With another month left for the tumultuous year of 2022 to end, it’s a good time to prepare to make the most out of 2023 with Wall Street’s highest-rated stocks. Recently, Merck (NYSE:MRK), Eli Lilly (NYSE:LLY), Apple (NASDAQ:AAPL), and Salesforce (NASDAQ:CRM) have been rated favorably by Wall Street analysts.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Merck (MRK)

Pharmaceutical giant Merck is best known for its medications for life-threatening diseases. Its cancer drug, Keytruda, and its HPV vaccine Gardasil are the best-sellers that form the backbone of Merck’s product revenues.

Early this month, Guggenheim analyst Seamus Fernandez maintained a Buy on MRK stock and raised his guidance on the sales of Keytruda, Gardasil, and the pulmonary arterial hypertension medication Sotatercept. This also prompted the analyst to increase his price target on the stock from $104 to $111.

To build its long-term portfolio, Merck is also tapping external sources. To that end, the company has made several strategic acquisitions which have been fruitful growth catalysts. The most recent acquisition was made last week when the company announced that it will acquire Imago BioSciences (NASDAQ:IMGO) for $1.35 billion.

What is the Price Target for MRK Stock?

MRK stock has a Strong Buy consensus rating on Wall Street. However, the average price target of $110.40 indicates 1.8% upside potential.

Eli Lilly (LLY)

Another pharmaceutical company that’s popular on Wall Street is Eli Lilly. LLY’s solid portfolio of drugs is widely used to treat diabetes, autoimmune diseases, and cancer. Demand for its medications is driving its revenue growth.

Eli Lilly consistently returns cash to shareholders through share repurchases and dividends. The return of cash to shareholders through dividends and share buybacks was around $4.35 billion in 2021.

Not only that, but Lilly’s cost-reduction efforts are also bearing positive returns. In the past six years, the company has managed to achieve around 1,000 basis points worth of growth in its operating margin, which is impressive.

What is the Price Target for LLY Stock?

Earlier this month, Truist analyst Robyn Karnauskas maintained a Buy rating on LLY stock and also raised her price target to $421 from $400. The failure of Roche’s (OTC:RHHBY) Alzheimer’s drug trial led the analyst to estimate a 5% increase in the penetration rate of Lilly’s competing drug, donanemab.

Wall Street is optimistic about the stock, too, with a Strong Buy consensus rating based on 12 Buys and two Holds. The current price is forecast to reach $383.69, implying 4.9% upside potential.

Salesforce (CRM)

Now coming to technology, Salesforce, a leading provider of on-demand Customer Relationship Management software, is one of the biggest beneficiaries of the rapid digital transformation across the globe. Impressively, the company is targeting revenue of $50 billion by the Fiscal Year 2026. If it happens, Salesforce will be the fastest enterprise software company to achieve that milestone. On a trailing-12-month basis, the company generated over $29 billion in revenue.

Additionally, Salesforce boasts a strong balance sheet with cash of about $13.5 billion as of July 31, 2022. This makes it easier for the company to pursue growth initiatives and enhance shareholders’ value without the help of more debt. At the same time, Salesforce’s total-debt-to-total-capital ratio was 8.5%. This makes the company an attractive stock to investors who are looking for relatively safe bets.

Ahead of its Q3 results on November 30, Wedbush analyst Daniel Ives reiterated an Outperform rating on Salesforce, with a price target of $215. The analyst expects Industry Cloud deal activity to have been high and Tableau and MuleSoft to have been better than expected.

What is the Price Target for CRM Stock?

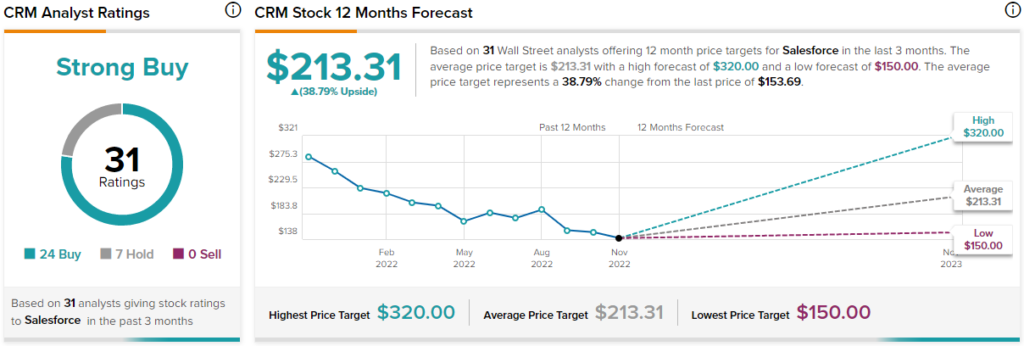

Wall Street analysts think that CRM stock has the potential to increase by 38.8% over the next 12 months, reaching $213.31. Analysts have a Strong Buy consensus rating on CRM based on 24 Buys against seven Holds.

Apple (AAPL)

Apple is in a difficult situation currently, with a significantly lower-than-expected iPhone Pro production in sight. However, strong fundamentals and its massive size make it one of the most popular stocks among investors.

Even hedge funds are bullish about the stock, with more than 675,000 shares added to hedge fund portfolios in Q3. Interestingly enough, about 42% of the portfolio of Warren Buffet’s Berkshire Hathaway is made up of Apple stock.

However, even with Apple shares down 20% year-to-date, it’s still not inexpensive, with a forward P/E of 23.7x. Nonetheless, Wedbush analyst Daniel Ives reiterated a Buy rating and $200 price target for Apple. “Our bullish thesis on Apple is demand-driven, which is very firm, although these brutal supply shortages in the near-term remain a clear overhang for the stock to navigate,” assured the analyst.

What is the Price Target for AAPL Stock?

Apple is a Wall Street darling, with a Strong Buy consensus rating based on 24 Buys and four Holds. The average AAPL price target stands at $180.48, which indicates 25.1% upside potential.

Ending Thoughts

One cannot deny the challenges that await companies this year and next. Nonetheless, it is the long-term view that matters, and Wall Street never fails to show us that.