KeyCorp (KEY) stock is up 14% over just the past month, but there could still be more upside ahead for shares of the major regional bank. KeyCorp’s recent performance may seem like that of a hot tech stock, but it’s an important reminder that there are plenty of investment opportunities in other less exciting but more stable sectors/industries of the market, like financials and banking.

At a time when higher-multiple and more speculative tech and growth stocks are facing more pointed questions about their valuations and future growth prospects, defensive stocks like KeyCorp are seeing renewed interest from investors. With much less demanding valuations and ample dividend yields, these stocks are becoming more attractive. KeyCorp’s strong results over the past month show why they deserve an allocation within investor portfolios as well.

I’m bullish on KeyCorp based on its renewed momentum, cheap valuation, and attractive 5.0% dividend yield, which all make it a sensible play in an uncertain market environment.

What Is KeyCorp?

KeyCorp is a major regional bank with $57.6 billion in assets under management and roughly 1,000 full-service branches (as well as 40,000 ATMs) dispersed across 16 states, with a large concentration in Ohio (where it is based) and throughout the Midwest. It’s also in New York State, New England, and the Pacific Northwest.

Commonly referred to as KeyBank, the company offers both consumer and commercial banking services, as well as wealth management and investment banking, giving it a fairly diversified business model. This is especially true compared to the typical regional bank.

Recent Performance

Stocks like KeyCorp were in the doghouse in 2023 after the regional banking crisis, but a year later, these stocks are in much better shape.

KeyCorp recently reported second-quarter earnings, and there was a lot to like. The company reported 5% year-over-year deposit growth, as well as a 3% year-over-year increase in non-interest income, thanks to increased momentum in business segments like Wealth Management, Payments, and Commercial Mortgage Servicing. Encouragingly, the company also reported that its investment banking pipeline has continued to pick up steam.

These positive results in non-interest income segments are encouraging, but many seasoned investors know that net interest income (NII) is crucial when evaluating bank stocks because it is one of the primary ways most banks make money. NII is the difference between what a bank earns from its loans and the money it pays depositors for their savings.

While KeyCorp’s NII fell 8.8% year over year, it grew by 1.5% sequentially from the previous quarter, showing that, as other banks have reported, things are turning around in this important area after bottoming out. CEO Christopher M. Gorman stated that he believes the first quarter will be a “cycle low” for NII during KeyBanc’s second-quarter earnings call.

Similarly, earnings per share fell 7.5% year-over-year but showed strong growth of 25.0% from the previous quarter.

Shares of KeyCorp are Still Cheap

Even after its strong run-up over the past month, KEY stock is still attractively valued. Shares trade at just 14.8 times 2024 consensus earnings estimates, a substantial discount to the S&P 500 (SPX), which trades at 23.6 times earnings.

But looking further out, KeyCorp looks even cheaper. Shares trade at just 10.3 times consensus 2025 earnings estimates, making the stock a tempting bargain for value investors.

Substantial Dividend

In addition to this undemanding valuation, KeyCorp boosts its appeal as an investment opportunity with an enticing 5.06% dividend yield. This yield blows away the relatively meager 1.4% yield of the S&P 500. Not only that, but it also soundly beats the 4.15% yield offered by 10-year treasuries.

In addition to this attractive yield, KeyCorp is also an appealing dividend stock thanks to its rock-solid consistency. The Cleveland-based company has paid out dividends to its investors for 29 consecutive years, and it has increased the size of its payout for the past 13 years in a row and counting, making it the type of dividend stock investors can count on.

Is KeyCorp Stock a Buy, According to Analysts?

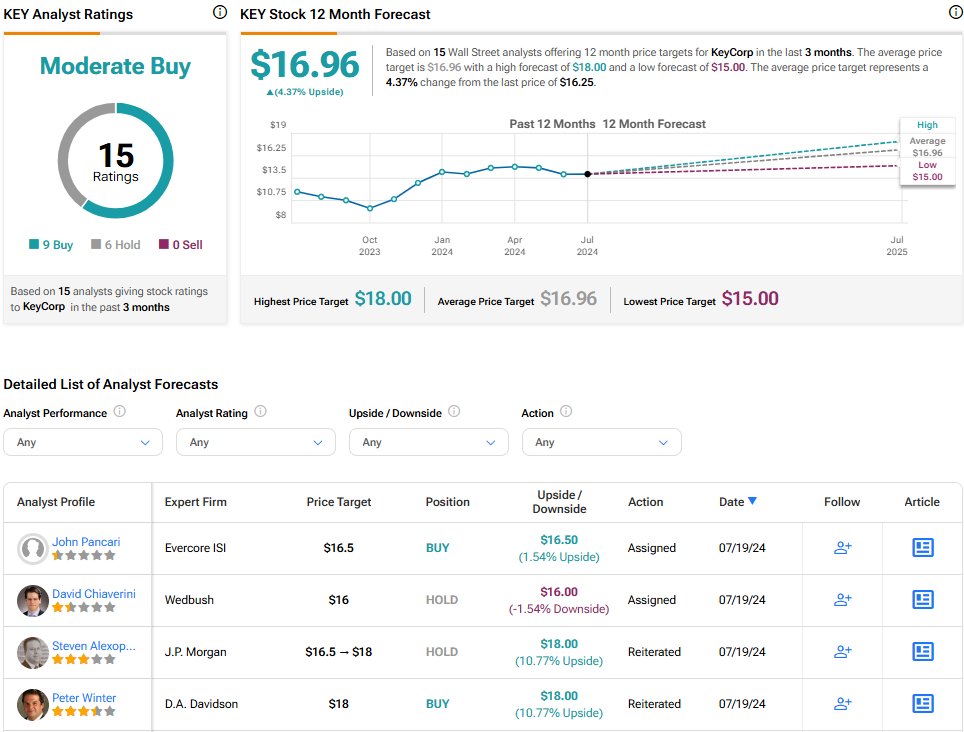

Turning to Wall Street, KEY earns a Moderate Buy consensus rating based on nine Buys, six Holds, and zero Sell ratings assigned in the past three months. The average KEY stock price target of $16.96 implies 4.4% upside potential from current levels.

A Perfect 10

KeyCorp is also highly rated by TipRanks’ proprietary Smart Score stock-rating system. In fact, the stock earns an illustrious 10 out of 10 Smart Score. The Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from one to 10, based on eight key market factors. Scores of 8, 9, or 10 are considered equivalent to an Outperform rating. The score is data-driven and does not involve any human intervention.

Investor Takeaway

I’m bullish on shares of KeyCorp based on its recent momentum, undemanding valuation, and attractive 5.06% dividend yield, as well as the consistency with which it has paid and increased its dividend payout over time. As a choppy market oscillates between tech stocks and more value-oriented stocks, these factors all make KeyCorp an appealing place to allocate some funds.