Earnings season is just kicking off, and a strong showing from UnitedHealth (NYSE:UNH) is just what anxious investors wanted to see during this time of recession worries and persistent inflation for consumers. After sifting through UnitedHealth’s quarterly results and full-year guidance, I am bullish on UNH stock and expect it to continue providing excellent returns.

Headquartered in Minnesota, UnitedHealth is a giant among U.S. healthcare businesses. The company covers patients through its UnitedHealthcare and Optum healthcare plans.

As we’ll discover, analysts are overwhelmingly optimistic about UnitedHealth’s future prospects. Hence, though UNH stock already moved higher in recent months, there’s still room for growth and share-price appreciation.

Potential UnitedHealth Deal Faces Scrutiny on Capitol Hill

Even before UnitedHealth released its latest round of quarterly results, there was already a lot going on with the company. For example, U.S. Senator Elizabeth Warren and Representative Pramila Jayapal have asked regulators to look into UnitedHealth Group’s planned $3.3 billion purchase of healthcare company Amedisys (NASDAQ:AMED).

Reportedly, Warren and Jayapal raised antitrust concerns to the U.S. Department of Justice, claiming that acquisitions like the proposed UnitedHealth-Amedisys buyout could “reduce competition and pad their profits at the expense of their patients.” This is an ongoing story, so stay tuned for further developments.

Personally, I wouldn’t sell UNH stock just because there may be some regulatory pushback to the UnitedHealth-Amedisys deal. There’s just too much else happening with UnitedHealth to worry about that. For instance, Jefferies analysts recently raised their price target on UnitedHealth shares from $529 to $531. However, I suspect that the Jefferies analysts will have to raise their price target again soon, as the stock has already surpassed $531.

Furthermore, UnitedHealth plans to do something that would benefit many patients. Specifically, the company intends to make GLP-1 drugs more affordable. These drugs are used to treat diabetes and promote weight loss. According to Patrick Conway, head of UnitedHealth’s pharmacy benefit management unit, the company’s OptumRx prescription drug plan segment “will continue to negotiate lower prices through discounts over time” for GLP-1 drugs.

UnitedHealth’s Remedy: An Earnings Beat and Guidance Raise

I commend UnitedHealth for considering making diabetes drugs more affordable. However, what investors really want to see is UnitedHealth’s financial stats. On that topic, UnitedHealth published a fresh round of data points today for 2023’s third quarter.

If anything would convince me that UNH still has room to run, it’s UnitedHealth’s Q3 results. Impressively, UnitedHealth’s revenue grew by 14.2% year-over-year to $92.36 billion and surpassed analysts’ consensus estimate by $950 million. Moreover, the company delivered adjusted EPS of $6.56, beating the Street’s call for earnings of $6.33 per share.

Plus, as doctors would say, the prognosis looks good. UnitedHealth raised its guidance for the company’s Fiscal Year 2023 adjusted net earnings from the previous estimate of $24.70-$25 per share to a new range of $24.85-$25 per share. This upward-revised full-year earnings guidance comes in higher than the analysts’ consensus estimate of $24.83 per share.

UnitedHealth CEO Andrew Witty gave credit to his “colleagues’ steadfast focus on helping people access and receive the care they need,” but I suspect that the company’s success has broader implications than this. If UnitedHealth can deliver a beat-and-raise like this, I’m optimistic that the U.S. healthcare sector is probably thriving because healthcare is a necessity even when inflation hits consumers’ pocketbooks.

Is UNH Stock a Buy, According to Analysts?

On TipRanks, UNH comes in as a Strong Buy based on 17 Buys and three Hold ratings assigned by analysts in the past three months. The average UnitedHealth price target is $573.28, implying 6.3% upside potential.

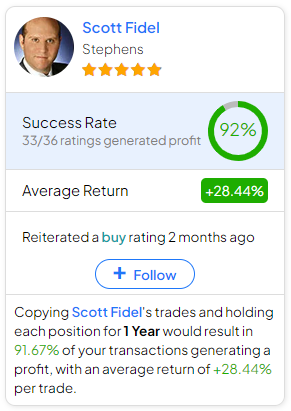

If you’re wondering which analyst you should follow if you want to buy and sell UNH stock, the most profitable analyst covering the stock (on a one-year timeframe) is Scott Fidel of Stephens, with an average return of 28.44% per rating and a 92% success rate. Click on the image below to learn more.

Conclusion: Should You Consider UNH Stock?

Clearly, the majority of analysts are confident about UnitedHealth’s ability to deliver good results in the coming quarters. Investors are also hopeful, evidently, as UnitedHealth shares are firmly in the green today.

So, I’m not losing sleep over possible congressional pushback to the UnitedHealth-Amedisys deal. Instead, I’m focusing on UnitedHealth’s excellent quarterly results and positive forward outlook, and I believe UNH stock is a good buy-and-hold investment to consider now.