The COVID-19 pandemic accelerated digital transformation and consequently the need for 5G – the fifth generation of wireless technology. 5G ensures higher speed, lower latency (time required for a set of data to travel between two points), and greater capacity than 4G.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Future Market Insights estimates the 5G technology market to grow at a compound annual growth rate (CAGR) of 71.9%, reaching $248.4 billion by 2028, driven by several factors, including the growing adoption of the Internet of Things (or IoT) and smart technologies, and increasing investments in the telecommunication sector by several countries.

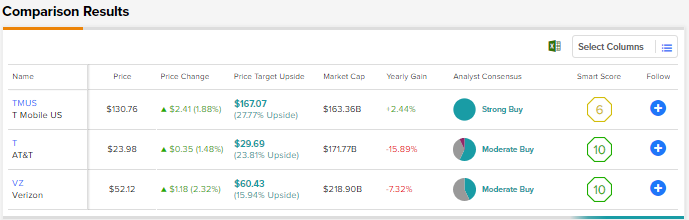

Given these tailwinds, we used the TipRanks stock comparison tool for 5G stocks to compare T-Mobile U.S., AT&T, and Verizon.

T-Mobile U.S. (NASDAQ: TMUS)

T-Mobile is one of the leading wireless service providers in the U.S., boasting 108.7 million customers as of December 2021 (5.8 million net customer additions in 2021). The company’s acquisition of Sprint in 2020 helped it gain a head start in deploying its mid-band-based 5G network in the U.S.

T-Mobile claims that as of the end of 2021, its 5G network covered 310 million people across 1.8 million square miles, delivering almost five times more geographic coverage than Verizon and nearly twice as much as AT&T.

T-Mobile delivered mixed Q4 results, but its 2022 guidance impressed investors, who were concerned about the intense competition in the U.S. telecom sector. T-Mobile experienced postpaid net customer additions of 5.5 million in 2021. Furthermore, as of December 31, 2021, the company’s Ultra Capacity 5G covered 210 million people, with the ability to deliver speeds of 400 Mbps or more.

Overall, T-Mobile’s revenue grew 17.1% to $80.1 billion in 2021. However, EPS declined 9.1% to $2.41 due to higher merger-related costs.

Looking ahead, the company expects postpaid net customer additions of between 5.0 million-5.5 million in 2022.

Tigress Financial analyst Ivan Feinseth believes that T-Mobile is well-positioned to benefit from accelerating trends in Cloud and Edge computing, rising demand for high-speed connectivity, and the ongoing integration of the IoT and the Metaverse, as they all will drive the demand for 5G wireless connectivity.

The analyst added, “TMUS will continue to drive value creation through ongoing deployment of its excess cash and cash flow to fund ongoing capital investment, strategic acquisitions, and debt reduction, as well as enhanced shareholder returns through its significant share repurchase commitment.”

In line with his optimism, Feinseth initiated coverage on T-Mobile stock with a Buy rating and a price target of $185.

Overall, the Street has a bullish stance on the stock, with a Strong Buy consensus rating based on 15 unanimous Buys. The average T-Mobile U.S. price target of $167.07 suggests 27.77% upside potential from current levels.

Verizon Communications (NYSE: VZ)

Telecom giant Verizon offers communications, technology, information, and entertainment products and services to consumers, businesses, and government entities. As of the end of 2021, the company’s consumer-focused segment had 115 million wireless retail connections, nearly 7 million wireline broadband connections, and 4 million Fios video connections.

Also, its business-focused segment had 27 million wireless retail postpaid connections and nearly 477,000 wireline broadband connections.

Thanks to wireless service revenue growth and increased 5G phone adoption, Verizon delivered better-than-anticipated Q421 revenue and adjusted EPS. The company ended 2021 with revenue of $133.6 billion (up 4.1% from 2020) and adjusted EPS of $5.39 (10% growth from 2020).

Regarding its 2022 guidance, Verizon expects organic service and other revenue growth of around 3%, wireless service revenue growth of at least 3% (excluding the impact of the TracFone acquisition), and adjusted EPS of $5.40 – $5.55.

Feinseth feels that solid wireless and enterprise IT revenue growth will continue to drive positive business performance trends for Verizon. Further, he believes that the ongoing rollout of the company’s 5G ultra-wideband service will drive multiple growth opportunities.

Feinseth highlighted that Verizon’s strong balance sheet and cash flow will continue to support ongoing capital investments, strategic acquisitions, and enhanced shareholder returns through dividend hikes. Verizon has raised its dividend for 15 consecutive years, and its forward dividend yield stands at 4.9%.

Feinseth reiterated a Buy rating on Verizon stock following the Q421 results and raised the price target to $68 from $67.

J.P. Morgan analyst Philip Cusick views Verizon stock as “a very defensive stock with solid FCF [Free Cash Flow] generation and dividend coverage.”

That said, Cusick downgraded Verizon stock to a Hold from a Buy and lowered the price target to $56 from $62. He sees “limited potential for capital return outside of dividends due to the current leverage and capex spend outlook.”

Cusick also cautioned about a slowdown in postpaid phone growth, with the potential for increased wireless competition from AT&T, T-Mobile, Dish, and cable companies.

Analysts on the Street are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on three Buys and four Holds. The average Verizon price target of $60.43 implies 15.94% upside potential from current levels.

AT&T (NYSE: T)

AT&T has been in the news since the company announced the spin-off of WarnerMedia, which will be merged with Discovery (DISCA) to form a new business (AT&T shareholders will own 71% of the new business). Also, to reflect the spin-off, AT&T cut its annual dividend by almost half to $1.11 per share. The company expects the transaction to be completed on April 5.

The spin-off will help AT&T deleverage its balance sheet and capitalize on the longer-term demand for connectivity. AT&T aims to boost its investments in key growth areas, namely 5G and fiber, and drive significant savings by reducing the company’s legacy copper footprint.

The company expects to enhance its 5G network by deploying 120 MHz of mid-band spectrum to cover over 200 million people by the end of 2023. This mid-band spectrum will complement AT&T’s existing 5G footprint, which covers over 255 million people in more than 16,000 cities and towns. Overall, AT&T predicts annual capital expenditure of $24 billion in 2022 and 2023.

Raymond James analyst Frank Louthan reaffirmed a Buy rating on AT&T stock after attending the company’s Analyst Day held on March 11. Louthan highlighted several key takeaways from the event, including management’s guidance of more than 3% wireless services growth in FY22 and low-single-digits growth in FY23.

The analyst concluded, “We are maintaining our $32 PT [Price Target], based on ~10x 2023E EPS at $26 plus an incremental ~$6/share in value from DISCA/WBD. We continue to believe a more focused vision along a simpler line of business creates a solid scenario for share price appreciation in 2022 and a solid, double-digit total return.”

Meanwhile, the Street is cautiously optimistic about the stock, with eight Buys, five Holds, and one Sell contributing to a Moderate Buy consensus rating. The average AT&T price target of $29.69 implies a 23.81% upside potential from current levels.

Conclusion

T-Mobile U.S., Verizon, and AT&T are well-positioned to benefit from the robust demand for 5G technology. While Verizon and AT&T’s dividend yields are attractive, the Street is currently extremely bullish on T-Mobile U.S. and sees higher upside potential for the stock over the next 12 months.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.