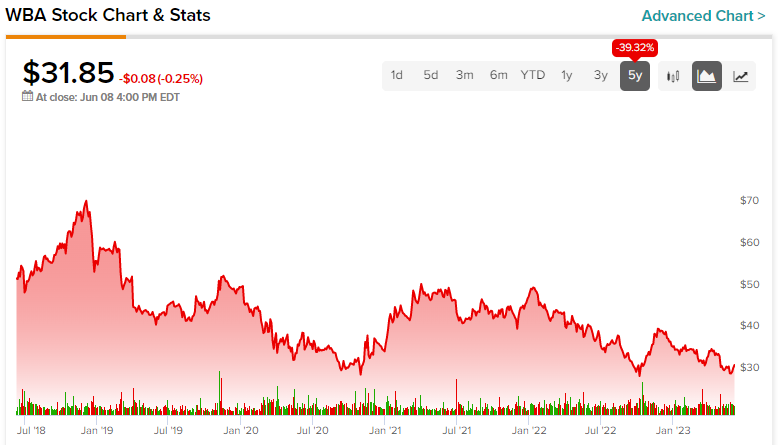

Walgreens Boots Alliance stock (NASDAQ:WBA) is currently attached to a dividend yield of about 6.1%, which is near its all-time high of around 6.4%. This can be attributed to the fact that the retail pharmacy giant’s stock has seen a prolonged decline over the past several years.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Despite this downward trend, Walgreens has consistently raised its dividend without exception. In fact, the company boasts a remarkable track record of 47 consecutive annual dividend increases! Considering the company’s record yield, coupled with the strong possibility of another dividend increase anticipated to occur in August (as dividend hikes are typically scheduled for this month), investor interest in the stock is likely to rebound. Hence, prospective investors could be subject to notable upside that is coupled with a rather juicy dividend.

Does WBA’s Profitability Sufficiently Cover Its Dividend?

Walgreens’ 6.1%-yielding dividend may sound attractive, but it would mean little if it wasn’t covered sufficiently by the company’s underlying profitability. The fact that investors have driven the stock lower in recent years, after all, could imply that Walgreens’ dividend is indeed in danger, potentially signaling a dividend cut. And yet, this doesn’t appear to be the case at all. As its most recent results once again demonstrated, Walgreens continues to produce resilient cash flows while being highly profitable.

In its Fiscal Q2-2023 results, Walgreens posted revenues of $34.9 billion, a year-over-year growth of 4.5% in constant currency. The company’s growth was partially driven by its International segment, which experienced a stellar quarter with comparable retail growth of 16% on top of the 22% growth the company posted last year. In fact, the International segment achieved its eighth consecutive quarter of retail market share gains.

Also, note that while the company’s retail domestic (U.S.) comparable sales, excluding tobacco, declined by roughly 1%, this performance compares against the 15.7% growth the company posted last year.

Overall, Walgreens’ rock-solid top-line results vividly demonstrate the unwavering resilience and indispensable significance of its essential business—pharmacies. The company’s ability to produce predictable cash flows regardless of the prevailing market conditions is remarkable.

Profitability-wise, Walgreens reported an adjusted earnings-per-share decline of 27.2% to $1.16, which may seem scary at first glance. That said, the decline was only due to a 26% headwind from COVID-19 vaccinations and testing that occurred last year. With COVID-19-related high-margin cash flows dipping compared to the prior-year period, it makes sense to see the incremental benefit gradually fading away. This doesn’t mean, however, that the company’s core business is in any trouble, as illustrated by its strong performance in sales.

Management expects that Walgreens’ performance will remain robust during the second half of its Fiscal 2023, maintaining its full-year adjusted earnings-per-share guidance of $4.45 to $4.65. While this implies a decline in profitability versus last year’s result of $5.04 due to a much lower contribution from COVID-19 vaccinations and testing, the core business remains highly profitable. Returning to our initial concern, the midpoint of management’s projection ($4.55) signals that Walgreens’ annualized dividend of $1.92 appears to be widely covered.

What Could WBA’s Next Dividend Increase Could Look Like?

Based on Walgreens’ typical financial calendar, the company should increase its dividend again this August, which will mark its 48th consecutive dividend increase. Now let’s look at the company’s five last dividend increases:

- 2018’s dividend increase: 10.0%

- 2019’s dividend increase: 4.1%

- 2020’s dividend increase: 2.2%

- 2021’s dividend increase: 2.1%

- 2022’s dividend increase: 0.5%

Based on this five-year dividend growth history, we can see a persisting trend of decelerating dividend growth. This is likely due to the company aiming to maintain its payout ratio at a relatively comfortable level (42% based on management’s guidance).

Along with the fact that the yield is already standing at a relatively hefty level, it’s likely that management will once again go for a humble hike. Still, the headline, along with Walgreens nearing half a century of consecutive dividend increases, should generate heightened investor interest in the stock.

Is WBA Stock a Buy, According to Analysts?

Turning to Wall Street, Walgreens has a Hold consensus rating based on two Buys, eight Holds, and two Sells assigned in the past three months. At $39.91, the average Walgreens stock price target implies 25.3% upside potential.

The Takeaway

In conclusion, Walgreens Boots Alliance presents an intriguing investment opportunity with its dividend yield near an all-time high and an impressive track record of consecutive annual dividend increases. Despite the stock’s downward trend in recent years, Walgreens continues to demonstrate resilience and profitability.

The company’s Fiscal Q2-2023 results showcase strong revenue growth and market share gains, particularly in its International segment. While adjusted earnings per share declined due to COVID-19-related factors, the core business remains highly profitable.

With management projecting robust performance for the second half of the fiscal year, it appears that WBA’s dividend is sufficiently covered. As Walgreens approaches its 48th consecutive dividend increase, investor interest is likely to be piqued, further fueling the stock’s appeal.