Dividend stocks are a cornerstone of many investors’ portfolios, offering a steady stream of income and the potential for capital appreciation. In a market filled with choices, however, selecting the right dividend stock is important for maximizing returns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Today, we spotlight three stocks that analysts have rated as Strong Buys. These stocks—VICI Properties, American Tower, and Royal Bank of Canada—each offer compelling investment cases. But which one stands out as the best choice? We used TipRanks’ Dividend Stocks Comparison tool to take a closer look, analyzing their value propositions, growth potential, and income opportunities.

VICI Properties: Betting on Experiences Over Goods

We’re starting with VICI Properties (VICI), a real estate investment trust (REIT) specializing in owning and acquiring gaming, hospitality, and entertainment destinations. The company was formed in 2017 as a spin-off from Caesars Entertainment and has since grown to become one of the largest REITs in the gaming industry, with a market cap of over $35 billion.

Additionally, VICI’s portfolio consists of high-profile properties in Las Vegas and other key markets across the United States, including notable assets like Caesars Palace, MGM Grand, and Mandalay Bay. The New York-based company generates the majority of its earnings through single-tenant, triple-net leased properties.

Over the past year, the stock is up 8%, but it has performed particularly well since July, surging around 10%. This outperformance versus the broader market can be traced to some solid financial results—revenue grew by 6.6% year-over-year to $957 million in Q2—and one notable trend. Specifically, the trend is the secular shift away from discretionary spending on material goods and toward experiences; the company’s tagline is actually “Invest in the experience.”

As a result of its recent strong performance, management elected to increase dividend payments by 4.2% to $0.4325 per share—quarterly. In turn, this gives us a 5.15% forward dividend yield.

From a valuation perspective, VICI’s forward price-to-AFFO (Adjusted Funds From Operations) ratio is 15.1x. Notably, this is below the sector average of 16.8x and below the company’s seven-year average P/AFFO ratio of 16.2.

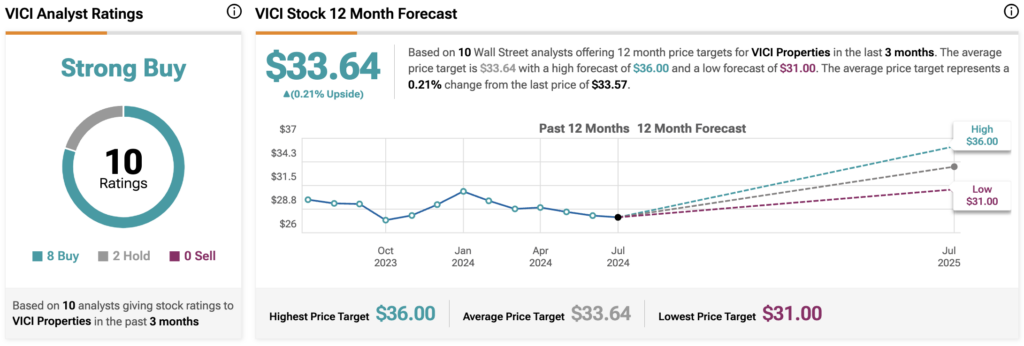

On TipRanks, VICI comes in as a Strong Buy based on eight Buys, two Holds, and zero Sell ratings assigned by analysts in the past three months. The average VICI Properties stock price target is $33.64, implying a 0.21% upside potential.

American Tower: Connecting the World, One Tower at a Time

Moving on to another contender, American Tower Corporation (AMT) is another REIT and one of the largest owners and operators of wireless communications infrastructure worldwide. Founded in 1995, American Tower has established itself as a cornerstone of the telecommunications industry.

Furthermore, with a portfolio of over 224,000 communications sites spanning 25 countries across six continents, the Boston-based company’s assets include cell towers, rooftop antennas, and small cell networks. These assets are leased to major wireless carriers, broadcasters, and other communication service providers. Its business model is built on long-term, non-cancellable lease agreements—typically five to 10 years—with top-tier tenants, providing a stable and predictable revenue stream.

Like VICI, the business is performing well, with total property revenue growing by 6.9% year-over-year on an FX-neutral basis. Moreover, the company boasts an EBITDA margin of 62.5%, surpassing the REIT sector median of 53.6%.

To bolster its growth, American Tower Corporation has focused on both organic expansion and strategic acquisitions, consistently increasing its global footprint, with recent growth particularly strong in Africa and Europe. Additionally, the company has diversified into the data center business through its CoreSite acquisition, providing some exposure to the booming artificial intelligence (AI) segment.

In terms of dividends, American Tower isn’t a massive dividend payer, with a forward dividend yield of 2.67%. However, it is well-covered with a payout ratio of 61% based on projected AFFO for 2024. From a valuation perspective, it doesn’t scream ‘value’ either, with a forward P/AFFO ratio of 22.8x versus the sector average of 16.8x. However, its fundamentals are strong, with a net debt to EBITDA ratio of 4.8x as of Q2 2024.

Likewise, on TipRanks, AMT comes in as a Strong Buy based on 10 Buys, one Hold, and zero Sell ratings assigned by analysts in the past three months. The average AMT stock price target is $240.70, implying a 1.50% upside potential.

Royal Bank of Canada: Banking on Growth and Stability

Finally, there’s Royal Bank of Canada (RY), one of Canada’s largest and most prominent financial institutions, with a rich history dating back to 1864. It’s a universal bank with operations across personal and commercial banking, wealth management, insurance, and capital markets. The group has established itself with a significant global presence, ranking as the 10th largest investment bank worldwide by fees.

Looking at recent financial results, they demonstrated the strength of RBC’s business model, reporting a 7% increase in net income compared to the previous year, despite a slight decrease in return on equity and increased provisions for credit losses. The bank’s residential mortgage segment showed strong growth, up 10.2% year-over-year.

Like many of its peers, RBC’s net interest income has been benefiting from high-interest rates, with the Personal & Commercial Banking segment seeing a 15% rise compared to the prior year. Moving forward, the banking group should be able to benefit from the unwinding of structural hedges.

Moreover, the stock offers a 3.4% forward dividend yield—well covered by earnings—and trades at 13.8x forward earnings, representing a 19.4% premium to the sector. However, the forward price-to-earnings-to-growth (PEG) ratio currently sits at 2.06, representing a huge 65.4% premium to the sector. This premium can’t be justified by the 3.4% dividend yield.

Similarly, on TipRanks, RY comes in as a Strong Buy based on 11 Buys, two Holds, and zero Sell ratings assigned by analysts in the past three months. The average RY stock price target is $125.35, implying a 1.68% upside potential.

The Final Verdict

While these stocks have their merits, they’re all trading very close to their target prices. VICI Properties offers a strong case with its focus on gaming and entertainment, benefiting from a secular shift toward experiences over material goods, solid financial performance, and attractive valuation metrics below the sector average. American Tower, with its extensive global telecommunications infrastructure and expansion into AI-related assets, presents growth potential but at a higher valuation. Meanwhile, Royal Bank of Canada provides stability and income growth in the financial sector but trades at a premium that could limit upside. My preference would be VICI as I’m a strong believer that this secular shift away from material goods and toward experiences will continue throughout the medium term.