In this piece, we used TipRanks’ Comparison Tool to check in on three COVID-era losers — DIS, BA, and DAL — that seem unlikely to be held down for too long, even if a 2023 recession hits. Despite dire circumstances, each name has a “Strong Buy” from Wall Street analysts, with a solid magnitude of year-ahead upside.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The COVID-19 pandemic seems to be winding down, even as the less-deadly Omicron variant looks to surge in the fall season. With boosters and other effective protocols, the pandemic may not be able to hold back some of the biggest losers from the coronavirus market crash of 2020.

From airlines to cruise lines, many COVID-hit stocks have yet to post a full recovery from their 2020 slides. With a recession likely coming up, many such COVID-hit firms (travel and leisure firms) could face another hit to the chin as demand wanes, not due to public health concerns but financial stress on consumer balance sheets.

Indeed, many COVID-hit companies are in desperate need of a break. Still, a lot of such punished firms have been forced to stay on their toes to remain resilient in the face of profound macro challenges. Sure, the light at the end of the tunnel may be a tad farther off as economic storm clouds approach. However, I expect more of the same out of the well-run pandemic-era losers: resilience through trying times.

Disney (NYSE:DIS)

Walt Disney has already been through so much, with COVID lockdowns taking away from parks and cruise revenues. Though Disney+ helped Disney make it through one of the worst headwind storms in its history, it did not take long before the video-streaming market came crumbling down in the face of an economic recession.

Streaming used to be the cure to a media firm’s growth woes. These days, a capable streaming platform is just another pricy requirement for staying competitive. Though streaming is maturing, it’s still capable of growth. Like with any market, the best players could hog most of the economic profits to be had. In that regard, I view Disney as the new king of the streaming kingdom, with its must-stream trio of Disney+, Hulu, and ESPN+.

In the grander scheme of things, Disney’s streaming push is still in its earlier stages. Yet, its growth has been absolutely remarkable. Even if a recession weighs on streaming as a whole, I view Disney as a firm capable of taking share away from incumbents. CEO Bob Chapek knows that content is king, and billions will need to go into content creation to win the streaming wars.

Disney’s streaming strategy is sound, and price increases will keep coming as users get “stuck” on new exclusive series. As COVID abates further, I expect parks and cruises to continue gaining traction. There’s still plenty of pent-up demand unmet, in my opinion, and I don’t think a recession will destroy such demand permanently. It’ll merely delay it.

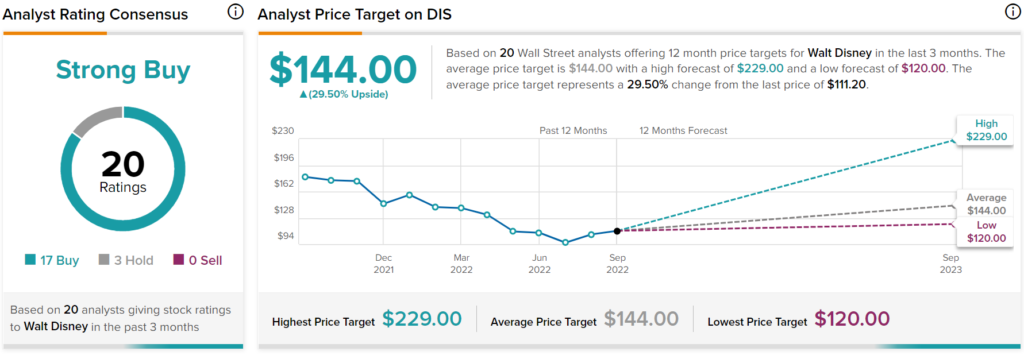

Wall Street loves Disney stock, too, with 17 Buys and three Holds assigned in the past three months. The average DIS stock price target of $144 implies nearly 30% upside potential over the year ahead.

Boeing (NYSE:BA)

Boeing is a planemaker whose troubles started well before the pandemic wreaked havoc on global air travel. Making aircraft was never supposed to be easy.

Recent supply chain woes weighed on the firm’s ability to meet the demand for its newest fuel-efficient planes, including the 737 MAX and 787 Dreamliner. Both aircraft have been hit with their fair share of issues. With many such problems and supply chain issues being ironed out, Boeing can finally begin to deliver for its clients and investors.

Recently, Boeing clocked in solid second-quarter results that saw cash flows improve. Deliveries for the 787 are expected to pick up, and the firm no longer seems destined for a crash-landing.

Though Boeing has come a long way since the depths of 2020, its stock (currently at $151 and change per share) isn’t much higher from where it spent most of 2020. In any case, I expect clearer skies ahead as management looks to tackle the remainder of its operational issues. Once it can clear the runway, it may prove tough to stop shares from taking off, even if a recession is in the cards for 2023.

At just 1.6 times sales, I’d argue there’s a lot to gain by giving the firm the benefit of the doubt. Wall Street analysts seem to agree, with 11 Buys, two Holds, and a price target implying more than 40% upside. Currently, the average BA stock price forecast is $213.33 per share.

Delta Air Lines (NYSE:DAL)

Sticking with the air travel theme, we have Delta, which, like Boeing, is back on the retreat toward 2020 levels. Shares of the major U.S. carrier are off more than 50% from their 2020 pre-pandemic high. With the stock on the retreat since its relief rally peaked in early 2021, the stock seems to be a no-fly for many investors.

The airlines are capital-intensive businesses that struggled through COVID lockdowns. As air travel demand gradually comes back online, Delta will be in a spot to take to the skies again. However, in the meantime, the coming storm of macro headwinds seems to be outside of management’s control.

When a recession hits, travel demand tends to slip. Labor shortages, higher costs from inflation, and reduced capacity could also act as a lingering thorn in the side of the airline as it looks to move past its multi-year funk.

If it’s not the high cost of jet fuel, it’s a demand-weighing recession that’s of concern for Delta. Though revenues could turn lower in 2023, I think the stock is getting too cheap to ignore at 0.5 times sales.

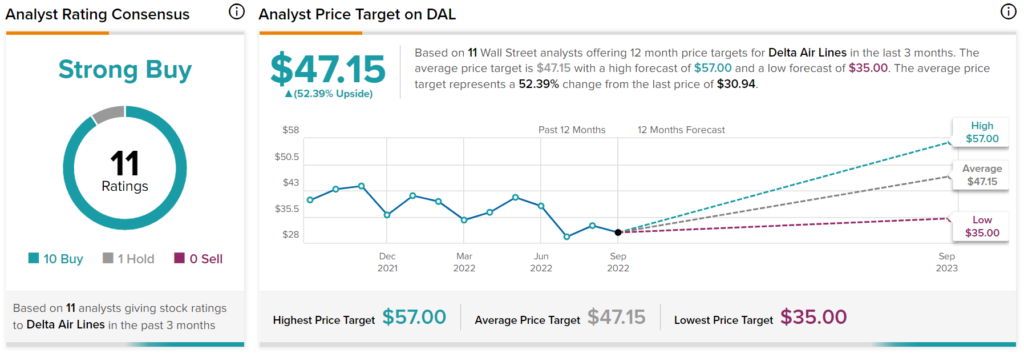

Wall Street loves Delta, as analysts have rated the company as a strong buy with 10 Buys and one Hold. In addition, the average DAL stock price target of $47.15 equates to a potential gain of 52.4%.

Conclusion – Wall Street Expects the Most from Delta

Disney, Boeing, and Delta are COVID losers that are marked down ahead of a recession. Despite yet another setback, I believe each firm is so battered that it may not take much to send them back into rally mode. Of the three stocks, Wall Street expects the most from Delta. Personally, I’m a fan of Boeing because it’s basically a member of a duopoly.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue