Shares of global media powerhouse ViacomCBS (VIAC) have begun to settle down after a devastating implosion in shares that brought it from around $100 to as low as $29 and change per share.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The massive spike in VIAC stock probably should have never happened to begin with. Now that the dust has settled and momentum chasers are out, there’s real value to be had in the media and entertainment firm that looks ripe for takeover at $34 per share.

Though ViacomCBS make be an intriguing takeover target, buying any stock based on such speculation is never a good idea. If no acquirers step forward, it’s up to management to iron out the wrinkles.

Currently, there’s limited visibility on the uncertain road ahead, as the firm moves deeper into the streaming market. Despite the dirt-cheap multiple, I am neutral on the stock.

Ultra-Competitive Streaming Market

At 6.8 times trailing earnings and 0.8 times sales, VIAC stock screams value, but a more thorough analysis must be conducted to ensure the already cheap stock doesn’t stand to become even cheaper.

While the valuation is incredibly depressed, the name also has some baggage. The company has been betting heavily on its streaming platform to stand up to the likes of Netflix (NFLX).

As the video-streaming market gets more crowded with time, though, getting in on the action is no guarantee of stellar returns on investment. As with most markets, there will be winners and losers.

With Netflix recently sagging lower following its underwhelming results, it’s clear that content providers need to offer consumers something they simply cannot refuse.

Whether that’s through a deep library of content for an attractive monthly price or must-see hit content at a higher price, ViacomCBS needs to differentiate itself.

Thus far, ViacomCBS has seen mixed success from its move into the streaming world.

Can Paramount+ Take Share?

Paramount+ looks to be a top growth driver for ViacomCBS. That said, it’s hard to tell how the service will stand up once its growth really begins to stagnate, as its rivals continue funneling considerable amounts of cash into the production of content.

Indeed, consolidation within the industry has given rise to some powerful competitors, and the fight for consumers’ eyes has never been fiercer.

With a fairly deep content library, ViacomCBS can offer its consumers a pretty selection. At the end of the day, though, consumers only have so much time in their day and cash in their wallets to justify adding yet another streaming service.

Despite ViacomCBS’ impressive library, I think new must-see content will be a differentiating factor if Viacom is to take share away from the streaming leaders. In terms of exclusive must-see content, Netflix and Disney (DIS) will be tough to top.

Despite growing investments in video streaming, the transition away from TV hasn’t been too smooth. Investors must ask themselves whether ViacomCBS has what it takes to make its platform a standout service to take it to the next level.

Otherwise, there’s no telling how much VIAC stock could continue to drag if consumers deem the firm’s offerings are “just another streaming service” that they don’t want to have to pay up for.

Currently, I view Paramount+ as robust but less sticky than the likes of the leaders in the streaming space. That said, ViacomCBS may have an opportunity to flex its muscles in the lower-priced corner of the streaming market.

With ad-supported Paramount+ Essential Plan and Pluto TV services, the value proposition could be tough to stack up against for fans of its content.

Wall Street’s Take

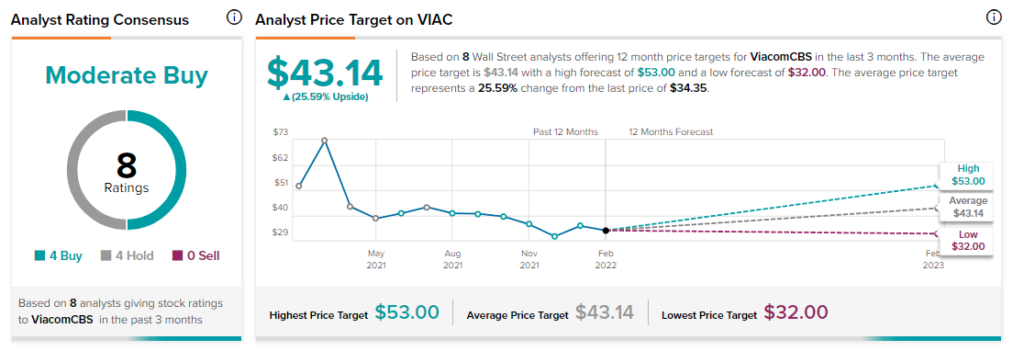

According to TipRanks’ analyst rating consensus, VIAC stock comes in as a Moderate Buy. Out of eight analyst ratings, there are four Buy recommendations and four Hold recommendations.

The average ViacomCBS price target is $43.14, implying an upside of 25.6%. Analyst price targets range from a low of $32 per share to a high of $53 per share.

Bottom Line on ViacomCBS Stock

ViacomCBS is a classic deep-value stock, but it’s one that’s full of uncertainty. The valuation is cheap, but given all the competition in streaming these days, it’s tough to get behind the name at this juncture.

Recently, Comcast (CMCSA) and ViacomCBS received regulatory approval for a streaming venture, SkyShowtime, across 20 European markets. The move is intriguing and could mark the beginning of a prosperous relationship.

Further consolidation and partnerships could produce a deep enough platform to give Netflix and Disney a run for their money. ViacomCBS is doing its best to adapt, but it’s really tough to tell what the future holds for the firm.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure