As we move into the final quarter of the year, market volatility continues, and investors are selling stocks that actually have good fundamentals and could grow over the long term – this creates an attractive opportunity to buy these stocks at much lower prices.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

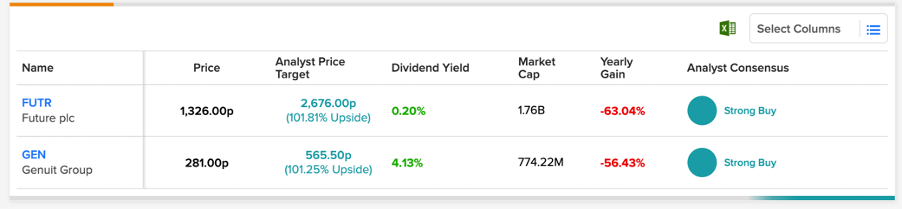

Considering this backdrop, we have used TipRanks’ tools to pick out two promising stocks: the media group Future Plc (GB:FUTR) and pipe manufacturing company Genuit Group (GB:GEN).

Not only do these companies have more than 100% expected growth in their share prices, but they are currently trading down.

We used the TipRanks Shares Screener tool to list the stocks that have high potential along with negative yearly gains. This tool can be used by investors to screen stocks and filter them on the basis of different parameters.

Future Plc

Future Plc is a British media group with a portfolio of well-known magazine brands such as Marie Claire, TechRadar, PC Gamer, Country Life, Decanter, and more.

The company stock has lost around 65% of its value so far this year. However, analysts are highly bullish on the stock based on its diversified audience base and multiple monetisation avenues.

The company recently announced that its full-year profits will be on the higher side of expectations. It also stated that the company is back in the organic growth zone with improved digital advertising income.

In its half-year results, the company reported a 48% increase in its revenues and 51% growth in its operating profits. The positive results reflected a perfect combination of organic growth and higher value from acquisitions.

The company remains optimistic, with positive audience momentum in the second half and more investment in new verticals.

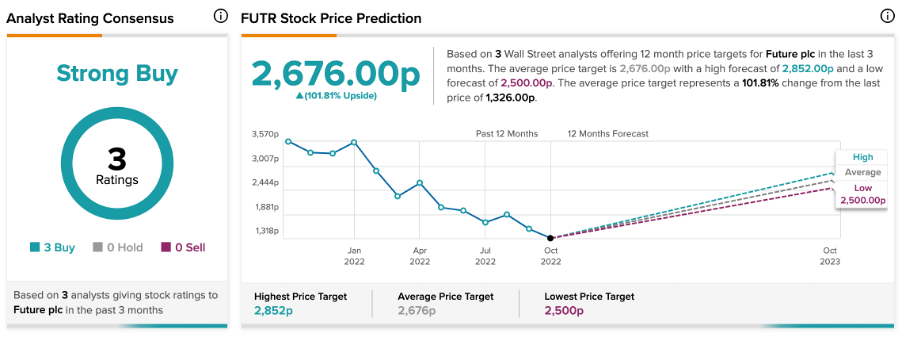

Future Plc share price forecast

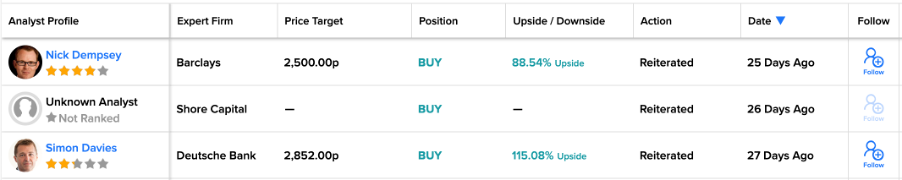

According to TipRanks, Future’s stock has a Strong Buy rating, based on three Buy recommendations.

The FUTR target price is 2,676p, which has an upside potential of 101.8%.

Genuit Group

Genuit Group is a manufacturing company dealing in plastic piping systems for the construction industry.

The company’s stock is not an investors’ favourite right now, having fallen by 52% this year so far. The short-term headwinds in the housing sector do affect the business. However, Genuit has balanced exposure in the construction market, and the company’s fundamentals remain strong.

The company has an advantage of price leadership in the industry, and it is currently sitting on a strong order book. Based on this, the management expects to meet the full-year targets smoothly.

The company also ticks the box for income investors with a dividend yield of 4.13%. In its half-yearly results, the company announced an interim dividend of 4.1p, which was 2.5% higher than last year’s.

Genuit Group share price forecast

According to TipRanks, Genuit Group stock has a Strong Buy rating.

The GEN target price is 565.5p which is 101.2% higher than the current price level. The price has a high forecast of 661p and a low forecast of 470p.

Conclusion

These two companies are being unfairly ignored as the share prices are on a downward trajectory. However, considering the fundamentals and backing from analysts, these could be hidden gems.