This summer didn’t just see temperatures heat up. The S&P 500 has been on fire, with the index breaking record after record during the month of August and now sitting at 3,526.65 points.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

As its 2020 S&P 500 price target of 3,388 has been left in the dust, investment firm Wells Fargo is weighing in on where the market is heading. Christopher Harvey, head of equity strategy, writes in a recent note that “it does not appear the market is about to hit a wall,” noting that he doesn’t want “to leave the party too early.”

“There is a growing perception that a COVID vaccine is a 1H21 event – and we need to price it in now. Fiscal/monetary accommodation is massive… Cash build-up provides additional ammo. This is why we have not pivoted defensively but are rotating to cyclicality, COVID β and easy 1H21 comps,” Harvey commented.

According to the analyst, small-caps have a high COVID β, “which remains a short-term catalyst – i.e., outperforming as news on the virus/vaccine front improves.” Therefore, he argues that as “COVID figures and vaccine prospects improve, small caps are positioned to outperform as the market rewards cyclical (economic) exposure.”

Turning Harvey’s outlook into concrete recommendations, Wells Fargo analyst Jim Birchenough, who happens to boast a 5-star rating from TipRanks, is pounding the table on two small-cap stocks that look especially compelling. He sees over 70% upside potential in store for each, so we used TipRanks’ database to take a closer look.

IMV Inc. (IMV)

Hoping to provide more effective, more broadly applicable and more widely available solutions to patients, IMV develops a unique class of cancer immunotherapies and vaccines to treat infectious diseases such as COVID-19. Following an update on the progress of its vaccine pipeline, Wells Fargo believes now is the time to get in on the action.

Birchenough points to its COVID-19 vaccine candidate, DPX-COVID19, as a key component of his bullish thesis.

“With DPX-COVID19 progressing to Phase 1 imminently with Canadian government funding, and strong support for a homegrown option voiced by the Canadian Minister of Innovation, we continue to view the vaccine approach as potentially best-in-class, with strong rational polypeptide approach, validated adjuvant in DepoVax (DPX) and overall approach most similar to that taken by Novavax in the U.S., where strong clinical validation has been seen,” the analyst explained.

Citing previous RSV vaccine results, Birchenough thinks that a differentiated profile of antibody has been established, with T-cell and IgA responses also witnessed. On top of this, data on Moderna’s candidate offers “opportunity for improvement in terms of antibody response, neutralization response, safety and tolerability.” Therefore, the analyst sees “a high likelihood of success into Phase 1 results and broader development.”

According to management, the Phase 1 study is set to kick off any day now, with the preliminary results expected in fall 2020. If positive, IMV will initiate a Phase 2 study shortly after. The preliminary data will include immunogenicity (antibody level) and functionality (viral neutralization) results, and the study will evaluate the candidate across two age cohorts, with the participants receiving 25μg or 50μg doses. It should be noted that IMV was granted an award of CA$4.75 million from Canadian government agencies to support Phase 1 clinical development and manufacturing.

Birchenough also mentions that the company believes “DPX-COVID-19 may differentiate in two aspects: 1) the duration of induced immunoresponse and 2) efficacy in the elderly immunocompromised population.” Adding to the good news, IMV has completed the DPX-COVID-19 cGMP formulation and manufacturing process development, with multiple batches successfully produced. It also has CDMOs in Canada, the U.S. and other countries to help prepare for a possible launch.

With top-line data for its cancer vaccine also expected to be released in 2H20, the deal is sealed for Birchenough. To this end, the analyst rates IMV an Overweight (i.e Buy) along with an $11 price target. This figure conveys his confidence in IMV’s ability to soar 176% in the next year. (To watch Birchenough’s track record, click here)

Looking at the consensus breakdown, 5 Buys and 2 Holds have been published in the last three months. Therefore, IMV gets a Moderate Buy consensus rating. Based on the $8.73 average price target, shares could rise 119% in the next year. (See IMV stock analysis on TipRanks)

Sutro Biopharma Inc. (STRO)

Pioneering a new way of discovering therapeutics, Sutro Biopharma is focused on next generation cancer and autoimmune therapeutics — antibody drug conjugates (ADCs), bispecific antibodies and cytokine derivatives. Ahead of several updates related to its development pipeline, Wells Fargo sees major growth in store.

