Verizon (VZ) stock took a beating not long ago, having its worst single-session drop in two years. Yes, even a global brand like Verizon can occasionally fall out of favor on Wall Street. However, when that happens, it’s not time to panic sell. Instead, it’s the right time to apply contrarian principles and see the bright side when other traders only focus on negativity.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Verizon is a telecommunications company that provides telephone, broadband/wireless, and other services. This isn’t a startup business that will file Chapter 11 anytime soon. We’re talking about a giant company with brand-name recognition and a $186 billion market cap. As a result, I am bullish on the stock.

Remember What Makes Verizon Great

Investors shouldn’t lose sight of what makes Verizon a titan among businesses in the first place. First, we live in a time when 5G network connectivity is practically a requirement for individuals and companies. The era of 5G is here, and there’s no turning back to slower, lower-bandwidth 4G speeds.

Among companies that offer 5G wireless technology, Verizon is quite possibly the best in the business. For example, Verizon offers 5G Ultra Wideband for fast speeds and low latency among multiple devices simultaneously.

The company also provides 5G Nationwide for inter-connectivity among 5G and 4G devices, 5G Home Internet for ultra-speedy Wi-Fi connections, and 5G Business Internet to handle companies’ wide-band needs.

Why do so many individuals and businesses rely on Verizon for these services? Perhaps it’s because the company’s network connections are reliable. This isn’t just my opinion, either, as drive-testing firm RootMetrics determined that Verizon delivers the best 5G data reliability of any carrier. Amazingly, Verizon earned the RootMetrics U.S. Overall RootScore Award for the 18th consecutive test period.

For the customers, Verizon provides not only top-of-the-line 5G services but also broadband/fiber, managed security, and Internet of things (IoT) capabilities. The company can even help develop smart cities.

Additionally, Verizon is a stand-by for sensible investors. Currently, VZ pays a forward annual dividend yield of 5.76%. It’s no wonder that income-focused traders look to Verizon for generous cash distributions.

Verizon Stock’s Drop Looks like an Overreaction

It can be scary when a stock falls fast, but true contrarians see these events as buying opportunities. In the case of Verizon stock, it’s not difficult to figure out why it dropped recently. However, a clear-minded view of Verizon’s Q2 2022 earnings report may inspire you to capitalize on a possible overreaction to the downside.

On July 22, Verizon stock tumbled from the previous trading session’s closing price of nearly $48 to around $44 by the end of the day. That’s a decent-sized decline for Verizon stock, which doesn’t usually move that much.

With that, Verizon’s trailing 12-month P/E ratio has come down to 8.63, enticing value seekers of all stripes. Still, before jumping into the long side of the trade, investors will need to take a close, hard look at Verizon’s quarterly results, which admittedly are less than perfect.

Were the results really that bad, though? In the second quarter of 2022, Verizon reported adjusted EPS (excluding special items) of $1.31. Although this represents a decline from the prior year’s result of $1.39, it barely missed the analysts’ estimate of $1.32. Therefore, Verizon’s quarterly earnings weren’t far off the mark.

Turning to the top-line results, Verizon posted total revenue of $33.8 billion, which was “relatively flat from second-quarter 2021,” according to Verizon. The analysts had modeled $33.7 billion, so Verizon’s actual result was in-line or perhaps even a slight beat.

Not too bad so far. Then why would Verizon stock log its biggest single-day percentage decline since March 12, 2020? Most likely, investors were focused on Verizon’s forward guidance for Fiscal Year 2022. Specifically, the company projected adjusted EBITDA growth of -1.5% to flat, which is down from Verizon’s previous guidance of 2% to 3%.

On top of that, Verizon’s lowered its guidance for adjusted EPS from a previous range of $5.40 to $5.55 to a new range of $5.10 to $5.25. Apparently, Verizon stock traders didn’t like these adjustments. On the other hand, lowered guidance could provide a setup for a positive surprise later on. Thus, contrarians can interpret a low bar as easy for Verizon to clear in future fiscal reports.

Wall Street’s Take on Verizon

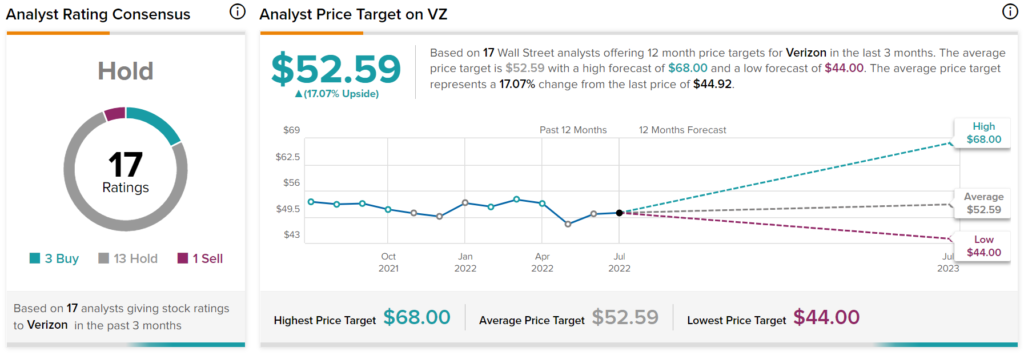

Turning to Wall Street, VZ has a Hold consensus rating based on three Buys, 13 Holds, and one Sell assigned in the past three months. The average Verizon price target is $52.59, implying 17.1% upside potential.

The Market Just Handed You a Terrific Gift

If the stock market gives you an opportunity to buy Verizon stock at a low valuation multiple, that’s truly a gift. Yet, some traders will be afraid to accept that gift.

Just remember what makes Verizon a great company in the telecommunications field. Then, prepare for the market’s low expectations to lead to a potential surprise to the upside – and hopefully, an unexpected rally in Verizon stock.