After posting weak Q1 earnings back in April, Verizon’s (VZ) latest quarterly statement brought with it a sense of renewed optimism.

The largest wireless carrier in the U.S. reported earnings on Friday, July 24, beating the estimates despite COVID-19’s sharp impact on its wireless and media businesses.

Although revenue dropped by 5.3% year-over-year to $30.4 billion, the figure came in $420 million higher than the consensus estimate. Non-GAAP EPS of $1.18 alos beat the Street’s forecast by $0.03.

Lower in-store traffic resulted in an 18% drop for equipment sales, bringing total Wireless revenue down by 4.1% year-over-year. Additionally, a decline in roaming usage and waived fees resulted inWireless service revenue dropping by 1.7% to $15.9 billion. The figure still landed ahead of the $13.18 billion consensus estimate. However, Media sales also took a dive, sinking by 24% to $1.4 billion.

Elsewhere, a handsome beat was reported, with the net addition of 173,000 postpaid phone subscribers exceeding the Street’s call for 14,000.

On another positive note, management maintained its previous guidance for adjusted EPS growth of between -2% to 2% in 2020.

Although Oppenheimer’s Timothy Horan anticipates some COVID-19 “weakness to persist,” the 5-star analyst applauded a decent quarter for the telecom giant and expects wireless service revenue to “improve sequentially.” Adding to the optimistic sentiment is a robust balance sheet “generating solid cash flow,” with the company exiting the first half of 2020 with free cash flow (non-GAAP) of $13.7 billion, up by 74.1% from the same period last year.

Horan said, “Verizon reported a solid quarter with healthy wireless trends and reaffirmed FY20 guidance. As expected, financial results were better than the overall economy on critical communications services revenue. Positively, the company continues to focus on investing in its 5G network deployment and rolling out DSS for nationwide coverage in 2H20.”

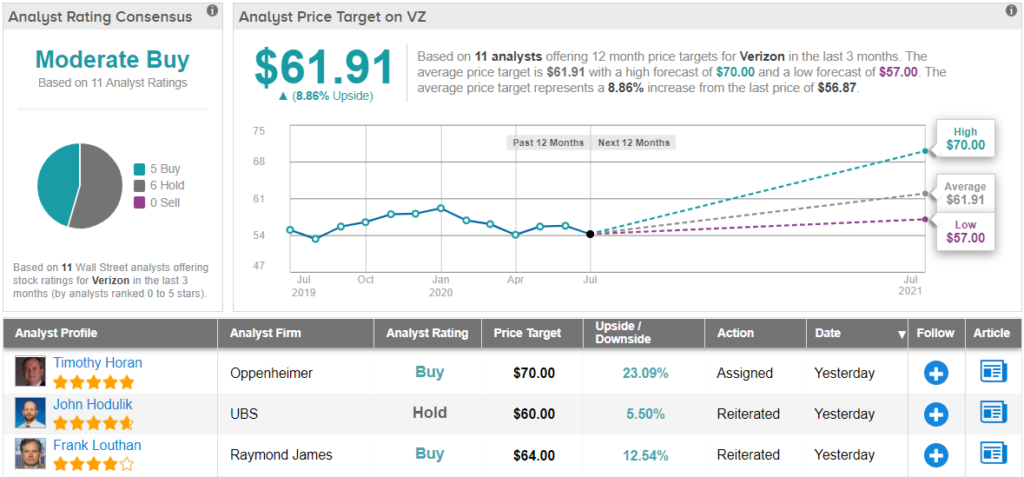

Accordingly, Horan maintained an Outperform (i.e. Buy) rating on Verizon shares along with a $70 price target. Investors could be pocketing a 23% gain should Horan’s forecast play out over the coming months. (To watch Horan’s track record, click here)

Turning to Wall Street’s analyst corps, a Moderate Buy consensus rating is based on 5 Buys and 6 Holds. With an average price target of $61.91, the Street projects upside potential of nearly 9% from current levels. (See Verizon stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.