The telecom industry has battled with slow growth over the last few years and telephone giant Vodafone (GB:VOD) is no exception – but there are good signs around the company.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

But the company is now seeing sustained growth and its commercial drive seems to be coming back. Overall, telecom stocks are defensive, and the business will not be impacted negatively by current inflationary pressures.

Vodafone stock has managed to stay in the green with around a 6% return, year to date, but it has failed to rise above 140p in the last three years and is down by 4% over that period.

The telecom leader in the UK market, BT Group’s (GB:BT.A) stock is also struggling with its stock performance. BT’s stock is down by 6.1% in the last year.

Improving numbers

In July 2022, the company published its first quarter update for 2023. The company’s performance remained in line with expectations mainly because of growth in the Europe and Africa region.

Overall group revenue grew by 2.7% and group service revenue increased by 2.5% in the quarter. The UK service revenue growth of 6.5% was the highlight of the results. This was driven by customer growth, annual price hikes and roaming revenue.

Spain and Italy saw a decline in their revenues, which was offset by the growth in the UK region. Germany was also down by 0.5% but has commercially stabilised. Germany, Italy, and the UK are the company’s key markets and account for 50% of revenue.

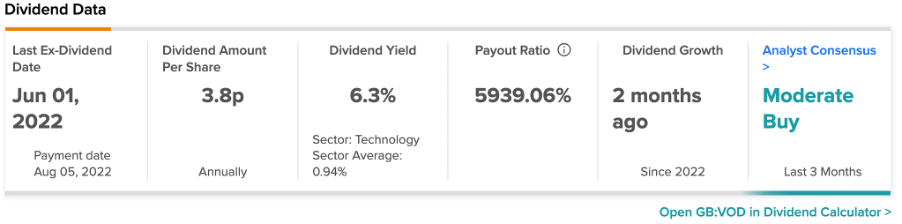

Attractive Dividends

The company’s dividend yield, at 6.3%, is safe. The stock is a gem for income investors, compared to its peers. BT Group has a dividend yield of 1.43% as compared to the sector average of 0.94%.

In the last results for the full-year 2022, the company announced a total dividend of €0.09 per share, including a final dividend of €0.045.

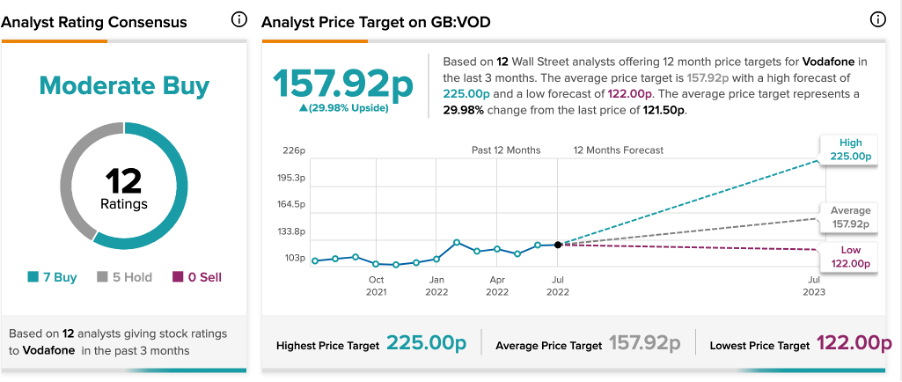

View from the City

According to TipRanks’ analyst rating consensus, Vodafone stock is a Moderate Buy. The company has a total of 12 ratings, including seven Buy and five Hold recommendations.

The average price target is157.9p, with a high and a low forecast of 225p and 122p, respectively. The price target is around 32.3% higher than the price level of 120.4p.

After the quarter update, Citigroup reduced the price target for Vodafone to 160p from 165p. It still maintained a buy rating on the stock.

Last month, Robert Grindle from Deutsche Bank also assigned a Buy rating to the stock with the highest target price of 225p.

Grindle said, “if the market rallies, Vodafone shares should not suffer and the group has high exposure to the infrastructure thematic (we expect more deals across the sector), the group’s mobile price-volume mix is improving in favour of more flexibility in capital intensity, and management is taking steps to improve operations and value visibility and to grow the business by the mid-single digit in the medium term.”

He further added, “There’s little reason why telcos such as Vodafone won’t continue to be a relatively safe harbour in difficult markets.”

Key Takeaway

Despite posting decent growth in numbers and following a sustainable dividend policy, the market is still reacting negatively to the stock.

However, in an inflationary environment, Vodafone stock is a safe choice for income investors with some pressure on the stock prices in the medium term.

For long-term investors, the company’s strong fundamentals and continued investments in countries like fast-growing economies like Africa will boost top-line growth.