During a period when businesses are struggling with declining sales and margins, Compass Group (GB:CPG) and SSP Group (GB:SSPG) are experiencing revenue growth – as a result of COVID restrictions being relaxed.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Five-star analyst Stuart Gordon is bullish on these food service companies and has recently reiterated his Buy ratings on them.

Gordon is a senior analyst at Berenberg Bank with strong coverage of service industry stocks from the UK, the U.S., and German markets.

As per the TipRanks star rating system, Gordon is ranked 595 out of 8,054 analysts and 884 out of a total of 21,594 overall experts. He has a success rate of 66% with an average return of 12.9% per transaction.

The TipRanks Expert Centre presents the ratings of various top analysts, which can help investors make choices with higher returns. TipRanks rates the analysts on three parameters, including success rates, average returns, and statistical significance.

Let’s see the two stocks in detail.

What is Compass Group?

Compass Group is a food service and catering company with global operations in 45 countries. The company operates across sectors such as education, healthcare, sports and defence.

The company came into the news last month when its share prices touched a two-year high point after it declared its third-quarter trading update. This jump in share prices led to full-year growth of 36% in the stock.

According to its trading update, its quarterly revenue surpassed pre-COVID times, which gave the company confidence to raise its revenue outlook for the year. Thanks to the relaxation of COVID restrictions, underlying revenues were at 109% of the 2019 level.

This was mainly driven by strong recovery in its business and industry sectors, with organic revenue growth of almost 60%.

Along with growing sales, the company’s margin game is also strong as it benefits from rising inflation. The operating margin increased by 0.4% from the first half of 2022 to 6.2% in the third quarter. It expects to hit a margin of 7% by the end of this year.

Compass also raised its revenue growth guidance from 30% to 35% for the full year of 2022.

View from the City

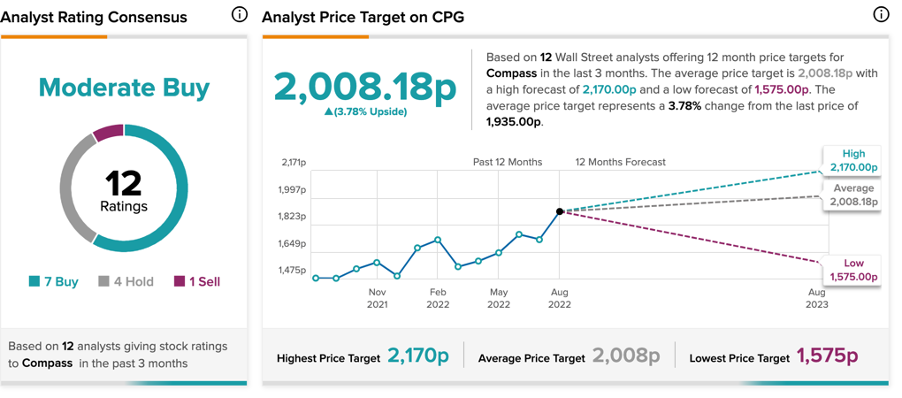

According to TipRanks’ analyst rating consensus, Compass stock is a Moderate Buy. Out of twelve analyst ratings, there are seven Buy, four Hold, and one Sell recommendation.

Compass stock price prediction is 2,008.18p, with a high forecast of 2,170p and a low forecast of 1,575p. The price target implies an upside potential of 3.78%.

Gordon has a 94% success rate on his ratings on Compass stock, with an average return of almost 22%.

What does SSP group do?

SSP Group is a contract-based operator of food outlets in different travel locations across the globe.

SSP’s stock has fully recovered after a huge fall at the beginning of the pandemic. The stock is trading down by around 8% in the last year. However, Gordon is bullish on the stock – along with other analysts.

In terms of business, the company had a good start to the year after COVID impacted the travel sector. In its trading update for the quarter that ended June 30, 2022, the company said revenue touched 87% of the 2019 levels. This is mainly attributed to recovery in travel, which led to increased sales at outlets at both airports and railways.

The company has also seen improvements in net margins and pricing during this recovery.

The company will continue to face inflationary pressures affecting its supply chain, but it is confident of achieving its revenue growth. The company also has new contracts which are expected to add £500 million in revenue by 2025.

View from the City

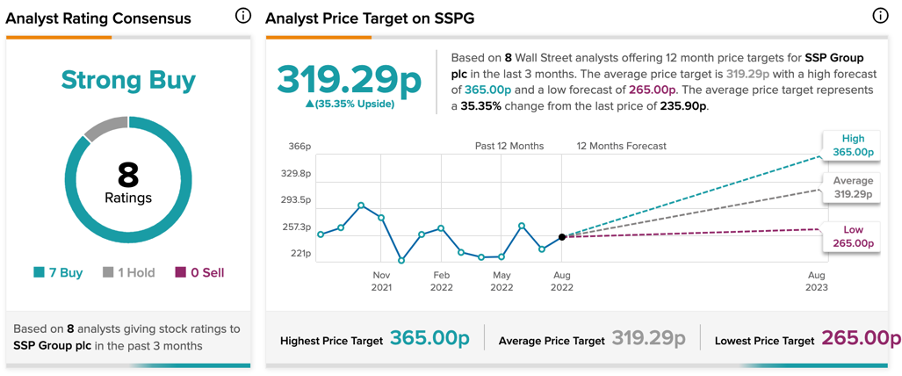

According to TipRanks’ analyst rating consensus, SSP Group’s stock is a Strong Buy. The stock has seven buy ratings and one hold rating.

The SSPG price target is 319.29p, which is 35.3% higher than the current price level. The price target has a high forecast of 365p and a low forecast of 265p.

Conclusion

Both the companies from Gordon’s list are gaining business at improved margins. The two food companies are operating on the other side of the inflation story, and their stable revenue growth should be attractive to investors.