It’s been a dreadful year for Peloton(NASDAQ: PTON). Its shares have plunged 75% year-to-date.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

TipRanks assign Peloton’s shares a Smart Score of 2 out of 10, citing negative technicals and fundamentals, and negative sentiment among investors and hedge fund managers.

I’m neutral on Peloton shares.

What’s hunting the shares of once highflyer on Wall Street? Three things, the fading of its momentum, negative free cash flow, and a share offering.

Rise and Fall

There was a time the shares of the largest interactive fitness platform in North America were Wall Street’s darling. From March to December of 2020, the momentum crowd was chasing after its shares, helping them gain 500%.

This glorious period for Peloton coincided with the spread of the COVID-19 pandemic and the shelter in place mandates around the U.S., which prompted scores of people to join the company’s platform. As a result, equipment and subscription sales soared, and so did sales, adding fuel to Wall Street momentum.

Peloton’s love affair with Wall Street came to an end in 2021, as the company’s momentum slowed down. Revenue growth dropped from 230% in September 2020 to 6.2% in September 2021.

The sales growth slowdown is due to several factors. One of them was the easing of lockdowns and shelter in place mandates, which made Peloton’s in-house exercise platform a less appealing proposition.

Meanwhile, Peloton began to run out of affluent customers to sell its value proposition, which includes high-end stationary bikes and treadmills, with the price of its equipment starting at $2,245.

Close to 60% of Pelton members have an annual income north of $150,000, a small market even for a rich country like the U.S.

Then there’s competition that Peloton faces from Equinox, SoulCycle, and regular gym chains.

The company remains unprofitable with any metric, EBITDA, operating margins, and net margins, making it hard to calculate the intrinsic value of its shares using conventional Discounted Cash flow models (DCF).

Negative Free Cash Flow and Share Offering

The lack of profitability pushed Peloton in a place Wall Street didn’t want it to be, a couple of quarters of negative free cash flows. Free cash flow is the operating cash left after the company makes the necessary capital expenses to finance expansion.

It’s the money that eventually boosts shareholder equity through dividend payouts or share buybacks. A negative free cash flow means that the company doesn’t have enough cash to pay for its capital expenditures. It must then either cut its capital expenditures or issue more shares to raise some money, as Peloton did on November 16, raising $1 billion.

Either choice is a negative development for existing stockholders. Cutting capital expenditure hurts future growth. Issuing more shares dilutes shareholder equity. Thus, the a significant drop in Peloton’s shares after the company announced the secondary offering.

Wall Street’s Take

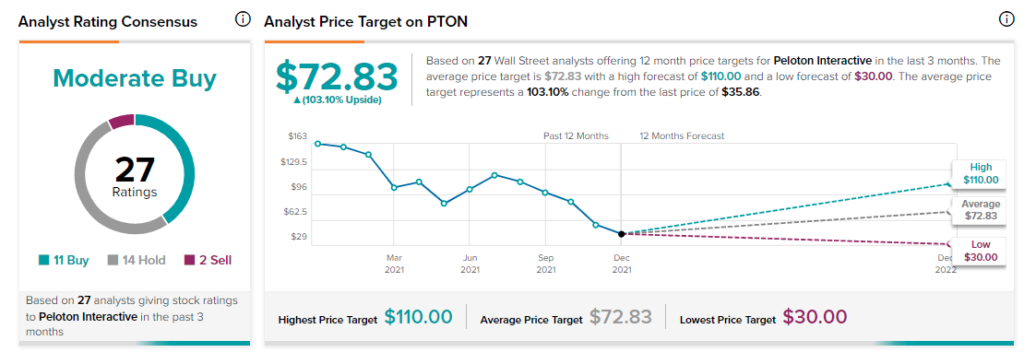

The analyst community seems to be unfazed by the loss of Peloton’s momentum. It rates the company’s shares a Moderate Buy for the next 12 months, with an average price target of $72.83. The average Peloton price target represents 103.1% upside potential.

That’s undoubtedly a big bullish call, given the many issues haunting the company’s shares.

Disclosure: At the time of publication, Panos Mourdoukoutas had no position in Peloton.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >