As the market rally enters a more advanced stage, many investors may be at risk of assuming we’ll be in for an economic “soft landing” just because of the latest cooler-than-expected inflation report and the prospect of 2024 rate cuts. In many ways, 2024 could be a good year, but investors ought to always be prepared for a broader range of scenarios (including a hard landing) with more defensively-focused firms like healthcare stocks (UNH, BIIB, and HUM will be covered in this piece).

Therefore, let’s use TipRanks’ Comparison Tool to see how a trio of highly-rated healthcare stocks stack up if that “Goldilocks” market environment (falling rates, soaring earnings) just isn’t in the cards for 2024.

UnitedHealth Group (NYSE:UNH)

UnitedHealth Group is a stellar long-term performer that’s seen momentum stall in recent years. Over the past year and three quarters, UNH stock has stayed well below its long-term ceiling of resistance of around $555. Even after the latest surge on the back of an upbeat annual Investor Day and quarterly earnings beat (Q3 adjusted earnings per share of $6.56 vs. $6.33 estimate on $92.4 billion revenue), that resistance level still seems like a high hurdle that’ll be tough to pass. In any case, I’m a fan of the firm’s continued focus on value-based care and am inclined to stay bullish alongside the analyst community.

The stock goes for 23.9 times trailing price-to-earnings, a premium to the healthcare plan industry average of 19.4 times. That’s a well-deserved premium, given that its medical loss ratio (MLR) — a performance metric (lower is better) used to gauge managed health providers — has been on the right track of late, hitting 82.3% in the latest quarter, topping estimates by an impressive 50 bps.

Additionally, the firm has a habit of raising the bar, recently hiking the low end of full-year adjusted net earnings by a slight margin.

Further, as weight-loss (GLP-1) drugs become more widespread, I’d look for UnitedHealth’s MLR to fall even further from here. Pending negative, unforeseen health consequences of such drugs, I do view their rise to glory as a potential long-term positive for the firm. Lower obesity rates could spell a lower chance of health consequences, and coverage for GLP-1 drugs is sure to be viewed in a positive light by customers.

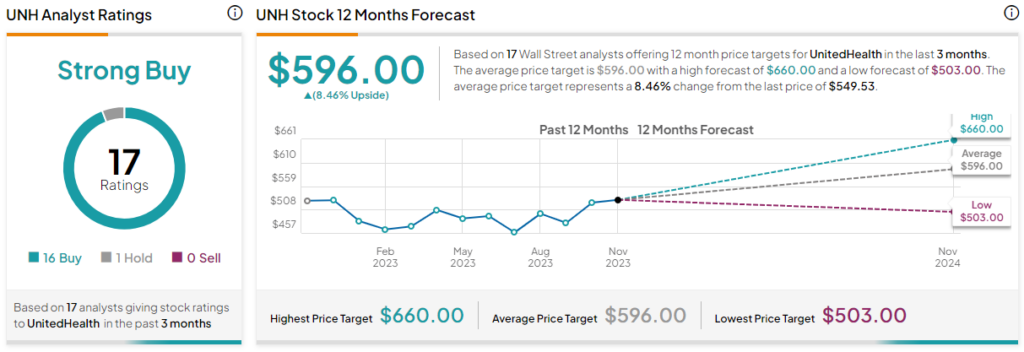

What is the Price Target for UNH Stock?

UnitedHealth is a Strong Buy, according to analysts, with 16 Buys and one Hold assigned in the past three months. The average UNH stock price target of $596.00 implies 8.46% upside potential.

Humana (NYSE:HUM)

Humana is another health insurance play that’s seen longer-term momentum stall out in recent years. The company has been in rally mode since mid-summer, led higher by promising quarterly earnings reports. At a slight discount to UnitedHealth, Humana certainly seems like a more value-rich way to play the managed care space and the potential tailwind sparked by GLP-1 drugs.

Of late, the big headline has revolved around a potential merger with fellow health insurer Cigna (NYSE:CI) in what would be a sure blockbuster. Reportedly, there are talks of a stock-and-cash deal that could be inked by year’s end. Specifics to the deal are hazy right now, but the chatter has managed to pummel shares of Humana and Cigna just over a week ago. Further, any such merger could be struck down by anti-trust regulators.

I view the negative reaction as overblown and a potential opportunity for value-conscious contrarians. Deal or no deal, I can’t help but be bullish on Humana as it continues to navigate through profound macro uncertainties.

At 20.7 times trailing price-to-earnings, HUM is still trading at a premium to the healthcare plan industry average of 19.4 times. That said, I view the narrow premium as justified, given the potential synergies to be had if Humana were to tie up with Cigna.

What is the Price Target for HUM Stock?

Humana stock is a Strong Buy, according to analysts, based on 11 Buys and three Holds assigned in the past three months. The average HUM stock price target of $585.57 entails 21.04% upside potential.

Biogen (NASDAQ:BIIB)

Biogen is a biotech company that Warren Buffett’s Berkshire Hathaway (NYSE:BRK.B) briefly invested in several years ago. Recently, Biogen stock has been a major dud, sinking over 28% in the past five years. Biogen may be perceived as a value trap to some, but I think there’s real value to be had for patient investors. As such, I’m staying bullish on the stock as it looks to gain some sort of meaningful traction on the back of its latest acquisition.

The company has a solid portfolio of treatments for neurological conditions like Alzheimer’s. The purchase of Reata Pharmaceuticals, which bolstered Biogen’s rare disease portfolio, helped propel the firm to its first quarter of sales growth in three years.

Biogen’s managers believe they’re in a spot to sustain long-term growth. However, it doesn’t seem like investors are buying what they’re selling. The stock is in a major funk right now, and that alone is enough to stay in more of a “wait-and-see” mode. At 2.33 times price-to-book (P/B), below the 4.89 times of the biotech industry average, Biogen stock sure does look deeply discounted. However, until the firm can prove it can keep the growth going strong, don’t expect shares to reverse course in the near term.

Nonetheless, the analyst community continues to praise the name. And it’s hard not to, given the potential upside as the firm aims to turn the growth tides. Though untimely, I think there’s a lot of gain by giving management the benefit of the doubt in its much-awaited return to growth.

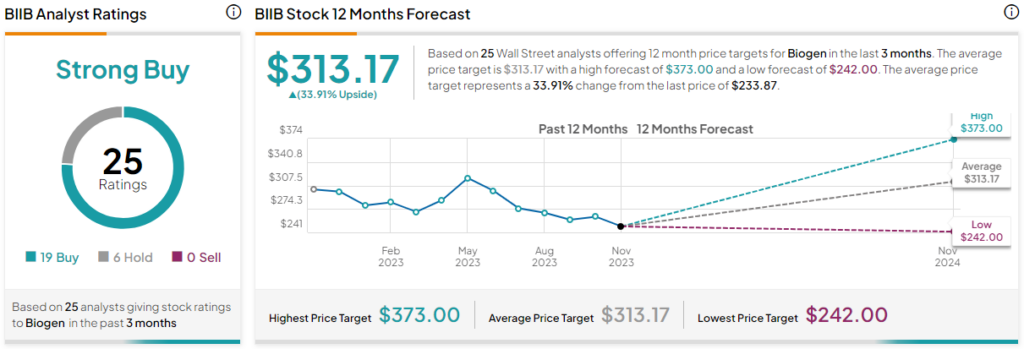

What is the Price Target for BIIB Stock?

Biogen sits at a Strong Buy on TipRanks based on 19 Buys and six Holds assigned by analysts in the past three months. The average BIIB stock price target of $313.17 implies 33.9% upside potential.

The Takeaway

Healthcare stocks can be a great place to profit from defensive growth. Should 2024 not live up to the hopeful expectations of investors, the following trio of stocks may be worth a look. Of the trio, analysts see the most upside from BIIB (a whopping ~34%).