With the stock market hitting new lows, investors are looking for dividend stocks that can generate stable income – two promising picks are vehicle renting company Redde Northgate (GB:REDD) and paper manufacturing company Mondi Plc (GB:MNDI).

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

These companies have Buy ratings from analysts and could also provide capital appreciation in the long run.

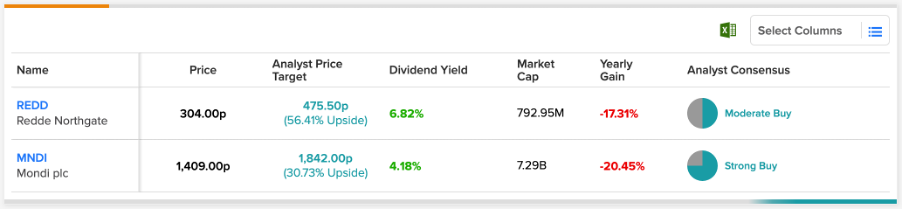

We compared the best dividend stocks in the UK using TipRanks’ Top Dividend Shares tool. Investors can also compare these stocks on different parameters, such as analyst rating, target price, etc.

Let’s see what’s working for these stocks.

Mondi Plc

Mondi Plc is a paper manufacturing company, dealing in sustainable packaging solutions.

The company is well positioned with its unique portfolio of packaging solutions that provide stability in its revenue generation.

The company reported a strong performance in its half-yearly results for 2022. Revenues were up by 37% from the last year’s, mainly due to higher selling prices. The company expanded its margin in all business segments as the pressure from cost inflation increased. As a result, the company’s underlying EBITDA of €942 million increased by 66%.

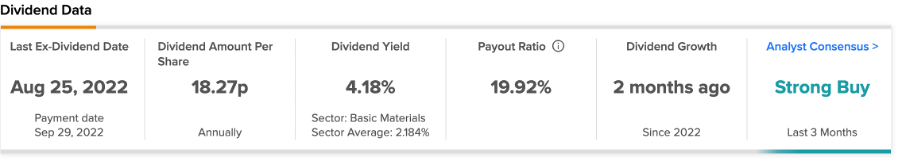

The strong financial position provides assurance towards stable returns for the shareholders in the future as well. Currently, the company has a dividend yield of 4.18%, compared to the industry average of 2.18%.

Looking ahead, the company expects inflationary pressures to continue, but its pricing remains strong in the second half as well.

Is Mondi a buy?

According to TipRanks’ analyst consensus, Mondi stock has a Strong Buy rating, based on three Buy and one Hold recommendations.

The MNDI target price is 1,842p, which has an upside potential of 33% from the current price level. The target price has a high forecast of 1,900p and a low forecast of 1,800p.

Redde Northgate

Redde Northgate is a leading vehicle rental company in the UK, also providing management and other legal services, and the installation of EV charging equipment.

The company has the advantage of a market-leading position as well as diversified revenue streams from different vehicle lifecycles.

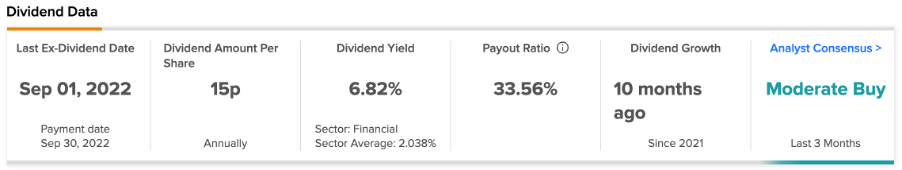

Redde Northgate also has the benefit of financial strength, and it recently refinanced its funding to reduce costs. Based on this, the board approved a £30 million buyback program and also approved a final dividend of 15p for 2022 in its annual results. Later on, the company doubled its buyback to £60 million to continue until June 2023.

Is Redde Northgate a buy?

According to TipRanks, Redde Northgate stock has a Moderate Buy rating.

The REDD target price is 475.5p, which is 56.4% higher than the current price level. The price target has a high forecast of 556p and a low forecast of 395p.

Conclusion

These companies managed to pay dividends even during difficult times. This gives investors confidence to trust them in the future.