Specialised REIT (real estate investment trusts) stocks enjoy the exposure of real estate properties without the pain of facing potential volatility in the sector – and here are two REIT stocks tipped by highly ranked analyst Julian Livingston-Booth.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Booth has more than 20 years of experience covering the European real estate sector.

Supermarket Income REIT (GB:SUPR) invests in grocery supermarkets, and Impact Healthcare REIT (GB:IHR) is focused on real estate in the healthcare sector.

Booth has been an equity analyst at RBC Capital Markets since joining the company in 2018.

Before this, he spent almost 18 years with Goldman Sachs in their real estate equity research team.

According to the TipRanks star rating system, Booth is a four-star rated analyst with a success rate of 51%. He is ranked 1,918 out of 7,968 analysts on the website. He has an average return of 4% per transaction.

Let’s see the two stocks in detail.

Supermarket Income REIT

Supermarket Income REIT invests in UK-based supermarkets and generates attractive income for its shareholders.

The company has a growing, diversified portfolio of grocery supermarkets with a stable rental income. It has been able to generate 48% of total shareholder return since its IPO in 2017.

In August, the company acquired four new supermarkets for its portfolio, which are sites for leading chains in the UK. The acquisitions were financed via a new credit facility at a net initial yield of 5.1%. Two of these acquisitions, which are for Tesco (GB:TSCO) supermarkets, have leases for around 12 years, which adds to a stable rental outlook for the company.

In its annual results for 2022, SUPR reported a 34% increase in passing rent to £77.6 million. The company also saw a 35% increase in its pre-tax profits of £110.3 million. It added 12 supermarkets in 2022 to its portfolio and generated a 7% total shareholder return.

The company, with another year of solid results and a growing portfolio of assets, continues to deliver long-term income to its shareholders.

Supermarket Income REIT share price forecast

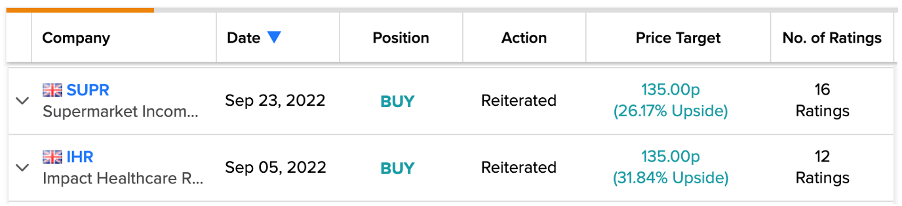

According to TipRanks’ analyst rating consensus, SUPR has a Moderate Buy rating.

The SUPR price target is 119.33p, with a high forecast of 135p and a low forecast of 110p. The price target is 12% higher than the current level.

Impact Healthcare REIT

Impact Healthcare REIT manages a diversified portfolio of real estate focused on the healthcare sector. It mainly invests in residential nursing care homes for older people.

The company has an attractive business model and offers great potential for both income and capital growth to shareholders.

The company has delivered strong results for the first half of 2022, with an 88% increase in its pre-tax profits of £27.3 million. The results were mainly driven by market growth of the assets in the portfolio and effectively managed cash strategies.

IHR also declared a dividend of 3.27p, which was 2% higher than the last year’s. The company’s dividend yield stands at 6.67% as compared to the sector’s average of 2.03%.

Is Impact Healthcare REIT a good investment?

According to TipRanks’ analyst rating consensus, IHR has a Moderate Buy rating.

The average price target is 135p, which is 32% higher than the current price level.

Conclusion

Investors prefer REITs as they offer higher dividend incomes and a good way of diversifying a portfolio.

Booth has a Buy rating on both stocks, and based on his solid experience in this sector, these could be good additions to the REIT space.