Are the markets on the mend? If you ask Wells Fargo’s head of equity strategy Chris Harvey, the answer is yes. Citing the S&P 500’s remarkable rebound since its March low and its strong showing over the last few days, the strategist argues that there has been an “incremental improvement.”

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

To this end, Harvey recommends that investors stick with equities, and snap up names “trading at or below book value,” pointing to small-caps in particular.

Taking Harvey’s outlook into consideration, we wanted to check out three small-cap stocks from the healthcare sector that are backed by Wells Fargo, a firm which happens to land the eighth spot on TipRanks’ list of Top Performing Research Firms.

After running the tickers through TipRanks’ database, we found out that each has been scoring points with the rest of the Street, earning a “Strong Buy” consensus rating. Not to mention all three boast plenty of upside potential.

Avidity Biosciences Inc. (RNA)

Developing a new class of oligonucleotide-based therapies called antibody oligonucleotide conjugates (AOCs) designed to overcome current limitations, Avidity Biosciences wants to offer better treatments for a wide range of serious diseases. Based on its impressive technology platform, Wells Fargo just gave RNA a thumbs up.

Representing the firm, five-star analyst Jim Birchenough told clients, “Our positive outlook is based on the company’s leading AOC platform and prospects to extend benefit of RNA therapeutics beyond the liver and localized CNS delivery of category leader drug approvals.”

Other companies have tried to make headway in the myotonic dystrophy (DM1) space, with “Ionis Pharmaceuticals and partner Biogen yielding evidence of target knockdown and positive downstream effects on key splice variants in DM1 patients achieving adequate tissue concentration.” However, this effect was limited to only a small sample size at a very high dose.

Preclinical data for AOCs, on the other hand, showed that lower doses produced a 50-75% DMPK target knockdown. Therefore, when the Phase 1 program for its AOC1001 asset is initiated, likely in 2021, Birchenough argues “that early data on target knockdown should be predictive of clinical benefit given the clear role of DMPK in disease pathogenesis and lower disease burden in patients with reduced DMPK expression.”

Additionally, RNA has clinical programs in Duschenne Muscular Dystrophy (DMD) and muscle atrophy, which are slated to kick off in 2022. Looking specifically at AOC-DMD, Birchenough believes the threshold for approval is low. To support this claim, he highlights the fact that Sarepta Therapeutics’ EXONDYS 51 for exon 51 skipping and VYONDYS for exon 53 skipping were approved based on dystrophin increases of only 0.9%, with no improvement in motor function shown. For AOCs, there was a fiftyfold increase in exon skipping compared with a simple oligonucleotide approach and 60% exon 44 skipping specifically in patient-derived myocytes. As a result, early biomarker data for RNA’s therapy could fuel major upside.

Reflecting another positive, the company’s pipeline also includes AOC candidates for genetic muscle diseases, including fascioscapulohumeral muscular dystrophy (FSHD) and Pompe disease, with the DUX4 and glycogen synthase 1 (GYS1) targets offering preclinical validation, in Birchenough’s opinion. He added, “Broader efforts beyond muscle disease, including the large immunology collaboration with Eli Lilly for up to 6 targets and $405 million in milestones each, along with sales royalties, represent significant option value, in our view.”

In line with his optimistic take, Birchenough joined the bulls. In addition to kicking off coverage with an Overweight call, he set a $60 price target, suggesting a whopping 153% upside potential. (To watch Birchenough’s track record, click here)

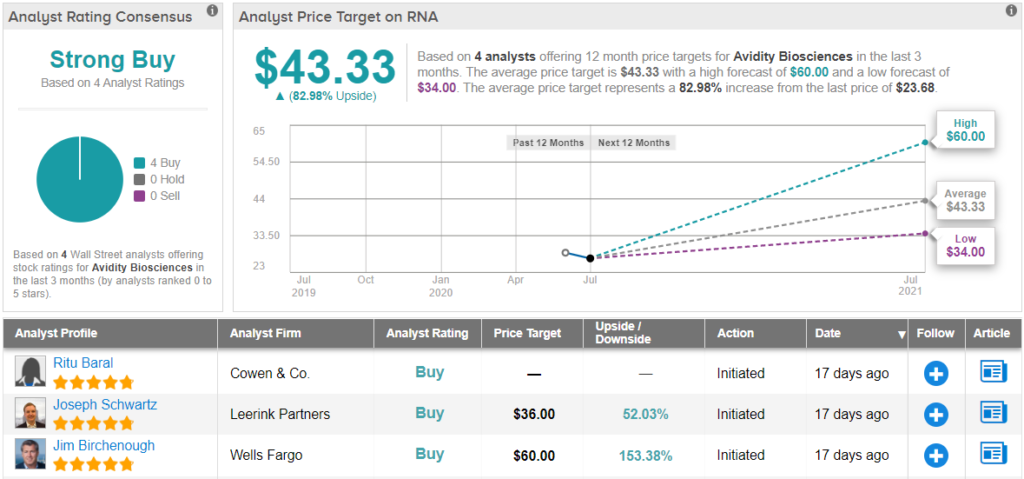

Do other analysts agree? They do. Only Buy ratings, 4, in fact, have been issued in the last three months, so the consensus rating is a Strong Buy. At $43.33, the average price target puts the upside potential at 83%. (See RNA stock analysis on TipRanks)

RAPT Therapeutics (RAPT)

Fully focused on developing oral therapeutics that target key drivers of the immune system, RAPT Therapeutics hopes to stomp out cancer and other inflammatory diseases. Ahead of a key data readout in the second half of 2020, Wells Fargo is singing its praises.

