Real estate investment trusts, or REITs, are an attractive investment option amid the ongoing turmoil. REITs generate steady cash flows through rental income. They are required to return a minimum of 90% of taxable income in the form of dividends, making them attractive for income-oriented investors. We will discuss three REITs – VICI Properties (NYSE:VICI), Reality Income (NYSE:O), and Iron Mountain (NYSE:IRM) – and use TipRanks’ Stock Comparison Tool to pick the one that can generate the best returns.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

VICI Properties (VICI)

VICI Properties boasts one of the largest portfolios of gaming, hospitality, and entertainment properties, including Caesars Palace Las Vegas and MGM Grand. The company’s triple net leases with the best-in-class tenants assured 100% rent collection during the COVID-19 pandemic. Under triple net leases, the tenant is responsible for paying all property expenses related to ongoing maintenance and operation, including taxes and insurance.

This week, VICI reported its third-quarter results. Revenue grew 100% year-over-year to $751.5 million, while adjusted funds from operations (AFFO) per share increased 8.5% to $0.49. Results reflected the impact of the company’s acquisitions of MGM Growth Properties LLC and the land and real estate assets of the Venetian Resort Las Vegas. VICI slightly revised its 2022 AFFO per share guidance to the range of $1.91 to $1.92, from the prior guidance range of $1.89 to $1.92.

Last month, VICI increased its quarterly dividend per share by 8.3% to $0.39. The company offers an annual dividend yield of 4.79%.

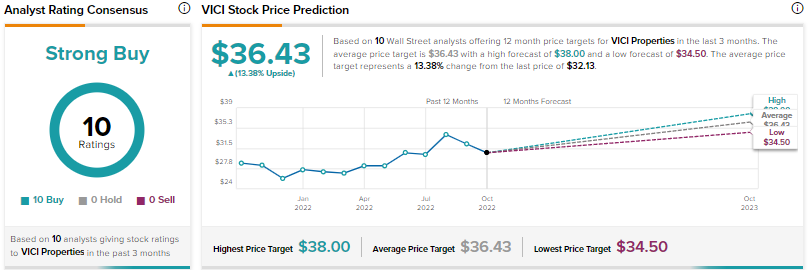

Is VICI a Good Stock to Buy?

Following the Q3 results, Deutsche Bank analyst Carlo Santarelli reiterated a Buy rating on VICI stock but cut his price target to $37 from $39 to reflect a lower target valuation multiple. Santarelli believes that in the ongoing environment, VICI is “more compelling” for REIT investors based on the historical stability of the rental payments.

VICI Properties stock scores the Street’s Strong Buy consensus rating based on 10 unanimous Buys. The average VICI stock price target of $36.43 implies 13.4% upside potential. Shares have risen 6.7% year-to-date.

Realty Income (O)

Realty Income’s portfolio includes 11,427 properties located across 50 U.S. states, Puerto Rico, the U.K., and Spain. It mainly focuses on single-unit freestanding commercial properties under long-term, net lease agreements with leading global operators, like Walgreens (WBA), Dollar General (DG), Dollar Tree (DLTR), and FedEx (FDX).

Realty continues to strengthen its portfolio through acquisitions of high-quality real estate. After investing more than $3.2 billion in the first half of 2022, the company increased its full-year acquisition guidance to over $6 billion.

Also known as “The Monthly Dividend Company,” Realty recently declared its 628th consecutive monthly dividend ($0.25) and has increased its dividend 117 times since it was publicly listed in 1994. This dividend aristocrat’s annual dividend yield stands at 4.87%.

Realty Income is well-positioned to support its attractive dividends. In Q2, the company’s AFFO per share increased 10.2% to $0.97.

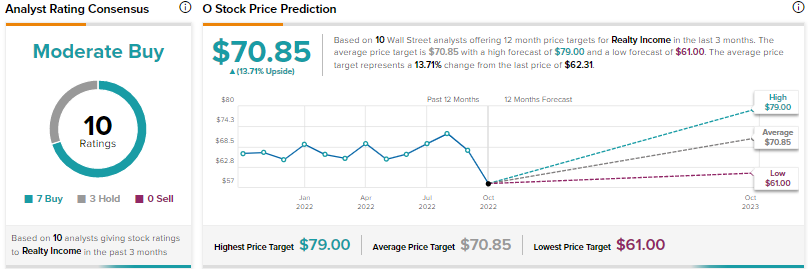

What is the Target Price for Realty Income?

Recently, Mizuho analyst Haendel St. Juste downgraded Realty Income stock to a Hold from Buy and lowered the price target to $61 from $76. The analyst cited lower investment spreads relative to peers, high acquisition expectations, and increased currency headwinds as the reasons for his rating revision.

Overall, the Street is cautiously optimistic about Realty Income stock, with a Moderate Buy consensus rating based on seven Buys and three Holds. The average Realty Income stock price target of $70.85 implies about 14% upside potential. Shares have declined 13% year-to-date.

Iron Mountain (IRM)

Iron Mountain is a specialized REIT that offers storage and information management services. Its real estate network comprises nearly 1,380 facilities in 59 countries (as of Q2-end). Its extensive range of services includes digital transformation, data centers, secure record storage, information management, art storage and logistics, and asset lifecycle management.

In Q2, Iron Mountain’s revenue increased 15.2% to $1.29 billion. The company’s storage rental revenue accounted for 58.4% of the overall Q2 revenue, while service revenue contributed the remaining. Notably, the company’s service revenue is growing at a faster rate than its storage rental revenue. AFFO per share grew 9.4% to $0.93.

The company expects full-year revenue growth in the range of 14%-17% and AFFO per share growth of 6% to 10%.

At its Investor Day event held in September, Iron Mountain revealed that it intends to grow its revenue at a CAGR of about 10% to $7.3 billion in 2026. The company expects $4 billion of capital expenditure over 2023-2026 to support its growth plan.

With a quarterly dividend per share of $0.62, the company’s annual dividend yield stands at 5.02%.

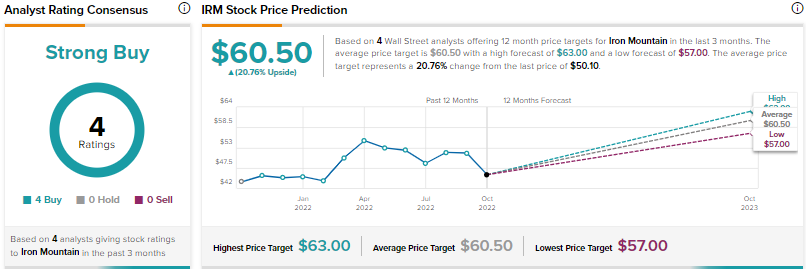

Is IRM a Buy?

Iron Mountain earns the Street’s Strong Buy consensus rating based on four unanimous Buys. The average Iron Mountain stock price prediction of $60.50 implies nearly 21% upside potential. IRM stock has declined 4.2% so far this year.

Conclusion

The three REITs we discussed offer comparable dividend yields. However, currently, Wall Street sees higher upside potential in Iron Mountain stock than in VICI Properties and Realty Income.

Unlike the other two REITs, Iron Mountain is not known for dividend increases. The company is investing aggressively in its growth initiatives. Given the rapid digitization and transition to the cloud, the strong demand for data centers is expected to drive Iron Mountain’s future growth.