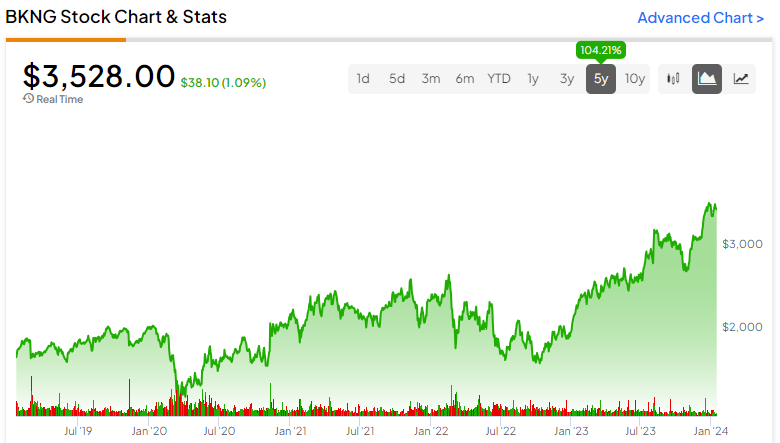

Shares of Booking Holdings (NASDAQ:BKNG) have rallied by about 218% from their COVID lows. The online travel and restaurant reservations giant saw its stock dip as low as $1,107 in March 2020, when investors were selling off most equities, especially travel-related ones. However, with the travel industry rebounding strongly and hotels starting to be favored by travelers relative to Airbnbs (NASDAQ:ABNB), Booking stock has skyrocketed above $3,500 lately. Nevertheless, I remain bullish on BKNG stock.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Tourism Industry Rebounds to Pre-Pandemic Levels

Investor optimism in Booking Holdings is driven by a pivotal factor—the resounding resurgence of the tourism industry post-pandemic. Illuminated by the insights from the International Monetary Fund’s 2023 World Economic Report, global tourism has rebounded to pre-pandemic levels, signaling a remarkable recovery.

Booking Holdings, with its portfolio of leading reservation platforms including Booking.com, KAYAK, Priceline, Agoda, and OpenTable, strategically capitalizes on the entire spectrum of the tourist/traveler experience, spanning accommodations, dining, car rentals, and beyond.

While the initial excitement of “revenge travel” has tempered due to the gradual escalation of prices, which has somewhat softened consumer enthusiasm for spontaneous trips, the travel industry is poised for an impressive 16% increase in 2024, according to Euromonitor.

You can see the whole development of industry dynamics in Booking’s past revenues, as well as its expected revenues for this year and next year. Here are Booking Holdings’ revenues per year:

- 2018: $14.53 billion

- 2019: $15.09 billion

- 2020: $6.80 billion (pandemic impact)

- 2021: $10.96 billion

- 2022: $17.09 billion

- LTM (Last 12 months/Q4 2022 to Q3 2023): $20.63 billion

- 2023: $21.36 billion (expected)

- 2024: $23.62 billion (expected)

Hotels & Resorts Recapturing Ground Over Airbnb Stays

The second catalyst driving the surge in Booking stock stems from a forming trend wherein hotels and resorts are reclaiming market share from Airbnb accommodations. On the one hand, concrete evidence may be challenging to establish, as both Airbnb and Booking Holdings have been posting robust revenue growth in recent quarters due to the travel industry’s resurgence. On the other hand, a blend of anecdotal accounts and research findings suggests that hotels are gaining the upper hand.

Notably, a global survey commissioned by Hyatt (NYSE:H) and conducted by OnePoll revealed that almost two-thirds of family travelers prefer hotels or resorts over home rentals. This inclination aligns with the evolving dynamics of the Airbnb ecosystem, marked by escalating prices and the imposition of additional fees such as cleaning charges and service fees.

In response to this changing tide, hotels have strategically adapted, leveraging enticing discounts that have played a pivotal role in their recent success. The dynamic interplay of transparent pricing, a renewed emphasis on cleanliness, and irresistible discounts have effectively positioned hotels as a preferred choice. Travelers, increasingly valuing the convenience and predictability hotels offer, are steering towards their attractive benefits.

Booking’s Profits Set to Soar; Shares Remain Attractive

Supported by the current resurgence in the travel industry and a notable shift in consumer preferences favoring hotels, Booking’s profits are poised to surge. Thus, despite an already impressive rally in shares, I believe that Booking’s investment case remains attractive. But first, some context is needed.

First and foremost, Booking employs an exceptionally capital-light business model. The company doesn’t own the hotels, restaurants, or car fleets featured on their platforms. Instead, it seamlessly collects commissions upon booking, resulting in a business model with remarkably high margins. Notably, the company’s EBITDA margin for the past four quarters stands at 33.1%, rebounding in line with increased revenues as underlying unit economics have strengthened.

Furthermore, it’s worth highlighting that the company’s revenue per employee has experienced a significant surge after Booking’s strategic workforce adjustments during the pandemic. Specifically, Booking achieved revenues per employee of $795.2K in Fiscal 2022, surpassing the pre-pandemic figure of $570.7K in Fiscal 2019 by a wide margin. That’s because the company’s workforce shrank from 26,400 to 21,400 people.

Looking ahead, the combination of escalating revenues and improving margins is anticipated to propel the company’s EPS to a record-breaking $150.55 for Fiscal 2023. This translates to a price-to-earnings (P/E) ratio of 23.2 at the stock’s current price levels—an appealing multiple considering the strong EPS growth outlook over the medium term.

Specifically, analysts foresee Booking’s EPS growing by an average of 19.2% per annum over the next five years, hinting that Booking is well-positioned to effortlessly grow into its current valuation.

Is BKNG Stock a Buy, According to Analysts?

Turning to Wall Street, Booking Holdings has a Moderate Buy consensus rating based on 17 Buys and six Holds assigned in the past three months. At $3,726.81, the average Booking Holdings stock forecast suggests 6.2% upside potential over the next 12 months.

If you’re wondering which analyst you should follow if you want to buy and sell BKNG stock, the most accurate analyst covering the stock (on a one-year timeframe) is Doug Anmuth of JPMorgan (NYSE:JPM), with an average return of 29.21% per rating and a 95% success rate. Click on the image below to learn more.

The Takeaway

Overall, Booking Holdings’ powerful rally from its pandemic lows reflects the resounding rebound of the tourism industry and, potentially, the strategic positioning of hotels over Airbnb stays. The company’s impressive revenue growth and capital-light business model are set to drive record earnings this year, with the travel industry expected to continue its flourishing trajectory in the years to come.

With a compelling P/E ratio and a promising EPS growth outlook, Booking’s investment case remains attractive. Accordingly, I hold a bullish stance on the stock.