Eli Lilly (NYSE:LLY) has risen over 65% year-to-date. The significant appreciation in the pharmaceutical company’s stock is attributed to the considerable growth potential associated with its diabetes and obesity products. While its weight loss and diabetes drugs will likely add billions to its sales, its high valuation could restrict the upside potential. Thus, a pullback could provide an opportunity to Buy LLY stock.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

LLY Stock – Valuation Plays Spoilsport

Eli Lilly is poised to deliver solid sales. However, Deutsche Bank analyst James Shin notes that the stock has already factored in the positive developments. Thus, he foresees the potential for upside gains to be restricted by its elevated valuation.

Shin initiated coverage of LLY stock with a Hold rating on November 8. The analyst highlighted that the excitement surrounding its weight loss and diabetes drug has increased its valuation. Shin said Eli Lilly stock is trading at a price-to-earnings multiple of 48 (based on expected Fiscal 2024 earnings), which is near all-time highs and greater than the industry average of 17.76, limiting the upside potential.

With this background, let’s delve deeper.

Weight Loss and Diabetes Drug to Boost Sales

Investors should note that in May 2022, the U.S. FDA (Food and Drug Administration) approved Eli Lilly’s Mounjaro drug for treating type 2 diabetes in adult patients. Since then, the company has benefitted from the strong sales of Mounjaro. Impressively, in Q3, Mounjaro’s revenue crossed $1.4 billion globally, up from $980 million in Q2.

This number could grow substantially as Mounjaro has shown positive results in significantly reducing weight. On November 8, the company announced that the FDA had approved Zepbound injection (Eli Lilly is marketing Mounjaro as Zepbound, its obesity drug), which will boost its sales.

For instance, data analytics and consulting company GlobalData expects Zepbound’s sales to reach $4.1 billion by 2031, steadily inching closer to the projected $8.1 billion sales for Wegovy. Investors should note that Wegovy is the drug for treating obesity developed by Novo Nordisk (NYSE:NVO)(DE:NOVC). As Eli Lilly’s sales are expected to grow, let’s see what the Street recommends for LLY stock.

What is the Future of Eli Lilly Stock?

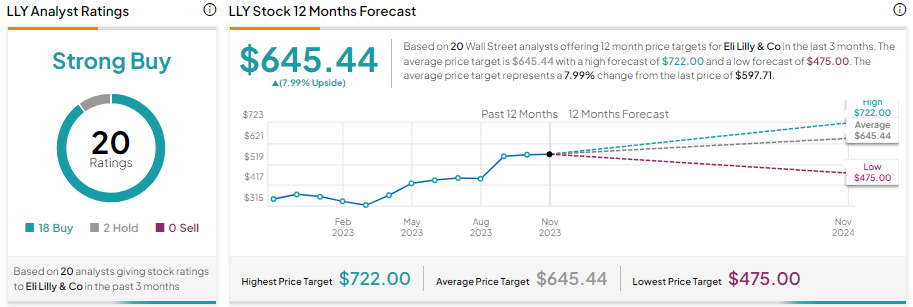

While Shin maintains a Hold and expects valuation could limit the upside potential of LLY stock in the near term, the overall Wall Street analysts’ consensus estimate remains bullish. With 18 Buy and two Hold recommendations, Eli Lilly stock has a Strong Buy consensus rating.

The average LLY stock price target of $645.44 implies 7.99% upside potential from current levels.

Bottom Line

The pharmaceutical giant will likely generate robust sales and benefit from the massive growth opportunity stemming from its diabetes and obesity products. However, due to the recent growth in its price, the stock’s valuation appears full, thus limiting the upside potential as reflected through the analysts’ average price target.