An investment in health insurance company UnitedHealth Group (UNH) during uncertain times is likely a smart idea because its business is inelastic. It can outperform many companies, even during periods of recession or inflation.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The multinational managed healthcare and insurance company has consistently rewarded its investors. It has high rates of income and dividend growth. In an environment where everyone is looking for the next safe investment, UNH stock is one to consider. I am bullish on the stock.

UnitedHealth offers health & medical services globally. It has been around since 1977. In addition to insurance services, it also provides healthcare products.

UNH is a growth stock, and it’s not trading at a significant premium to other stocks with less growth potential. To remain ahead of the curve in its increasingly competitive industry, it wants to pursue new acquisitions & investments.

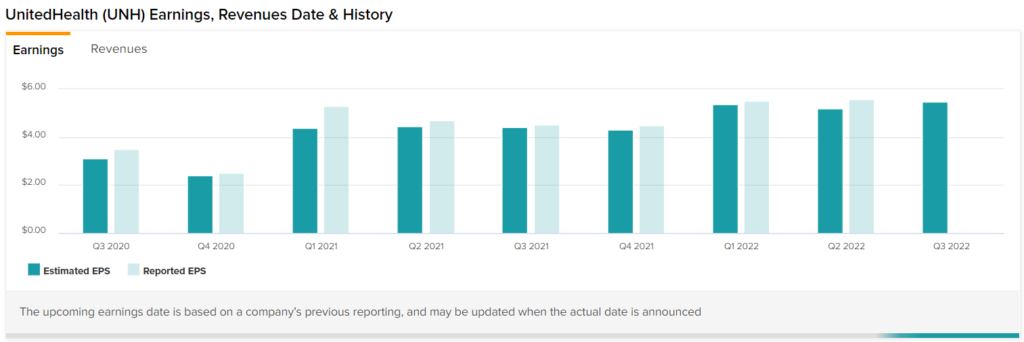

Its latest earnings report gives people plenty of reasons to consider investing in this stock. UNH saw balanced growth in the second quarter as its businesses continued to expand. The most significant movements came from UnitedHealthcare’s strong expansion and Optum Health’s focus on value-based arrangements.

UNH’s Recent Earnings Report Highlighted Several Strengths

UnitedHealth saw revenue growth of 13%, going from $71.3 billion to $80.3 billion year-over-year. Earnings from operations came in at $7.1 billion, representing 19% year-over-year growth.

UNH announced that its second-quarter earnings exceeded $5 billion, compared to $4.27 billion in the second quarter of 2021. Its diverse portfolio of health insurance plans and Optum medical care services helped it outperform its competition.

UnitedHealthcare treated 280,000 more people than the previous year, and the number of patients served has grown considerably in the past few years.

UnitedHealthcare saw a 12% increase in revenue from member expansion, rising from $55.5 billion to $62.1 billion. For the health insurer, Optum, revenue per patient increased 30% over the same period. It experienced growth in value-based care arrangements and continued growth in its services offered that year.

Optum reported double-digit growth in Q2 due to an increasing customer base and the expansion of its pharmacy care services, including specialty and community pharmacies. In the second quarter, Optum earned $45.1 billion in revenue and experienced a year-over-year growth rate of 18%.

The company is excited about the growth it expects for this year. Its first-half performance has allowed it to bump up its EPS estimates, which should translate into higher adjusted EPS. The respective ranges for full-year and adjusted net earnings are $20.45 to $20.95 per share and $21.40 to $21.90 per share.

What UNH is Doing to Expand

UNH has prioritized growth in the past three years. It is focused on acquisitions, which has helped it expand its business and reach new people worldwide.

UnitedHealth Group recently snapped up a privately-held Florida mental health and substance abuse treatment company Refresh, for undisclosed financial terms. Advanced health services also put UnitedHealthcare in a unique position to manage its clientele.

By operating a network of 300 outpatient mental health, substance abuse, and eating disorder centers, the company ensures that healthcare is accessible for anyone who needs it.

In June, UNH’s affiliate acquired EMIS Group plc (EMIS), a UK-based health technology company, in an all-cash deal valued at around $1.51 billion. UnitedHealth acquired Optum to offer healthcare services in the UK. Not only will this deepen an already strong presence, but it also aligns with the country’s healthcare system.

Optum will continue to grow this year, thanks to its acquisitions, cutting-edge technology, and approachable care. Each individual segment is expected to help drive the overall segment’s growth with solid performance.

Optum launched a lab benefit management solution that helps health plans reduce unnecessary lab testing. The company expects the new product to bring about $12 to $36 savings per member or over $3 billion in annual savings for the company.

Despite a difficult past few years, UnitedHealth is one of the few healthcare companies with a thriving global business. Its core markets are recovering, and memberships are increasing. However, its continuous growth is attributable to an aggressive expansionist approach, which should continue to pay back investors for several years.

UnitedHealth: A Top Dividend-Growth Stock

UnitedHealth began in 1974 and is one of the largest health insurance providers. Now, its products & services help tens of millions of people access healthcare on a global scale.

Not only does it have a big scale & customers with high switching costs, but it is also well entrenched in its industry. For the healthcare company, this makes a dividend hike much easier. It also creates a significant competitive advantage against other companies that don’t offer these benefits.

Most recently, the managed healthcare company increased its dividend by 13.8%. The quarterly cash payout from $1.45 to $1.65 per share is the increase that was announced in June, reaffirming its status as a top dividend stock.

As mentioned, UnitedHealth’s dividend appears ultra-safe today & it makes up less than one-third of UNH’s earnings. The company has tremendous flexibility when it comes to returning capital to shareholders since its outstanding earnings are so high.

Wall Street’s Take on UNH Stock

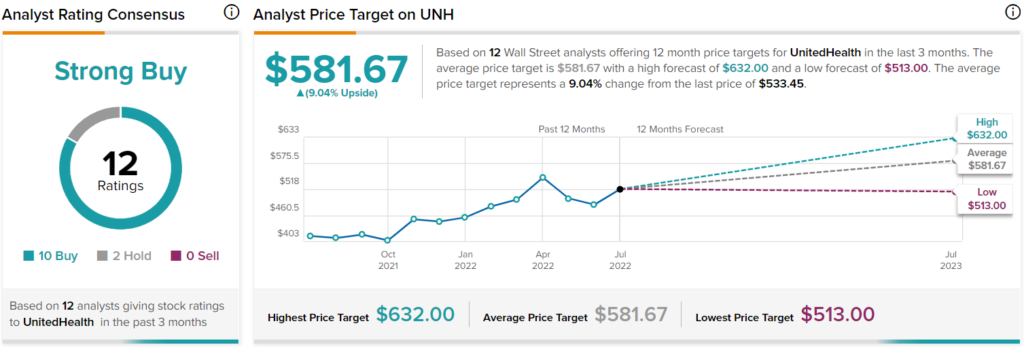

The sentiment surrounding UnitedHealth is bullish. UNH has a Strong Buy consensus rating based on 10 Buys and two Holds. The average UNH price target is $581.67, implying 9% upside potential.

UnitedHealth: One of the Safest Picks for a Volatile Market

The market is volatile. Hence, investors are looking for safe investments. The market’s volatility makes it difficult to find a long-term investment that will provide a stable return.

UnitedHealth is a well-established company that has been around for years. It has great financials and plenty of experience delivering sustainable returns, allowing you to invest with relatively less stress.