Shares of ride-hailing and food delivery kingpin Uber (NASDAQ:UBER) have been surging lately, up 140% YTD. The company has delivered (pardon the pun) on its promise to drive margins higher, and the proof, as they say, is in the pudding in the form of a higher share price. As self-driving continues to improve and roll out to new localities, Uber’s margins could rise further as drivers begin to be taken out of the equation over the next several years. It’s hard not to be bullish on the company after walking the walk.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

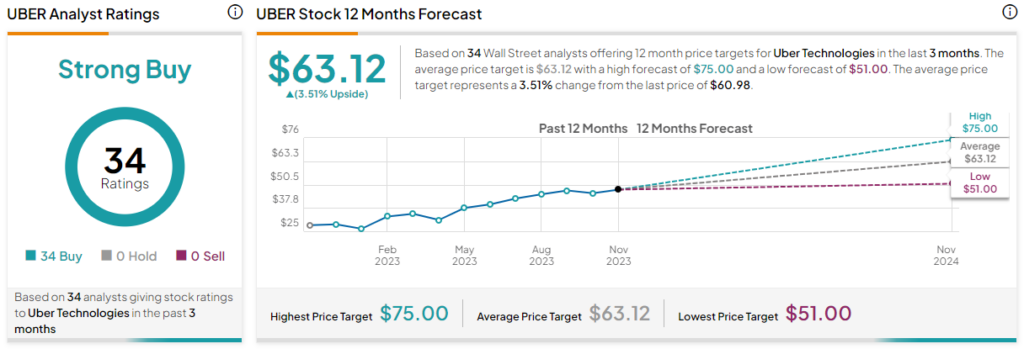

As you may know, UBER stock has been one of the most heavily favored by Wall Street analysts for more than a year now. Honestly, I don’t remember the last time I saw UBER stock without a “Strong Buy” rating or 100% Buy ratings from analysts covering the name.

When it comes to Uber, analysts have been right on the money. As it stands today, they’re still incredibly upbeat, with all analysts sticking with their Buy ratings (more on this later) despite the past year’s euphoric surge.

Uber: Well-Positioned for the Age of Autonomy and AI

Uber is an underestimated tech titan that has the network effects, data, and management to keep its run going strong into the new year. Although the firm received a bit of flack for its use of generative AI for images on its Uber Eats platform (some of them didn’t seem all too appetizing), I think Uber is on the right track when it comes to AI. Looking ahead, Uber is poised to roll out a new AI assistant to help its Uber Eats customers find better deals and better-tailored options.

Further, the biggest AI innovation to hit the roads (self-driving vehicles) could be the boon that takes the ride-hailing giant to even higher highs over the coming years. From ride-hailing to food delivery and even freight delivery, Uber has a lot to gain as it enters the self-driving age.

Depending on your location, you can hail a Waymo autonomous vehicle from your Uber app. Alphabet’s (NASDAQ:GOOGL) Waymo and Uber certainly seem like a match made in heaven. Alphabet has the autonomous tech, while the Uber app is already in virtually everybody’s pocket.

Apart from Waymo, Uber is also looking to go driver-free with its Uber Freight business, recently teaming up with self-driving tech firm Waabi. It’s a pretty big deal that bolsters Uber’s cargo transporting capabilities. Undoubtedly, when many think of Uber, it’s all about getting a ride or having food delivered, not so much about the freight business. Over the next few years, I’d look for freight to contribute a more meaningful slice of the pie as it looks to expand its capabilities across all transportation fronts.

Every Analyst is Bullish on UBER Stock

On TipRanks, UBER stock comes in as a Strong Buy. Out of 34 analyst ratings, there are 34 unanimous Buy recommendations. The average UBER stock price target is $63.12, implying upside potential of 3.5%. Analyst price targets range from a low of $51.00 per share to a high of $75.00 per share.

Though the average price target has compressed a bit, I think analysts will be inclined to hike their targets as they revisit their models with more consideration for the road ahead, which could entail a real boom in self-driving.

In short, it doesn’t appear to be a great time to take profits in one of the newest members of the S&P 500 (SPX) now that it’s flirting with its all-time high of around $64 per share. It’s a well-deserved member of the index and could move up in the rankings as it continues to seize the opportunity at hand.

The Bottom Line on Uber

How could you not like Uber at this juncture? With shares nearing a breakout and numerous tailwinds that could propel it steadily higher over the coming years, I continue to view the stock as a great bet.

Wall Street analysts proved spot on in maintaining their Buy ratings for UBER during its slump earlier this year, and I think they’ll continue to be right as the company continues to show its magnificence. Who knows? An induction into the Magnificent Seven may be next.