In 2022, the broader markets are getting more and more volatile, and technology and high-growth names that were on everybody’s radar have taken a beating. In this scenario, this week we are shining the spotlight on American Homes 4 Rent (AMH), a name that seems like a solid defensive play and is also riding the housing market demand tide.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Why AMH?

The housing market is currently characterized by rising prices and lower inventory. According to the Zillow Home Price Expectations Survey, housing inventory levels will not reach 1.5 million monthly units until 2024. The survey also expects home prices to rise by 26.8% in the next five years. Furthermore, the share of first-time home buyers is expected to remain below 2019 levels until 2024.

These are perfect conditions for AMH, which is focused on providing single-family homes for rent. At the end of March, AMH owned 57,984 single-family properties across 22 states.

A key advantage lies in the company’s business strategy. It is also a home builder, and instead of buying up properties from the market, it can bring new inventory to the market at lower costs. In the recent first quarter, AMH delivered 452 newly constructed homes under its AMH Development program. During this period, AMH continued to witness a larger number of occupied properties, increased rental rates, and lower uncollectible rents.

The company remains focused on ‘built-for-rental’ homes through its AMH development program. The cost to acquire and develop land and construct a rental home for AMH ranges from $250,000 to $450,000. Meanwhile, in the case of the purchased property, additional costs of $20,000 to $40,000 are incurred above the purchase price.

Robust Financials

AMH has been a consistent performer even during peak pandemic times. Revenue has been steadily ticking upwards from $960.4 million in 2017 to $1.13 billion in 2019 and $1.30 billion in 2021. The figure is further expected to rise to $1.65 billion in 2023. At the same time, funds from operations (FFO) have risen from $1.02 in 2017 to $1.36 in 2021.

Moreover, AMH has been delivering an earnings beat for eight quarters in a row.

Market Participants Are Gunning for AMH

This financial performance has been attracting attention from different quarters. TipRanks data indicates both hedge funds and insiders have been lapping up AMH shares while Wall Street remains Bullish on the stock.

Hedge funds have increased holdings in the stock by 2.1 million shares in the last quarter, indicating a very positive hedge fund confidence signal. Moreover, some of the biggest names on the Street have been busy buying AMH.

Ray Dalio’s Bridgewater Associates has initiated a fresh position worth $11.65 million. Additionally, Greg Poole’s Echo Street Capital Management has holdings in the stock worth about $244.83 million.

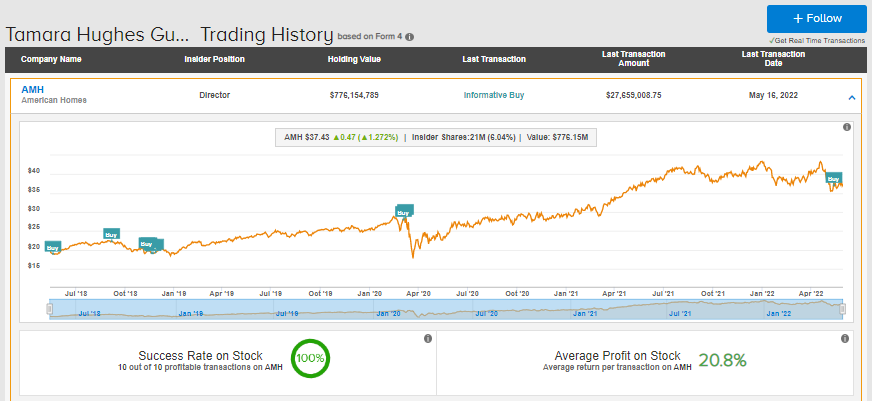

Concurrently, insiders have bought AMH shares, which is always positive reinforcement of the underlying company story. In the last three months, AMH insiders have bought shares worth $27.9 million. The bulk of the buying activity came from Director Tamara Hughes Gustavson, who bought AMH shares worth $27.66 million in May. Most importantly, this was an informative Buy.

Furthermore, Gustavson has been a consistent buyer of AMH shares since July 2018 and has a track record of 100% profitable transactions in the stock.

Analysts Remain Bullish

Yesterday, J.P. Morgan analyst Anthony Paolone reiterated a Buy rating on the stock, while decreasing the price target to $43 from $44.

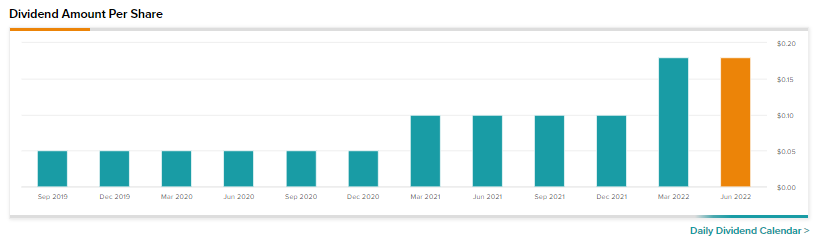

Overall, the Street has a Strong Buy Consensus rating on AMH based on nine buys and three Holds. The average AMH price target of $44.83 implies a 19.77% potential upside. This expected price gain is on top of the 1.47% dividend yield AMH currently offers! Earlier this year, the company boosted its dividend by a massive 80%.

Simultaneously, TipRanks data shows our users are positive on AMH and their number of Buy transactions is four times the number of Sells on AMH.

Elevated interest in the stock is also reflected in its trading volume, which was close to 17 million shares on May 31. In comparison, the average volume in AMH over the past three months has been 3.06 million.

Closing Note

AMH’s business has been firing on all cylinders for a while now. A host of factors have come together to make the stock extremely attractive. Extremely favorable underlying market trends and marquee names such as Ray Dalio picking up the stock should put AMH on the radars of our savvy readers.

Read full Disclaimer & Disclosure