Investors seeking to boost their portfolio returns might find it beneficial to take advice from experts, such as hedge fund managers. TipRanks accumulates data from Form 13-Fs released by about 483 hedge funds to show which stocks they are buying and selling. Furthermore, the TipRanks Hedge Fund Confidence Signal indicates how bullish hedge fund managers are about a stock.

Thus, using the TipRanks Stock Screener tool, we have focused on two healthcare stocks: CVS Health (CVS) and UnitedHealth (UNH). Both stocks carry a “Strong Buy” rating and were bought by hedge funds in the last quarter.

Let’s take a closer look.

CVS Health

CVS Health owns a retail pharmacy chain and operates as a pharmacy benefits manager and health insurance provider. The company’s recent acquisitions of Signify Health and Oak Street Health helped expand its service portfolio and geographic footprint. Furthermore, its prudent cost control measures and capital allocation strategies support future growth prospects.

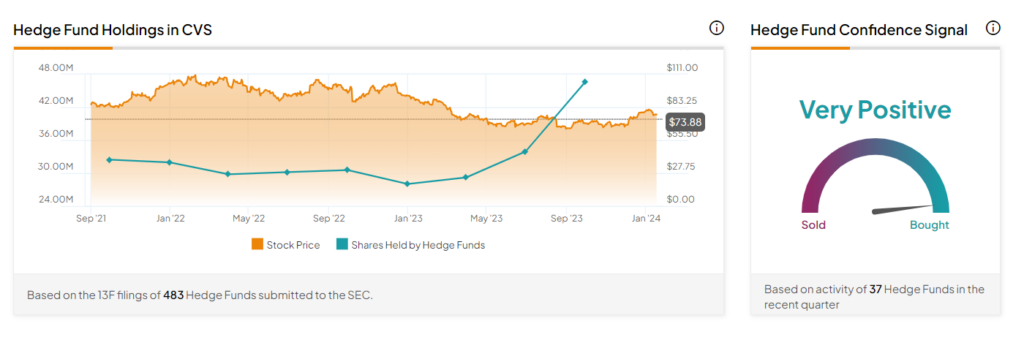

Importantly, CVS stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. Per the tool, hedge funds bought 12.7 million shares of this healthcare giant last quarter. According to the tool, popular hedge fund managers, including Fisher Asset Management’s Ken Fisher and Bridgewater Associates’ Ray Dalio, increased their positions in the stock.

Is CVS a Good Stock to Buy Now?

Wall Street is bullish about CVS stock. It has received 14 Buy and four Hold recommendations, translating into a Strong Buy consensus rating. Meanwhile, analysts’ average price target of $90.53 implies 22.5% upside potential. Shares of the company declined 13.4% in the past year.

On a positive note, the stock has a Smart Score of “Perfect 10” on TipRanks. Note that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

UnitedHealth

UnitedHealth offers healthcare products and insurance services. The company’s strong cash position keeps UNH well poised to expand through strategic acquisitions in the long term. Further, expanding the customer base, leveraging AI, and optimizing resources are part of the company’s growth strategy.

Interestingly, the stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. The tool shows that hedge funds bought 641,200 shares of this healthcare company in the last quarter. Our data shows that Bill & Melinda Gates Foundation Trust’s Bill Gates and Echo Street Capital Management’s Greg Poole were among the hedge fund managers who increased their exposure to UNH stock.

What is the Future of UNH Stock?

Following the release of upbeat Q4 results last week, eight analysts reiterated a Buy rating on the stock. Among these, Wells Fargo analyst Steve Baxter is optimistic about the performance of CVS’ OptumHealth and OptumRx segments.

UNH stock has received 15 Buy, one Hold, and one Sell recommendations for a Strong Buy consensus rating. The average UnitedHealth stock price target of $593.13 implies 14.9% upside potential from the current level. Shares of the company have gained 8.2% in the past year.

Ending Note

The volatile stock market scenario makes it prudent to invest in defensive investment options, such as healthcare stocks. In addition to this, investors can consider looking at the opinions of hedge fund managers, who are known for beating the average market returns.

Find out which stock the biggest hedge fund managers are buying right now.