Uber (UBER) might have missed out on the highly-publicized GRUB acquisition, but there are other opportunities for the ride sharing pioneer.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

So believes BTIG analyst Jake Fuller, who highlights three different strategies that “could collectively be worth ~$600 million to annual EBITDA (coincidentally in line with the synergy projected with a GRUB combination).”

Fuller’s first suggestion relates to deconsolidation – basically, the removal of a subsidiary off the balance sheet. Fuller thinks Uber is willing to consider the deconsolidation of its losing self-driving car business, ATG (advanced technologies group). With an 80% stake in a business expected to report a “$400 million-plus annual loss,” wiping it off the balance sheet would require Uber to “solicit additional investment.”

“ATG would need ~$2.6 billion of new capital (UBER bearing all of the dilution) to drop ownership below 50% and deconsolidate. Given the size of the investment required, it’s unlikely that this would happen in one fell swoop. Nevertheless, we anticipate new capital will successively drive ownership down, resulting in deconsolidation over time,” Fuller explained.

Additionally, there are other “organic opportunities.” Last week, Uber announced its Priority Delivery and Restaurant Rewards programs. The former will allow Uber Eats customers to receive deliveries faster, while the latter will let restaurants communicate directly with customers by providing loyalty rewards. According to Fuller, the initiatives could be worth 4-7 points to Eats’ ANR (adjusted net revenue).

But back to that GRUB miss, Fuller thinks there could be an alternative. With “unconfirmed reports” suggesting rival Postmates is open to a sale, this could create an opportunity. While it might not provide the same impact as the GrubHub acquisition, it would nevertheless “remove a competitor, boost scale and unlock synergy.” According to the 5-star analyst, an acquisition could result “in EBITDA potentially in the $100-160 million range.”

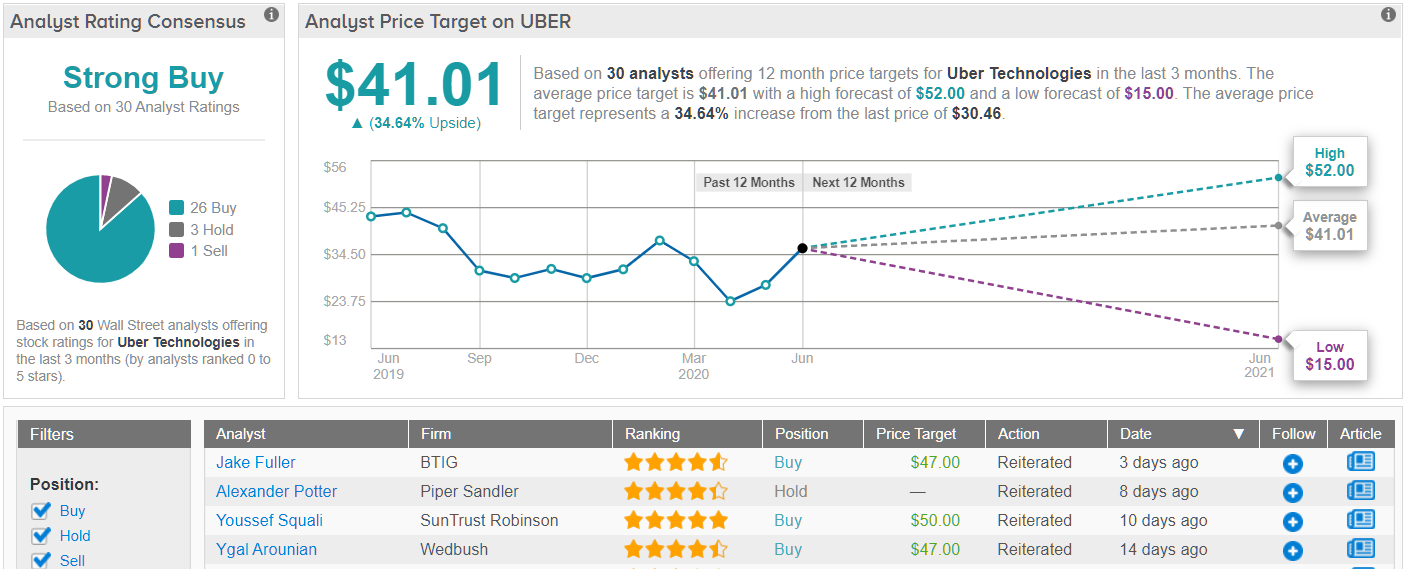

In conclusion, Fuller reiterated a Buy rating, accompanied by a $47 price target. Investors could be riding home with a strong 54% gain, should Fuller’s target be met over the coming months. (To watch Fuller’s track record, click here)

Uber gets the majority of the Street’s backing, too. With 26 Buys versus 3 Holds and 1 Sell, Uber has a Strong Buy consensus rating. At $41.01, the average price target indicates upside potential of 35%. (See Uber stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.