Investors have been cautious lately, but there are opportunities in the big three sectors of tech, healthcare, and industrials. Investors are aware of many negative factors in the market today: high inflation, uncertain market performance, and Russia’s invasion of Ukraine. Many factors may have been important – but so far, these are the main reasons that have led to 2022 being a year of uncertainty for investors.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

As I see it, there are opportunities, but they are not as evident to most investors as they would like. One of the hidden gems in the current market must be UnitedHealth (UNH).

It is a health insurance company that offers millions of Americans a wide range of plans. The company provides individual and family plans and even Medicare Advantage and Medicare Supplements.

UnitedHealth is partnered with over 1.3 million healthcare providers and supplies healthcare products to over 100 million customers through two divisions: UnitedHealthcare and Optum.

UnitedHealth Group has grown its revenue, share price, and dividend over the past five years. Investors should note these strengths. During market volatility, this stock may be one of the best options for your portfolio. I am bullish on UNH stock.

UnitedHealth Entering a Very Good Year

The nuanced health insurance realm is complex and always evolving. That’s a particularly relevant factor in this context, as the coronavirus pandemic has made major concerns about the U.S. system. Fundamentals remain a primary driver of UNH stock performance, though.

An aging population, technological advancements, and the increased presence of disease will all fuel this market growth. UnitedHealth has a lot of potential for growth in the healthcare insurance market. It is assured of long-term success because the local health insurance market is projected to grow at around 9.7% through 2028. That will likely help the company grow even more and create many new innovative products that keep the customer base going.

Optum expects 600,000 new patients this year. Per-consumer revenue grew 30% in 2021. Utilizing the success of Optum, UnitedHealth has seen major growth this year. It responded to the competition in the Medicare Advantage market by adding 800,000 new members.

Programs that charge patients based on the success of their treatment instead of services rendered are becoming commonplace for insurance companies as evidence shows they are more profitable. That being said, it does help with patient retention. The company expects to have continued double-digit revenue growth with $317 billion and $320 billion in total revenue for this year.

UnitedHealth has had to adapt to the changing world of healthcare and respond to all of COVID-19’s challenges, from outbreaks like the measles virus to the worry that hospitals might refuse reimbursement. As long as they continue their unique efforts, it’s reassuring to know there are investors out there waiting to invest in UnitedHealth.

The Dividend is Secure

The payout ratio of UnitedHealth’s dividend is increasing because the amount of revenue that the company has generated is growing. Approximately one-third of its earnings are going back to shareholders, which provides them with room for growth in the future.

UnitedHealth is not new to healthcare; it’s a giant in the industry known for its deeply entrenched employees within their customers’ lives. Along with scale, they have a competitive edge over other companies. It’s easy to get caught up in how they make money, but like utilities, their job is mostly about customer retention.

UnitedHealth is considered a premier value stock that may now be trading below its fair value after pulling back. It attracts investors seeking to invest in companies with strong growth forecasts. Recent dividend growth makes it more attractive, as well.

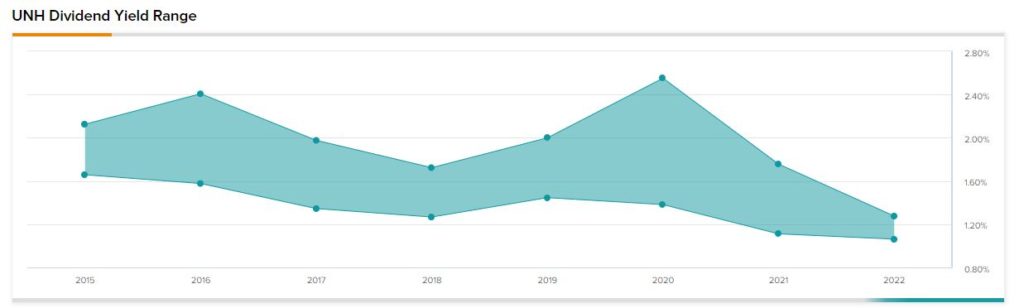

Despite UnitedHealth’s rapid dividend growth in recent years, its returns don’t keep pace with its share price increases. The current yield is just under 1.2%.

UnitedHealth has been paying a quarterly dividend for a few years now. This is rare among companies nowadays; the value of dividends has increased drastically compared to 10 years ago. UnitedHealth’s dividend stands at $1.45. Its dividend has grown by a 24% CAGR in the last decade. Investor expectations don’t need to be high as this. However, this is a clear sign of the company’s commitment to increasing its payouts and creating value for its shareholders.

Wall Street’s Take

UnitedHealth continues to be admired on Wall Street. The stock has a Strong Buy consensus rating based on 15 Buys and three Holds. The average UnitedHealth price target is $590.35, which implies 19.9% upside potential.

The Bottom Line on UnitedHealth Stock

UnitedHealth remains a strong healthcare dividend stock. It makes up for its volatility by paying out generous dividends, which are expected to rise in the future. These dividends allow you to reinvest this income back into your portfolio, allowing you to grow your savings and diversify further.

More good news: The stock is trading 11% off its highs. Plus, there’s almost no doubt that the company will be able to boost earnings in the future. It is benefiting from secular tailwinds in healthcare. UnitedHealth Group’s stock is a promising buy because it has a value that will remain consistent and solid in the long term, which provides peace of mind for investors.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure