Office (USPTO) and is “now shopping around its claims to other courts.”

Is SolarEdge a Good Stock to Buy?

Meanwhile, SolarEdge stock plunged significantly earlier this month when the company’s Q2 earnings missed analysts’ expectations due to margin pressures. Several factors impacted the company’s profits, including currency headwinds and supply chain issues.

Following the Q2 results, Truist Financial analyst Bronson Fleig raised his price target for SolarEdge stock to $385 from $340 and reiterated a Buy rating. Fleig expects adverse currency fluctuations to continue to impact SolarEdge over the near term. That said, he remains bullish based on the company’s long-term growth potential backed by the robust demand for solar energy across multiple geographies.

Recently, J.P. Morgan analyst Mark Strouse increased his price target for SEDG stock to $419 from $373, and maintained a Buy rating. Strouse believes that the IRA will boost growth in “an already inevitable energy transition to renewables.”

Overall, SolarEdge scores a Moderate Buy consensus rating based on eight Buys, two Holds, and one Sell. At $369.45, the average SEDG price target implies 34.1% upside potential.

Sunrun (RUN) Stock

Sunrun, the largest residential solar and battery storage provider in the U.S., is poised to benefit from the IRA. The company impressed investors by narrowing its Q2 net loss, fueled by a 46% growth in revenues to $584.6 million.

Sunrun’s Solar Energy Capacity Installed increased 33% to 246.5 Megawatts in Q2 and the company expects its full-year capacity to be 25% or greater.

What is the Target Price for Sunrun?

Earlier this month, Evercore ISI analyst James West increased his price target for Sunrun stock to $67 from $64, and maintained a Buy rating in reaction to the company’s Q2 results. Based on Sunrun’s scale, West believes that the company’s “continued ability to deliver rapid growth remains impressive.”

West noted that Sunrun’s competitive advantages are helping it win additional market share. The analyst also believes that the company’s partnership with auto giant Ford (F) creates a “solid moat.” Under its collaboration with Ford, Sunrun will be the preferred installer for Ford Intelligent Backup Power that will be used in the F-150 Lightning electric vehicles. Sunrun will also enable the installation of the 80-amp Ford Charge Station Pro and the Home Integration System.

Recently, Barclays analyst Christine Cho initiated coverage on RUN stock with a Buy rating as she believes that Sunrun and Sunnova Energy (NOVA) are best positioned in the residential solar space. Cho expects the IRA to bring in tailwinds for the solar sector after multiple setbacks. Cho assigned a price target of $46 to Sunrun stock.

Overall, Sunrun earns the Street’s Strong Buy consensus rating backed by 12 Buys versus two Holds. The average Sunrun stock price prediction of $46.43 suggests 43.4% upside potential.

Conclusion

The Inflation Reduction Act is expected to accelerate the growth of solar companies. Currently, Wall Street seems to be more optimistic about Sunrun stock compared to First Solar and SolarEdge stocks. Moreover, analysts estimate a higher upside potential in Sunrun stock from current levels, compared to First Solar and SolarEdge.