Birchenough tells clients that the progress of its novel antibody drug conjugates (ADCs) keeps him standing squarely with the bulls. In particular, the analyst is excited about two candidates, wholly-owned STRO-002 in ovarian cancer and Bristol Myers Squibb-partnered BCMA ADC, CC-99712, in myeloma.

STRO-002, a folate receptor α ADC, is currently being evaluated at doses ranging from 5.2 to 6.0 mg/Kg before a dose is selected for the expansion cohort. This cohort is set to open later on in 2H20. On top of this, STRO is expected to update data from the ongoing Phase 1 dose escalation trial in 2H20.

Based on data from the Virtual AACR meetings, 62% of patients saw at least a 50% decrease in CA-125, all of whom achieved at least stable disease. Additionally, preclinical data demonstrated that there was an additive benefit when STRO-002 was combined with PD-L1 inhibitor BAVENCIO.

Expounding on this, Birchenough stated. “With dose escalation ongoing, we believe that early evidence of activity in highly refractory ovarian cancer is supported by a 62% CA-125 response and durable stable disease, and we are optimistic regarding prospects for competitive RECIST response to mirvetuximab at higher doses, with expected update by YE20. We believe that absence of ocular toxicity, if maintained at higher doses, could represent a major advantage over other ADCs, like mirvetuximab, and position STRO-002 for longer term dosing to support extended progression-free survival (PFS).”

As for CC-99712, it is currently progressing through a Phase 1 trial, with 3.0mg/Kg representing the last reported dose. Even though this therapy is competing with GlaxoSmithKline’s ADC, Birchenough argues the bar has been set low.

“Indeed, with a 31% overall response rate (ORR), ocular toxicity, and severe vision loss with the GSK ADC, we believe that avoidance of ocular toxicity in the ongoing phase 1 study in relapsed/refractory multiple myeloma could represent a significant early advantage of CC-99712 and be a major catalyst for STRO shares into a potential YE20 data update,” the analyst explained.

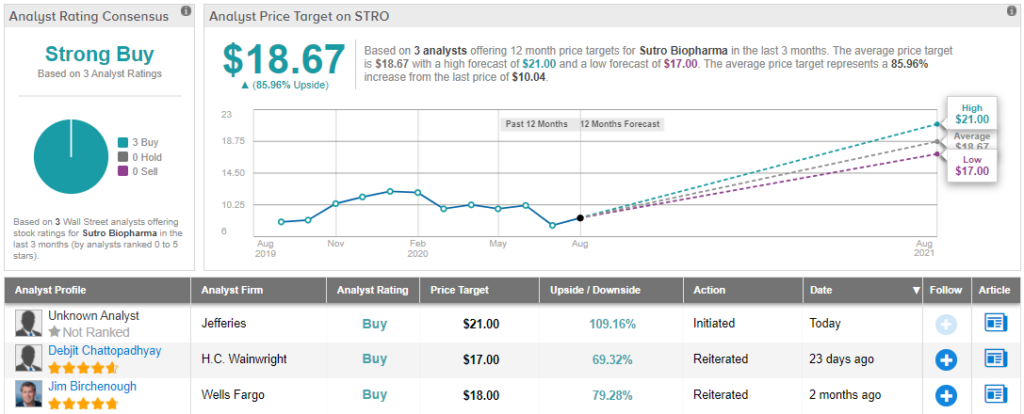

Given everything STRO has going for it, Birchenough decided to stay with the bulls. Along with an Overweight (i.e. Buy) rating, he puts an $18 price target on the stock. Should his thesis play out, a potential twelve-month gain of 78% could be in the cards.

Overall, with 3 “buy” ratings and no “holds” or “sells,” STRO shares have earned their Strong Buy consensus rating. The stock is selling for $10.08 and the average price target of $18.67 implies that there is room for 84% upside growth. (See Sutro stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.