High-yield telecom stocks have been on a turbulent ride this year, with rates on the rise and a potential recession brewing. Though higher bond yields will bring forth greater competition for dividend stocks, it’s hard to overlook the incredible value to be had in the telecom space these days.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sure, Warren Buffett may have ditched a sizable stake in the telecoms in the first quarter of this year, likely to raise money to finance his big oil bets. Still, with so much doom and gloom baked in, dividend seekers shouldn’t count them out of the game, even with the prominent headwinds they’re facing. In a choppy market plagued by high inflation, a secure dividend can help dampen the bumps in the road.

Let’s use TipRanks’ Comparison tool to see where Wall Street stands on three of America’s most popular telecom stocks.

AT&T (T)

AT&T is a $150 billion telecom titan that’s a favorite among many retirees and conservative income investors who don’t care as much for capital appreciation potential.

With a massive 5.3% dividend yield, shares of T do not disappoint on the front of income. However, the payout doesn’t seem so impressive when you factor in the brutal bear market that’s been ongoing for nearly six years. The perennial underperformer is now sitting down over 35% from its six-year high, just north of $32 per share.

Indeed, there’s a severe issue with management or a firm’s fundamentals for a stock to have been stuck in a rut for so long. Fortunately, there are reasons for optimism, with the company now fully focused on catching up in the U.S. telecom scene. With a new CEO (appointed in mid-2020) and the media division now spun off, the firm isn’t nearly as messy as it used to be. And it’s no longer the epitome of diseconomies of scale.

The dividend cut and recent spin-off mark a major pivot point for AT&T. It’s leaner and it could give rivals a better run for their money.

Turning to Wall Street, analysts are mildly bullish, with the average AT&T price target of $23, implying 18.3% upside from current levels.

Verizon (VZ)

After Warren Buffett’s firm dumped most of its large Verizon stake, many investors have followed suit. Undoubtedly, a hefty 5%-yielding dividend doesn’t mean much if you’re going to stomach 10% in annual downside. On a total returns front, Verizon stock has been a loser for well over a year now.

After delivering a muted first quarter, management sounded pretty downbeat amid growing macro uncertainties. The company also admitted wireless subscribers slipped in March. Undoubtedly, Verizon has been a telecom top dog for quite some time, but recent trends suggest the low multiple on the stock is more than warranted.

It’s not just inflationary pressures or the impact of a recession that makes Verizon stock an uncomfortable dividend stock to hold. Higher rates, which will increase borrowing costs, and strengthening wireless rivals — think AT&T — could worsen the blow. Further, Verizon’s debt levels will do the firm no favors in a higher-rate environment.

Despite the long list of negatives, the stock is dirt-cheap at 10.0 times trailing earnings and 1.6 times sales.

That’s cheap, but it’s still not the best deal in the telecom scene. Verizon’s rival AT&T sports a slightly higher yield at a slightly lower cost of admission (8.9 times trailing earnings). The marginal premium on VZ stock can be attributed to its leading network. As rivals catch up, this lead could narrow and so too could the stock’s multiple.

Wall Street isn’t too bullish on the stock, with a hold rating and the average analyst price target of $54, implying 9.91% upside from today’s levels.

Telus (TU)

Finally, we have a telecom that operates in the less-competitive environment up in Canada. In Canada, the telecom market is essentially dominated by three major players that aren’t as generous as U.S. telecoms when it comes to promotions and offers. Indeed, Canadian wireless users pay some of the highest prices out there, making it very rewarding to invest in Canadian telecom stocks, like Telus, over the long haul.

Unlike U.S. telecom stocks, which are in a world of pain, Telus stock has barely corrected, down just shy of 10% from its April highs of around $34 per share.

Due to the friendlier telecom environment and a solid growth profile, Telus stock trades at a much richer multiple than its American peers, with a lower dividend yield. The stock is also in a strong long-term uptrend, now up 40% over the past five years.

At writing, TU shares go for 25.1 times trailing earnings and 2.6 times sales alongside a 4.2% dividend yield. Even as rates rise, Telus looks well-positioned to continue making strides over its Canadian peers.

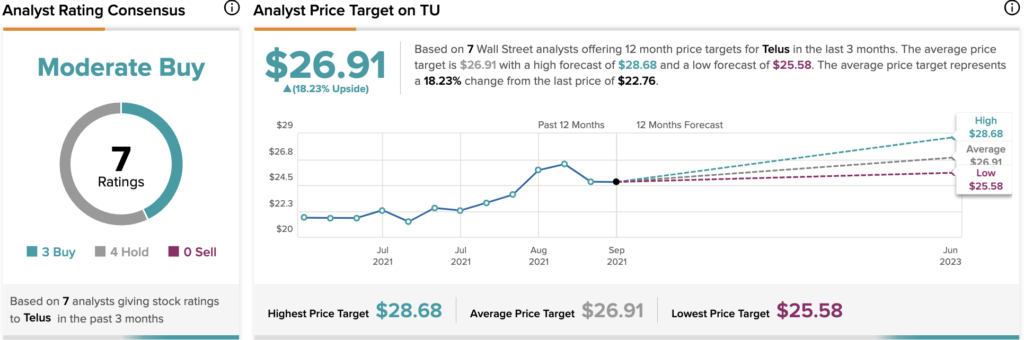

Wall Street is bullish, with the average Telus price target of $26.91, suggesting 18.23% upside from current levels.

Conclusion

Telecom stocks have been hit quite hard in recent months. With juicy dividends and lower betas, they seem like oversold plays that could hold their own as economic growth slows. Of the three stocks outlined in this piece, Wall Street appears to like Canadian telecom Telus most.

Read full Disclosure