Against a background of global economic turmoil, it can be difficult to pick investments – but TipRanks ‘Strong Buy’ rating can be a great guide to finding stocks for long-term returns.

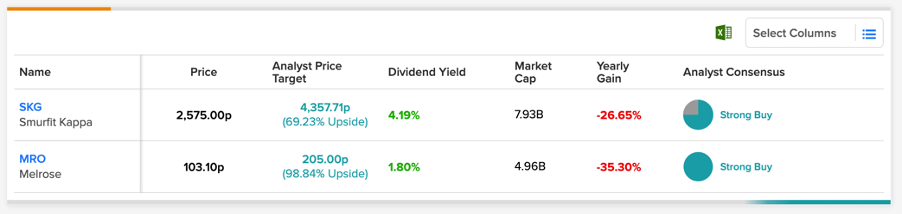

Two ‘Strong Buys’ are packaging products manufacturer Smurfit Kappa (GB:SKG) and investment company Melrose Industries (GB:MRO) which also have good ratings from analysts. These stocks also have more than 50% of upside potential in their share prices.

Here, we have used the TipRanks Stock Screener tool to list the stocks with Strong Buy ratings. This tool makes it easy to choose among thousands of stocks and filter them accordingly based on our choice of parameters.

Let’s discuss the stocks in detail.

Smurfit Kappa Group

Smurfit Kappa is a manufacturer and seller of paper-based packaging solutions with more than 300 production sites in Europe and America.

The company has a market-leading position with a stable customer base. The company continues to enhance its market position through multiple acquisitions in different markets. This gives the company an edge to pass on the higher prices to its customers to navigate through cost inflation.

The company’s last results reflected strong demand for sustainable products despite rising inflation pressures. It posted revenue growth of 36% to €6,385 million in the first half of 2022. The company also reported an EBITDA growth of 50%, overcoming the challenges of its supply chain and rising input costs.

Another highlight for the company is its balanced dividend policy along with continued investments toward operational efficiency. In its last results, Smurfit increased its interim dividend by 8% to 31.6p per share. The dividend yield is 4.19%, above the industry average of 2.18%.

Are Smurfit Kappa shares a good buy?

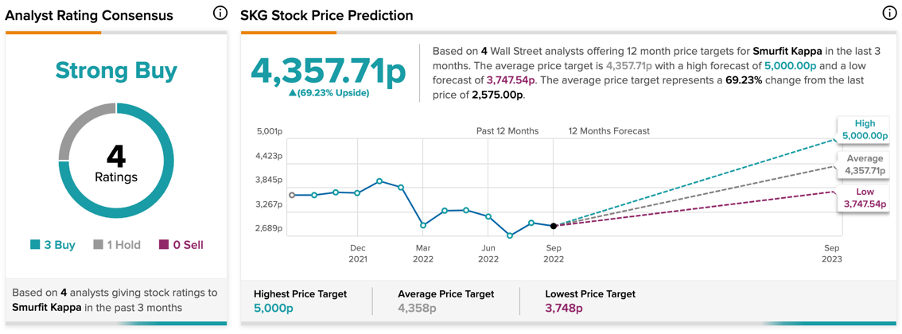

According to TipRanks, Smurfit Kappa stock has a Strong Buy rating, based on three Buy and one Hold recommendations.

The SKG target price is 4,357.7p, which has an upside potential of 70% on the current price level.

Melrose Industries

Melrose Industries acquires and sells manufacturing companies with the aim of improving their performance in the process. The company owns various manufacturing and industrial businesses across different geographic locations.

The company recently announced its interim results along with plans to spin off a big portion of its GKN business, which was acquired in 2018. Under the spin-off, Melrose will split the automotive and powder metallurgy segments of GKN into a separately listed company.

Melrose will keep the ownership of GKN’s aerospace under its control and will now focus on the restructuring of this business. In its aerospace division, the company expects growth in line with the market recovery and solid demand from the key defence platforms.

It also believes the two separate companies will be now better placed to raise money and plan further investments.

The company reported a revenue of £3.8 billion, slightly up from £3.7 billion in the previous year. The company expects inflationary pressures and supply chain disruptions to subside by the end of this year and the full-year numbers to remain in line with expectations.

Is Melrose a good share to buy?

According to TipRanks, Melrose stock has a Strong Buy rating, based on three Buy recommendations.

The MRO price target is 205p, which has a huge upside potential of 95%. The price has a high forecast of 220p and a low forecast of 180p.

Conclusion

Both companies’ stocks are currently trading at lower points than they were last year. Based on their positive outlook and business models, the companies are fairly placed to achieve their targets for the full year.

The ‘Strong Buy’ ratings from analysts back up the solid investment case.