Twitter, Inc. (TWTR), the American microblogging and social networking company, is exploring ways to diversify its revenue streams. The company launched Super Follows on September 1 for its American users – a feature that allows qualifying users to sell subscriptions in exchange for access to exclusive content. The Super Follows feature is currently available to U.S.-based users with at least 10,000 followers, but will soon be available globally on Apple (AAPL) iPhone devices.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Twitter also added a Safety Mode to its website and mobile app, which allows users to automatically block malicious accounts for offensive language or repeated uninvited replies. The Safety Mode feature, which is still in the beta phase, uses Artificial Intelligence to automatically block harmful accounts from a specific user for a certain time period. At the end of this period, users will receive a summary of all auto-blocked accounts, allowing them to decide whether to permanently block such accounts or remove selected users from the auto-block list.

Despite these encouraging developments, I remain neutral on Twitter, as the company is still struggling to monetize its userbase effectively. (See Twitter stock charts on TipRanks)

Twitter: Embracing the Creator Economy

As the creator economy has climbed to the forefront of marketing, social media giants are transforming into creator-friendly platforms. With the rising popularity of TikTok and Instagram Reel, and the growing number of startups that focus on content creators, the creator economy is likely to grow in the double digits in the next decade.

According to data from CB Insights, the creator economy was valued at an eye-popping $143.8 billion at the end of 2020, but this industry is still very young, as there are millions of content creators who have yet to monetize their content. Twitter has over 200 million daily active users, and with the launch of its new subscription-based business model, the company intends to become one of the preferred platforms for creators. Successfully executing this plan could help Twitter diversify its revenue sources, which would be a positive outcome for long-term investors.

Users must have at least 10,000 followers, be at least 18-years-old and based in the United States, and should have Tweeted at least 25 times in the last 30 days, to be eligible for Super Follows. Activists, journalists, musicians, content curators, writers, gamers, astrologers, skincare and beauty professionals, comedians, fantasy sports experts, and other creators that match these eligibility criteria can apply to monetize their follower bases.

The new feature is intended to boost interaction and allow users to earn money while offering content to their most dedicated followers.

In addition to Super Follows, the company has already launched a few monetization tools to keep creators and their followers glued to the platform. Last May, Twitter introduced Tip Jar, allowing users to send money directly to their favorite creators through integration with Cash App, Bandcamp, Patreon, and Venmo.

On August 27, Twitter rolled out Ticketed Spaces, or paid live audio rooms, allowing users to make money by hosting online events. Additionally, the company plans to add newsletters, anonymous subscriptions, exclusive spaces, and Patreon-like subscription tiers in the future, which is a testament to its increased focus on content creators to drive the monetization efforts of the company.

Wall Street’s Take

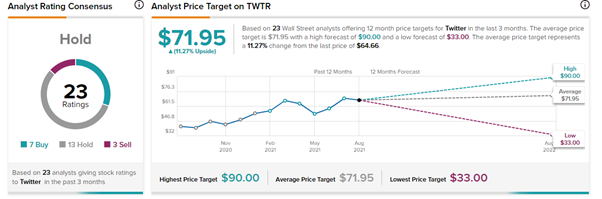

Based on the ratings of 23 analysts offering 12-month price targets for Twitter, the average analyst Twitter price target comes to $71.95 per share, which implies upside of 11.2% from the current market price.

If Twitter can emerge as a go-to platform for content creators who are looking for monetization tools, Wall Street analysts are likely to revise their price targets upward in the coming months.

Takeaway

Twitter is experimenting with several new features aimed at attracting content creators, which seems to be a good strategy, given the stellar expected growth of the creator economy. The competition in the industry, however, is likely to intensify in the future, and the success of the company will depend on its ability to thwart the competition.

Disclosure: At the time of publication, Dilantha Da Silva did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.