Analyst Yanan Zhu recently had a call with management that centered around its FLX475 cancer program. After the discussion, he sees an increased probability of success in charged tumors going into the proof-of-concept data readout across eight Phase 2 cohorts for the ongoing Phase 1/2 study in 2H20.

The company noted that enrollment for the Phase 2 part is on schedule, and that it’s trying to get as many of the eight cohorts filled as possible. Hopefully, it will be able to report at least the initial response rate data across most, if not all, cohorts by YE20.

Expounding on this, Zhu stated, “RAPT also noted that the data continue to look encouraging from the company’s perspective. In terms of the format of the data release, RAPT is aiming to report data at a major medial meeting, but if the abstract submission timeline becomes a bottleneck, RAPT may report the data in the form of a corporate update. Regarding the previously reported TECENTRIQ-refractory NSCLC patient with a confirmed PR in the phase 1 portion, RAPT noted that the patient continues to be in response at 13 months on study (FLX475 + KEYTRUDA), with a duration of response of nearly 1 year.”

It should be noted that COVID-19 delayed the enrollment for its Phase 1 study of RPT193 in atopic dermatitis. That said, enrollment has been restarted, and the data release remains on track for YE20. If that wasn’t enough, Zhu points out that its peers’ approach involving the depletion of Tregs using antibodies against CCR4 or CCR8 may be problematic.

“RAPT’s Small Molecule CCR4 Inhibitor Approach is Not Limited by the Challenges of Treg Depleting Approach. FLX475 is designed to block Treg migration to TME, without depleting Tregs. In addition, Treg migration to healthy tissues is mediated by other chemokine pathways and is not affected by FLX475,” Zhu commented.

Everything that RAPT has going for it keeps Zhu standing squarely with the bulls. He left an Overweight rating on the stock and bumped up the price target from $33 to $40. Should the target be met, a twelve-month gain of 59% could be in store. (To watch Zhu’s track record, click here)

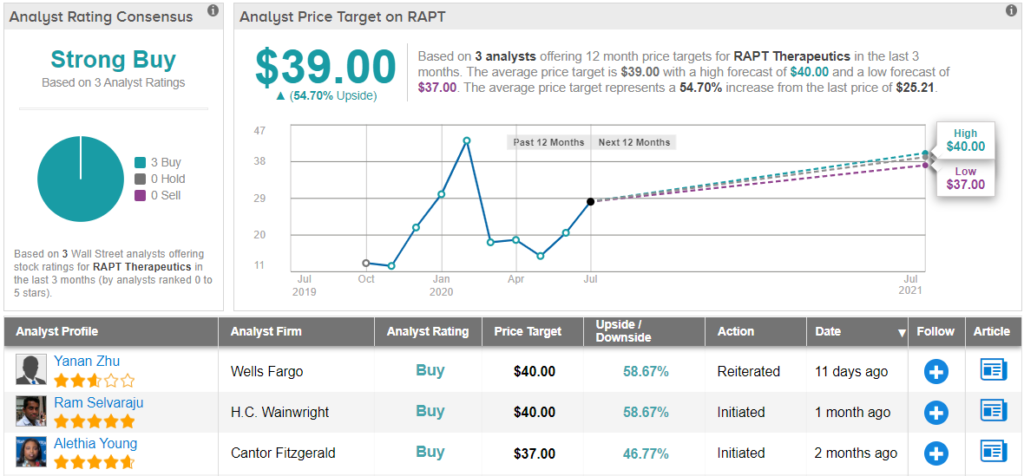

The bulls have it on this one. Out of 3 total reviews assigned in the last three months, all 3 analysts rated the stock a Buy. So, RAPT gets a unanimous Strong Buy consensus rating. The $39 average price target brings the upside potential to 55%. (See RAPT stock analysis on TipRanks)

Progenity Inc. (PROG)

Last but not least we have Progenity, which works with healthcare providers to offer advanced genetic testing services. While the company does face some challenges, Wells Fargo believes it will ultimately emerge as a long-term winner.

Covering the stock for the firm, four-star analyst Dan Leonard acknowledges the fact that shifting from an out-of-network lab to an in-network lab with the major insurance companies can create a short-term headache, with price reductions preceding volume gains. “The COVID pandemic, when lab volumes are off sharply from normalized levels, exacerbates this short-term pain. That said, we believe broader network access offers opportunity for volume gains in 2021 and beyond,” the analyst commented.

Additionally, there is a risk that other technologies will drive price deflation for non-invasive prenatal testing (NIPT). That being said, Leonard thinks the company’s Innatal 4 program could allow it to “play both offense and defense within this deflation trend.” He added, “We expect commercialization of Innatal 4 could reduce direct NIPT COGS by at least 50%. Further, we believe lower pricing could ultimately expand the market for NIPT to include more average risk pregnancies.”

Further adding to his optimism, Leonard points out that PROG’s preeclampsia rule-out test could have a material impact on its core reproductive health business. To back this up, he noted, “Our checks largely confirm that development of a preeclampsia rule-out test is the right design goal to target an important unmet medical need – determining how to manage patients who present with signs/symptoms of preeclampsia, a leading cause of maternal mortality.”

With PROG’s ingestible medical device program offering additional upside, the deal is sealed for Leonard. To this end, he initiated coverage with an Overweight rating. Along with the call, an $11 price target is attached to the stock. This figure implies shares could surge 22% in the next year. (To watch Leonard’s track record, click here)

Judging by the consensus breakdown, other analysts also like what they’re seeing. 4 Buys and no Holds or Sells add up to a Strong Buy consensus rating. The $13.75 average price target is more aggressive than Leonard’s, and implies 52% upside potential. (See Progenity stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.