In the recent market meltdown, legendary investor Warren Buffett has been on a shopping spree. One sector that seems to be of primary focus for Buffett is the oil and gas exploration sector. After increasing stake in Chevron Corporation (CVX), Buffett has been busy mopping-up shares of Occidental Petroleum (OXY).

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

While it makes sense to follow big investors, that’s not the only reason for me being bullish on OXY stock. I believe that the stock is positioned to create long-term value for investors.

It’s worth noting that Occidental stock touched highs of $74.40 in May 2022. With some correction in oil price, the stock has also corrected by about 20% to its current levels of $59.1. The correction provides an attractive entry point with industry and company specific catalysts, likely to support the uptrend.

Occidental’s Smart Score Rating

Worth noting, on TipRanks, OXY receives a Smart Score rating of 10 out of 10, indicating a solid chance for the stock to outperform the broader market.

Bullish on Oil Price

There has been a big reversal in oil price since the pandemic driven drop in March 2020. Brent oil currently trades near $100 levels and it seems that oil price will remain firm in the foreseeable future.

This view is underscored by the fact that the probability of recession in 2023 has increased significantly. Aggressive contractionary monetary policies to curb inflation have already impacted growth.

However, even with a recession probability, oil price has remained relatively resilient. A key reason is that oil is discounting the geo-political risk factor. At the same time, a recession would imply that policymaker’s step-back from aggressive tightening of liquidity. This will be positive for oil and the broader commodities segment.

Recently, JP Morgan opined that oil can touch $380 if Russia reacts to U.S. and European penalties through a sharp production cut. That’s the worst-case scenario. In the current scenario, it seems likely that oil will hover around $100 per barrel. This will benefit oil and gas exploration companies and Occidental Petroleum seems like a value creator.

Occidental is Positioned to Deliver Robust Cash Flows

Occidental stock has surged by 90% year-to-date 2022. A key reason for the rally has been its EBITDA margin expansion, and cash flow upside.

To put things into perspective, Occidental reported free cash flow of $3.3 billion for Q1 2022. This came at a realized oil price of $92. With Brent trading around $100 levels, Occidental is positioned to deliver annualized free cash flow of around $13 to $14 billion.

With strong cash flows, Occidental will be positioned to accelerate investment in exploration projects. At the same time, the company repaid $3.3 billion in debt during Q1 2022. With sustained deleveraging, the company aims to achieve an investment grade balance sheet.

It’s also worth noting that Occidental currently has an annual dividend pay-out of 52 cents. If oil remains around $100 per barrel, dividend growth seems likely. This view is underscored by the fact that Occidental believes that current levels of dividends are sustainable, even at $40 WTI oil.

In general, Warren Buffett likes businesses that are cash flow machines. It’s not surprising that the investor has been increasing a stake in Occidental.

A Strong Reserves Base

Occidental Petroleum believes that it can maintain production at current levels. At $100 per barrel oil, the outlook is bright as free cash flows will remain above $10 billion, on an annual basis.

The company’s proved reserves also back the production maintenance guidance. As of December 2021, Occidental reported 3.5 billion barrels of oil equivalent in proved reserves. On a year-over-year basis, the company’s proved reserves increased by 600 million barrels of oil equivalent.

Another important point to note is that Occidental has a majority of proved developed reserves. As of December 2021, the company reported proved undeveloped reserves of 865 million barrels of oil equivalent.

Considering the fundamentals, Occidental is well positioned to invest in boosting proved developed reserves. This will ensure that production remains stable in the long-term.

This might not be the best time to pursue acquisitions. However, considering the financial flexibility, inorganic growth in reserves seems like a possibility in the coming years.

Risk Factors – Recession and Debt

A deep recession can translate into lower demand for oil in 2023. This can negatively impact cash flows. Of course, Occidental has low break-even assets and dividends are safe.

However, it’s worth noting that as of Q1 2022, the company reported $25.8 billion in long-term debt. A relative decline in cash flows would delay the company’s target for deleveraging. This will negatively impact OXY’s stock price.

Having said that, the stock has corrected recently and might have largely discounted recession concerns.

Wall Street’s Take

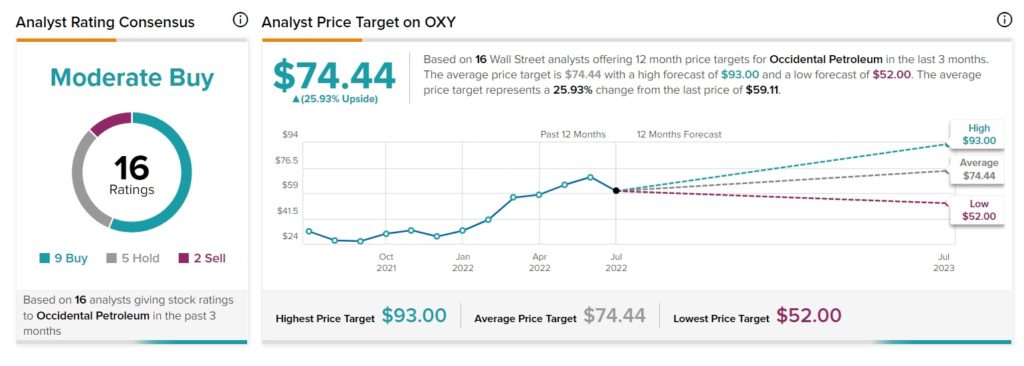

Turning to Wall Street, Occidental has a Moderate Buy consensus rating based on nine Buy, five Hold, and two Sell ratings assigned in the past three months. The average Occidental stock price forecast of $74.44 implies 25.93% upside potential.

Concluding Views – Occidental, A Cash Flow Machine

Occidental Petroleum will be positioned to generate free cash flow in excess of $10 billion, even if oil trades around $90 per barrel.

While the energy sector is cyclical in nature, geo-political concerns will ensure that the company continues to generate strong cash flows in the next few years.

Occidental is also positioned to create value through dividends and share repurchases. Considering these factors, OXY stock could be worth accumulating on weaknesses.

Read full Disclosure