Not all holiday gifts have to come from friends and family. You can give yourself an enduring gift if you consider buying Walmart (NYSE:WMT) stock while it’s down. You’ll be amazed to learn why the market objected to Walmart’s perfectly acceptable quarterly earnings report. So, I am bullish on WMT stock as a buy-and-hold position.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Walmart is a famous retail chain of stores where people buy all kinds of products, including home goods, food, pharmaceuticals, and more. With the holiday season upon us and Black Friday sales in focus, it seems obvious that Walmart stock would be a great investment.

However, the market wasn’t happy with Walmart at all earlier today. This may seem irrational, especially if Walmart’s results and forward guidance are perfectly fine. Yet, the time for value investors to make a move is when the market’s perception doesn’t match with reality and common sense.

Walmart’s Excellent Quarter: You Can’t Deny These Numbers

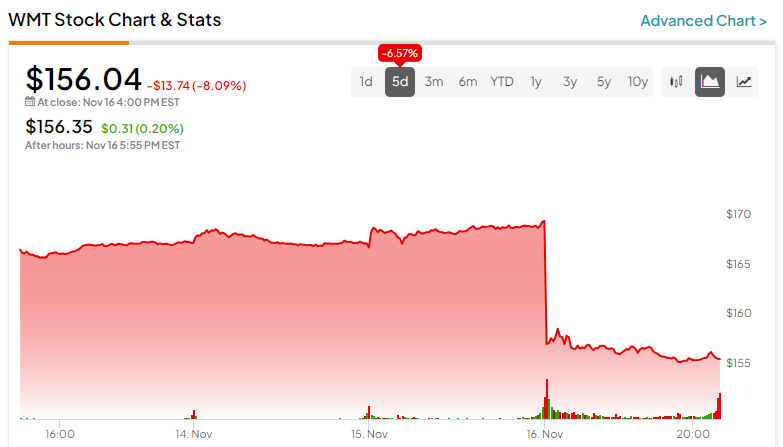

Walmart stock was ready to finish the year with impressive gains — until today, that is. The stock finished down 8.1%, which is an unusually large single-day move.

The company released its third-quarter 2023 financial results, and there’s actually a lot to like in Walmart’s report. First of all, Walmart’s U.S. “comp” (i.e., comparable same-store) sales increased by 4.9% year-over-year. Even better, the company’s U.S. e-commerce sales grew by 24%. So far, it sounds like Walmart has been quite successful in dealing with persistent inflation in essential goods.

Not convinced yet? Then consider Walmart’s Q3-2023 revenue, which rose by 5.2% year-over-year to $160.8 billion. Furthermore, this sales result beat the consensus estimate by $1.15 billion.

In addition, Walmart’s consolidated gross margin rate increased by 32 basis points (bps). Finally, the company reported adjusted earnings of $1.53 per share, thereby exceeding the consensus estimate by a penny per share.

Plus, all of this happened before the U.S. holiday season got underway. Do you know how financial commentators sometimes say the American consumer is strong? I’d say that Walmart’s quarterly results back this claim up.

Here’s Why Walmart Stock Dropped Today

Yet, something terrible must have happened to Walmart, right? After all, WMT stock dropped 8%, and this can’t happen without a reason.

Actually, stocks can drop without a reason, or at least without a convincing reason. When it comes to WMT stock, apparently, the market decided to panic sell it because of Walmart’s forward guidance.

Hold on a minute. Walmart actually raised its Fiscal Year 2024 adjusted EPS guidance. Specifically, the company now expects to earn $6.40-$6.48 per share for the year, which is an improvement over Walmart’s prior guidance of $6.36-$6.46 per share.

However, the market was displeased because Walmart’s guidance raise wasn’t high enough. In particular, the consensus estimate was for FY2024 adjusted earnings of $6.48 per share.

Sometimes, the financial markets can be too demanding of companies. Results can be solid, and guidance can be fine, but this just isn’t good enough for some panicky short-term investors.

Along with the not-good-enough guidance, today’s investors may have been spooked by a remark from Walmart CFO John Rainey. He said, “Recently, we’ve experienced a higher degree of variability and weekly performance in between holiday events in the U.S., including seeing a softening in the back half of October that was off trend to the rest of the quarter.”

To me, it sounds like Rainey is just trying to put Walmart’s largely positive results in perspective and prepare investors for what might be a challenging holiday season. Again, I don’t see anything terrible going on with Walmart.

Is Walmart Stock a Buy, According to Analysts?

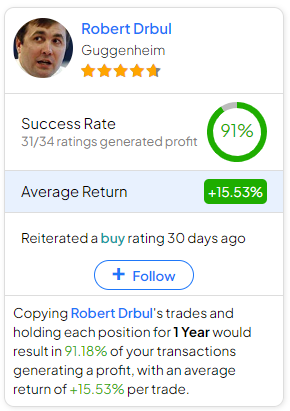

On TipRanks, WMT comes in as a Strong Buy based on 27 Buys and four Hold ratings assigned by analysts in the past three months. The average Walmart stock price target is $181.71, implying 16.5% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell WMT stock, the most profitable analyst covering the stock (on a one-year timeframe) is Robert Drbul of Guggenheim, with an average return of 15.53% per rating and a 91% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Walmart Stock?

Really, we should thank our lucky stars that the financial markets can be unreasonable sometimes. After all, that’s how prime dip-buying opportunities happen.

Walmart is still the king of U.S. big-box store chains, and the company’s full-year outlook was fine, even if the market has a different opinion about it. Therefore, I definitely feel that investors should consider a position in WMT stock, as I believe the price might not stay down for too much longer.