The threat of a recession, geopolitical tensions, and rising interest rates have significantly dragged down the tech sector this year. Tech giant Apple (NASDAQ: AAPL) has also been caught up in the broader market sell-off, with the stock down 20.2% year-to-date. Additionally, investors are also worried about the impact of supply chain disruptions and other macro headwinds on the company.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

While Apple is known for its groundbreaking product innovations like the iPhone, the company has also been focusing on expanding its Services business.

Focus on Services

Apple generated $97.3 billion revenue in the fiscal second quarter (ended March 26, 2022), of which Products accounted for nearly 80% of the revenue while the remaining came from Services. Apple’s Services revenue includes sales from advertising, AppleCare, cloud services, digital content (including Apple Store, books, music, video and games), and payment services (like Apple Card, Apple Pay).

Apple’s Services business is growing rapidly. What’s more, it carries a higher gross margin than the Products business. Apple’s Services revenue grew 17.3% to $19.8 billion, while Product revenue was up 6.6% to $77.5 billion.

Apple’s Services business is expected to be one of the key growth drivers of its future revenue with the company experiencing increasing customer engagement. Apple now has more than 825 million paid subscriptions across the services it offers on its platform.

Apple continues to launch several offerings to boost its services revenue. The company recently announced that its iOS 16 operating system will have Apply Pay Later, a buy-now pay-later service that will initially be launched in the U.S this year.

Wall Street’s Take

Recently, Evercore ISI analyst Amit Daryanani reiterated a Buy rating on Apple stock as he believes that there is “plenty of runway” for most Apple Services, such as Apple Music, TV, and Arcade.

Meanwhile, J.P. Morgan analyst Samik Chatterjee notes that despite its “longevity and portfolio expansion,” he estimates that Apple’s Payments revenue has only reached $1 billion in recent years, and is on track to expand to $4 billion by FY26, accounting for only 5% of the company’s total Services revenue.

That said, Chatterjee feels that gaining share in the Payments market is “a marathon, not a sprint,” and an addressable market of $30 billion is “on the horizon.”

The analyst sees “many avenues of upside” as Apple continues to strengthen its portfolio and expand its installed base. Chatterjee opines that Apple’s ecosystem is most comparable to that of PayPal (PYPL), with a total addressable market of $110 trillion.

Chatterjee reiterated a Buy rating on Apple stock with a price target of $200.

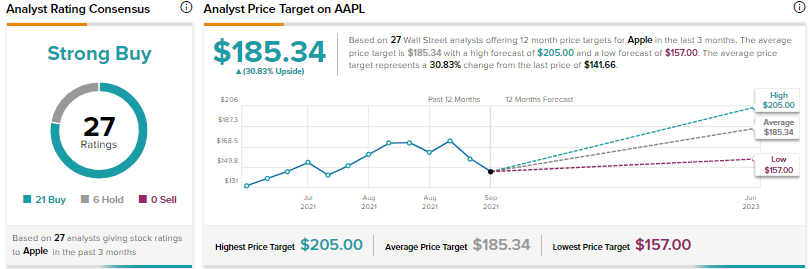

Overall, Apple scores a Strong Buy consensus rating based on 21 Buys and six Holds. The average Apple price target of $185.34 implies 30.83% upside potential from current levels.

Conclusion

Concerns about the impact of a challenging macro backdrop on consumer spending for premium products like Apple iPhone remain. That said, the majority of Wall Street analysts covering Apple continue to be optimistic on the company’s prospects based on its strength in the smartphone market, continued innovation, a rapidly growing Services business, and solid fundamentals.

Apple scores a “Perfect 10” on TipRanks’ Smart Score system, implying that it could likely outperform the broader market.

Read full Disclosure